Bitcoin has had an eventful week by way of value motion. The world’s largest crypto noticed an 18% enhance previously seven days, its highest share enhance this 12 months. This sudden surge induced a flurry of brief place liquidations, and based on Glassnode, 60,000 BTC value of futures positions had been closed. Amidst all the worth surge, knowledge from Glassnode has proven a big portion of traders at the moment are breaking above revenue.

Bitcoin Surges Past $35,000, Flipping Millions of Coins Into Profit

Bitcoin bulls managed to push Bitcoin price above $35,100 previously 24 hours, marking the largest one-day enhance this 12 months. The upward motion started close to the $25,000 degree and continued till it reached its new yearly excessive.

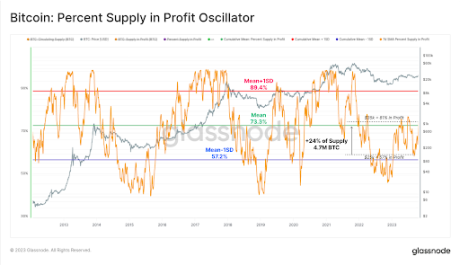

A blockchain analytics platform Glassnode report confirmed that Bitcoin zooming previous $35,000 is an enormous deal for holders. At this value degree, tens of millions of BTC holdings had been pushed into profitability. During this rally, the % of provide in revenue from the $25,000 to $35,000 value leap elevated by a large 4.7M BTC, equal to 24% of the entire circulating provide.

Long-term traders, specifically, had an enormous break in revenue at this value level. Although roughly 29.6% of long-term holder provide continues to be held at a loss, their combination holdings just lately broke into a brand new all-time excessive of 14.899 million BTC.

Source: Glassnode

Short-term holders had been additionally not overlooked, as investor confidence has recovered from bearish to impartial on the cost-basis fashions. We’re now at a crossover level to a constructive bullish sentiment for short-term holders. A glance into the typical purchase value of short-term holders places nearly all of entry into the market at $28,000, indicating a revenue margin for each brief and long-term merchants.

Source: Glassnode

What’s Behind Bitcoin’s Sudden Price Surge?

The sudden surge in Bitcoin might be attributed to the excitement behind the approval of BlackRock’s spot Bitcoin ETFs utility. Bitcoin backers pointed to the itemizing of BlackRock’s iShares Bitcoin Trust on the Depository Trust and Clearing Corporation (DTCC) web site, suggesting that BlackRock had begun seeding cash for the ETF.

Although Bitcoin has since shed off some of this price gain and is now buying and selling at $33,860 on the time of this writing, metrics present that 80% of holders are being profitable on the present value. Exchange alerts additionally point to bullish momentum, as merchants at the moment are exchanging their belongings for BTC on crypto exchanges.

The rise within the worth of Bitcoin to $35,000 was mirrored within the inventory costs of crypto-related firms like Coinbase and MicroStrategy. At that value, MicroStrategy’s Bitcoin holdings would have generated a revenue of $857 million for the corporate.

BTC reclaims $34,000 as soon as extra | Source: BTCUSD on Tradingview.com

Featured picture from Outlook India, chart from Tradingview.com

Source: Glassnode

Source: Glassnode Source: Glassnode

Source: Glassnode