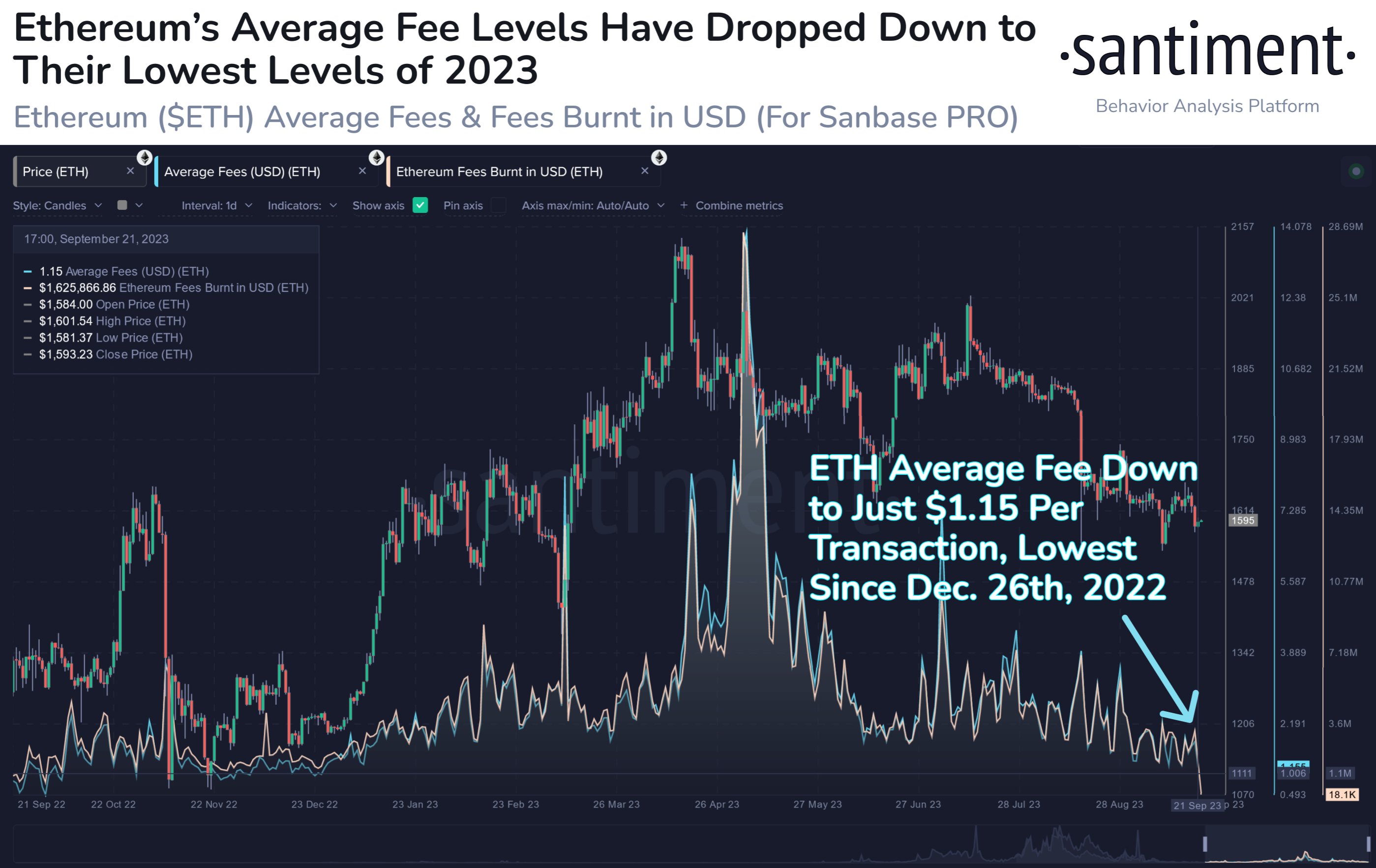

On-chain knowledge exhibits the typical Ethereum transaction payment has just lately dropped to $1.15, which is a brand new low for the yr 2023 to this point.

Ethereum Transaction Fees Has Registered A Drawdown Recently

According to knowledge from the on-chain analytics agency Santiment, the charges on the ETH community have declined throughout the previous couple of days. The related indicator right here is the “average fees,” which retains observe of the imply charges (in USD) that customers connect to their transactions on the Ethereum blockchain.

Generally, the quantity of switch charges that customers could put forth will depend on the diploma of competitors current on the community. When the mempool is congested, transactions could get caught for some time because the blockchain solely has a restricted capability to course of the transactions.

Some senders hurrying to get their strikes via throughout such instances could go for higher-than-average charges in order that the community validators prioritize their transfers.

Others could do the identical, and on this approach, the typical can get pushed up. Thus, when the community will get an exceptionally excessive exercise, the typical charges can blow up to excessive values.

On the opposite hand, when there may be little switch exercise on the blockchain, customers haven’t any incentive to pay excessive charges, so the typical stays low.

Because of this relationship, the typical charges will be one of many methods to gauge how energetic merchants on the community are at the moment. Now, here’s a chart that shows the development on this indicator for Ethereum over the previous yr:

The worth of the metric appears to have plummeted in latest days | Source: Santiment on X

The above graph exhibits that the Ethereum common charges have just lately dropped steeply, suggesting that community exercise has significantly cooled off.

When Santiment shared the chart, the typical charges had come down to simply $1.15 per transaction, which was the bottom noticed since December of final yr, making it the bottom level of the yr 2023 to this point.

While low charges are a consequence of low exercise, they’ll encourage extra utility on the blockchain, as a decrease value of motion signifies that extra customers can be prepared to shift round their cash. “Increased utility can then lead to recovering market cap levels,” explains the on-chain analytics agency.

ETH Price

Ethereum hasn’t been having the very best of instances just lately, as its value has registered a 4% drop previously week, taking it beneath the $1,600 stage.

Looks like ETH has been struggling just lately | Source: ETHUSD on TradingView

While Bitcoin hasn’t been significantly spectacular, the primary cryptocurrency has nonetheless proven extra energy than Ethereum. As market intelligence platform IntoTheBlock has identified, the market cap ratio of the 2 property has risen to 2.86, a brand new yearly excessive.

ETH has carried out poorly towards BTC throughout the previous few weeks | Source: IntoTheBlock on X

Featured picture from Shubham Dhage on Unsplash.com, charts from TradingView.com, IntoTheBlock.com, Santiment.internet