Over a billion {dollars} in liquidations despatched the XRP value and the crypto market again from the lifeless and into native highs. However, new information suggests the rally is likely to be brief, pushing down the nascent sector into essential help.

As of this writing, the XRP value trades at $0.5 with a 4% revenue within the final week. The cryptocurrency rallied within the earlier 24 hours however has been retracing its steps over the previous few hours, hinting at potential losses except consumers step in and defend these ranges.

XRP Price Braces For Impact?

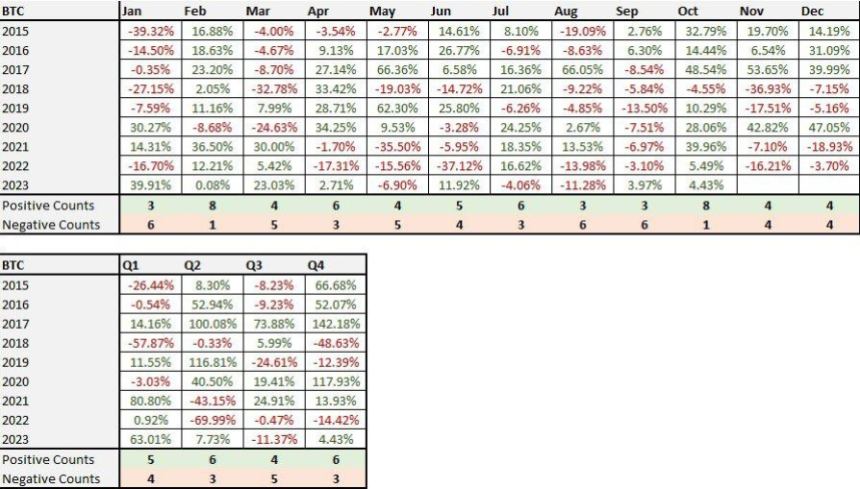

According to the buying and selling desk QCP Capital, the present rally within the crypto market coincides with seasonality. In the nascent sector, October is named “Uptober” as a result of main cryptocurrencies, together with the XRP value, development to the upside.

In the previous years, each Bitcoin, Ethereum, and XRP value rally started in October, making it one of the best month for the market, as seen within the chart beneath. However, the buying and selling desk warned its followers on social media X a few potential reverse that would have unfavorable results on cryptocurrencies:

However, we’re not absolutely satisfied by this transfer, and we predict that BTC would possibly take a look at tremendous key 25k help someday within the remaining quarter of 2023 (…) This aggressive bounce has been due virtually fully to exogenous elements to this point and won’t have the momentum to maintain.

The buying and selling desk believes these elements might lack the ability to maintain the present value motion. In addition, the narrative round approving an Ethereum future Exchange Traded Fund (ETF) within the US may set the stage for a massacre.

Two years in the past, when the value of Bitcoin reached its all-time excessive of $69,000, the Securities and Exchange Commission (SEC) accepted a BTC futures ETF. This occasion marked the crypto market’s high, making the present ETH future ETF an ominous occasion for XRP and the altcoin market.

QCP Capital claims that the newly accepted monetary asset may improve promoting strain within the sector resulting from including “synthetic coins” to the market. In different phrases, the ETH futures ETF creates a disbalance between the provision and demand forces within the sector. The agency added:

We would even go additional to say a futures-only ETF is arguably detrimental to identify value – because it doubtlessly directs demand away from the spot market into an artificial market.

Good News In The Short Term For XRP

The XRP value may gain advantage from the US authorities shutdown within the macro area. The evaluation exhibits that previously 30 years, every US authorities shutdown preceded a bull run for the monetary market. This is the one optimistic information for the cryptocurrency within the medium time period.

In the brief time period, XRP nonetheless has an opportunity to run again above $0.6; as for Bitcoin, the buying and selling agency expects the $29,000 to $30,000 resistance to stay intact.

Cover picture from Unsplash, chart from QCP Capital and Tradingview