On-chain information reveals Ethereum has noticed a big trade outflow not too long ago, an indication that purchasing could also be occurring out there.

Ethereum Exchange Supply Hits Lowest In 5.5 Years After $181 Million Outflow

According to information from the on-chain analytics agency Santiment, ETH has simply witnessed its largest trade outflow day since August twenty first. The indicator of curiosity right here is the “supply on exchanges,” which retains monitor of the full quantity of Ethereum that’s at present sitting within the wallets of all centralized exchanges.

When the worth of the metric goes down, it implies that a internet variety of cash is exiting these platforms at present. Generally, traders take their cash off these central entities towards self-custodial wallets after they plan to carry onto them for prolonged intervals, so this type of development is usually a signal that HODLing is occurring out there.

On the opposite hand, the indicator’s worth rising implies deposits are transferring towards the exchanges proper now. Investors could make such transfers for a wide range of functions, considered one of which might be promoting, so such a development can typically be a sign {that a} value correction might be coming quickly.

There can also be a counterpart indicator to the provision on exchanges: the “supply outside of exchanges,” which is fairly self-explanatory; it measures the full quantity of provide sitting inside self-custodial wallets.

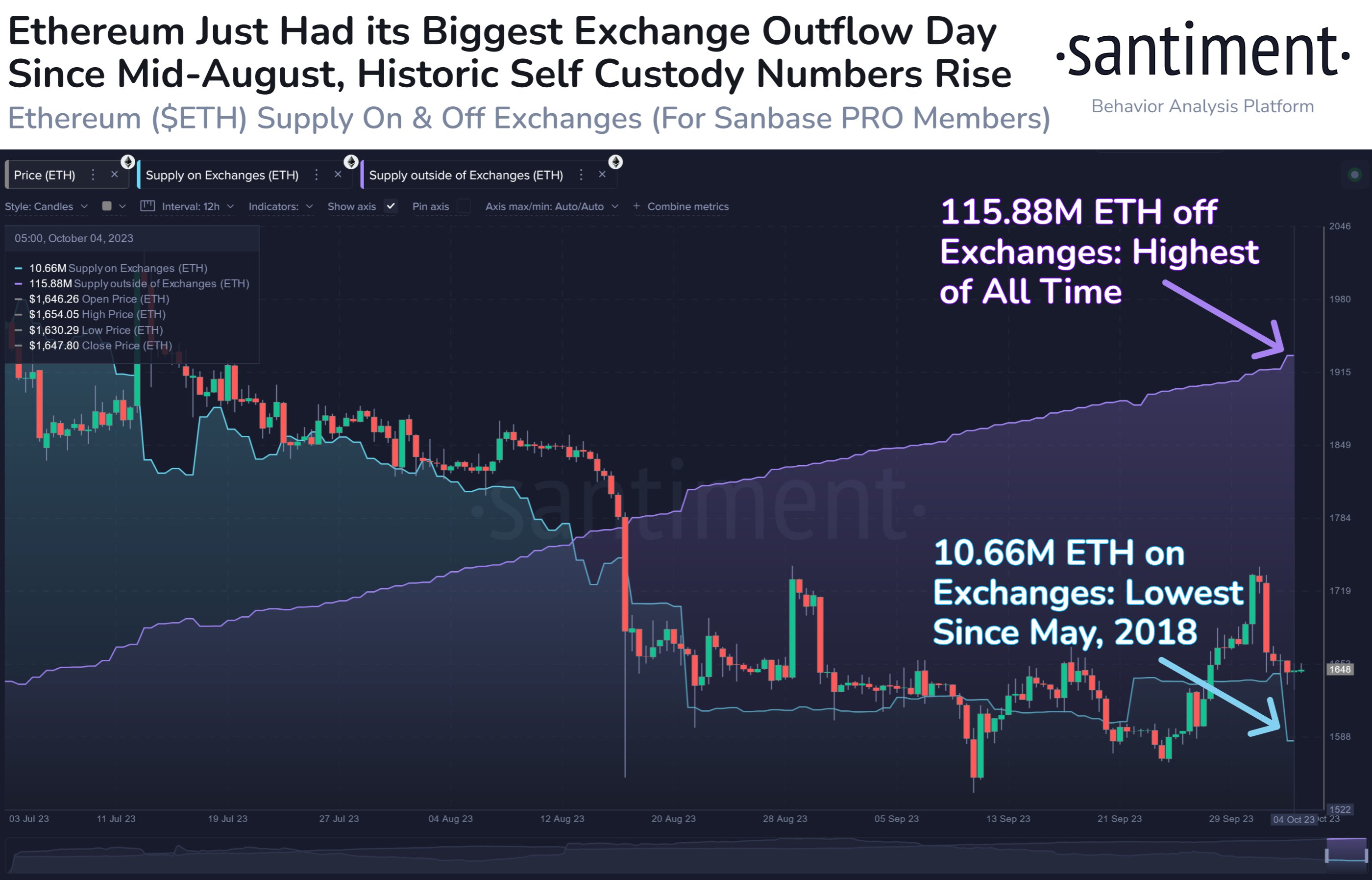

Now, here’s a chart that reveals the development within the Ethereum provide on exchanges, in addition to within the provide exterior of those platforms, over the previous few months:

The worth of the 2 metrics has gone reverse methods in current days | Source: Santiment on X

As proven within the above graph, the Ethereum provide on exchanges has seen a pointy plunge not too long ago, as a big internet outflow has occurred on these platforms. Naturally, a spike within the provide exterior of exchanges occurred alongside this plunge, as provide transferred in direction of that aspect.

In these newest withdrawals, traders took out 110,000 ETH (value round $181 million on the present trade fee) in direction of self-custodial entities, resulting in the provision on exchanges dropping to its lowest level since May 2018.

These outflows have come after the worth of the asset has registered a pullback following its current surge above the $1,700 mark, making it potential that these withdrawals are an indication of a internet quantity of shopping for exercise happening on the present costs.

From the chart, it’s seen that the provision exterior of exchanges has been on a perpetual uptrend, no matter no matter habits the provision on exchanges has been exhibiting.

This is clearly due to the truth that new ETH is consistently being minted within the type of validator rewards, so the full provide is at all times heading up. Since the newly minted provide counts beneath self-custody, it is smart that that the provision exterior of exchanges would maintain exhibiting total development.

ETH Price

Ethereum has been consolidating close to the $1,600 stage because the failed restoration try a number of days again.

ETH has been transferring sideways since its pullback | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.internet