On-chain knowledge reveals the Ethereum MVRV ratio is presently testing a degree that has traditionally served because the boundary between bear and bull markets.

Ethereum MVRV Ratio Is Retesting Its 180-Day SMA Right Now

The “Market Value to Realized Value (MVRV) ratio” is an indicator that measures the ratio between the Ethereum market cap and realized cap. The former is of course simply the full provide valuation at its spot worth. At the identical time, the latter is an on-chain capitalization mannequin that calculates the worth in a different way.

The realized cap assumes that the actual worth of any coin in circulation isn’t the spot worth (which the market cap refers to) however the worth at which it was final purchased/transferred on the blockchain.

One means to have a look at the realized cap is that it represents the full quantity of capital that the buyers have put into the cryptocurrency, because it considers every holder’s value foundation or shopping for worth.

Since the MVRV ratio compares these two capitalization fashions, it will possibly inform us whether or not the buyers maintain kind of worth than they initially invested in Ethereum.

The indicator’s usefulness is that it could function a method to decide whether or not the asset’s worth is truthful or not proper now. When the buyers maintain a price considerably greater than they put in (that’s, they’re in excessive income), they’d be extra tempted to promote, and therefore, the spot worth might face a correction.

Similarly, the holders as an entire being in deep losses can as a substitute be a sign that the underside is perhaps close to for the cryptocurrency, because it’s changing into fairly underpriced.

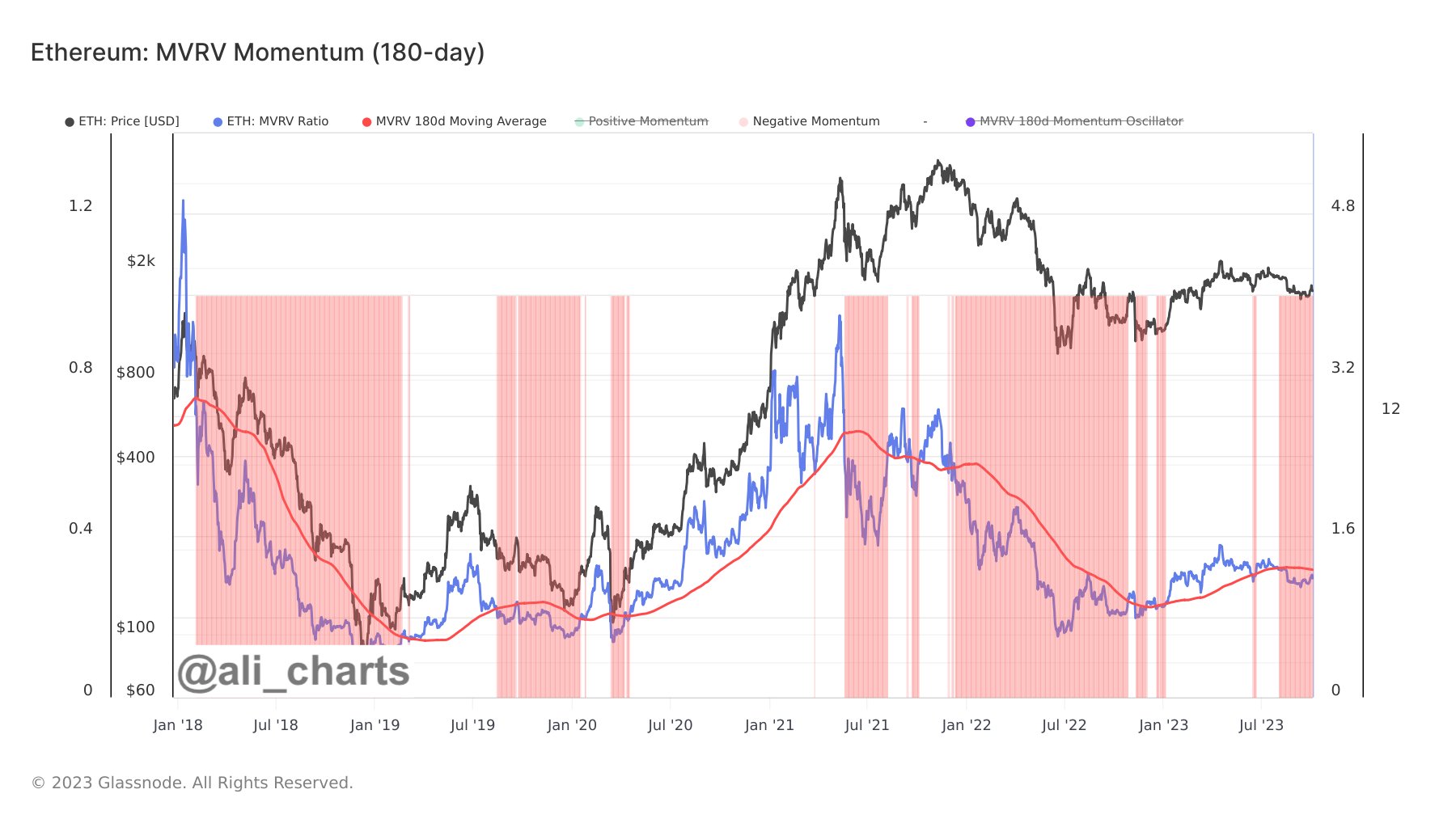

Now, here’s a chart shared by analyst Ali on X, which reveals the pattern within the Ethereum MVRV ratio, in addition to its 180-day easy shifting common (SMA), over the previous few years:

The worth of the metric appears to have been going up in current days | Source: @ali_charts on X

The 180-day SMA of the ETH MVRV ratio has curiously held significance for the cryptocurrency. According to Ali, “Ethereum market cycles transition from bearish to bullish when the MVRV (blue line) breaks strongly above the MVRV 180-day SMA (red line).”

During the bear market final yr, the ratio had been under the 180-day SMA line, however with the rally that started this yr in January, the metric had managed to interrupt above the extent, and bullish winds supported the asset as soon as extra. During the recent struggle for the asset, nonetheless, the MVRV has once more slipped underneath the extent.

Nonetheless, up to now few days, the ETH MVRV has been trending up a bit and approaching one other retest of this historic junction between bearish and bullish tendencies.

It stays to be seen whether or not a retest will occur within the coming days for Ethereum and if a break in the direction of the bullish territory may be discovered.

ETH Price

Looks like ETH has been trending sideways up to now few days | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com