The flagship cryptocurrency, Bitcoin, is quick approaching $31,000 following its features over the weekend. Analyzing this value motion, crypto analyst Ali Martinez has predicted Bitcoin’s future trajectory as he means that the bears might regain dominance quickly sufficient.

A Price Correction Imminent For Bitcoin

In a post shared on his X (previously Twitter) platform, Martinez famous the potential head-and-shoulders sample that was forming on the Bitcoin every day chart following its upward development. This chart sample has at all times been thought-about bearish because it suggests {that a} development reversal is likely to be on the horizon, that means there might be a dip in costs quickly sufficient.

Source: X

Confirming this assumption, Martinez acknowledged that the every day chart (which he shared alongside the publish) “hints at a possible sell signal emerging tomorrow [October 23].” According to him, this prediction is backed by the TD Sequential indicator, which is flashing “a green 9 candlestick.” The TD Sequential indicator helps merchants establish the precise time of a possible reversal.

Martinez additionally alluded to the Relative Strength Index (RSI), which he talked about has reached 74.21. He famous that this has been “a level triggering sharp corrections since March.” An RSI of over 70 additionally means that Bitcoin could also be overbought with a value correction imminent. This impending value correction can solely be averted if Bitcoin manages to clock “a daily candlestick close above $31,560.”

As of the time of writing, Bitcoin is buying and selling at round $30,700, up by over 2% within the final twenty-four hours and an extra 10% within the final seven days.

Options Market Could Contribute To Bitcoin’s Upward Momentum

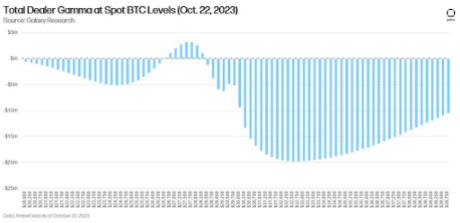

In a post on his X platform, Alex Thorn, Head of Firmwide Research, highlighted the position that choices merchants (quick gammas specifically) might play in driving Bitcoin’s value greater within the quick time period.

Source: X

He famous that the options market makers in Bitcoin are “increasingly short gamma as BTC spot price moves up.” This present positioning might assist “amplify the explosiveness of any short-term upward move in the near term,” contemplating that these quick gammas have to purchase extra Bitcoin to remain “delta neutral” as Bitcoin’s value continues to rise.

From his evaluation, Thorn was merely explaining that the choice market makers should place ‘buy orders’ to hedge in opposition to their short positions as Bitcoin’s value continues to climb, thereby including to buying pressure, which might trigger the crypto’s value to rise greater.

Meanwhile, he believes that the long gammas might present a security internet for Bitcoin’s value within the occasion of a value reversal. These lengthy gammas must purchase again spots as a way to stay delta-neutral, thereby offering assist and serving to resist any additional decline (within the quick time period, at the very least).

BTC bulls operating out of steam | Source: BTCUSD On Tradingview.com

Featured picture from Crypto Buyers Club UK, chart from Tradingview.com

Source: X

Source: X