In the months main as much as the Litecoin halving in August, the value of the blockchain’s native LTC token was repeatedly on the rise. This renewed curiosity in traders who rushed again into the token and ultimately pushed its value above $100. That is till the precise halving occasion rolled round, turning it right into a “buy the rumor, sell the news” situation. Since then, it has been a downward spiral for the token and the ache might not be over.

Litecoin Volume Slumps Post-Halving

Litecoin volume because the halving was accomplished has been lower than anticipated. While traders anticipated rising demand for the LTC token with the diminished provide charge, the other has been the case. Instead, the day by day buying and selling quantity of the cryptocurrency continued to hunch.

In the final day, the Litceoin day by day buying and selling quantity fell one other 23%. This introduced its day by day quantity to $255 million, a considerably low determine in comparison with the $500 million day by day volumes that the cryptocurrency was recording main as much as the halving.

LTC day by day volumes drops 23% | Source: CoinMarketCap

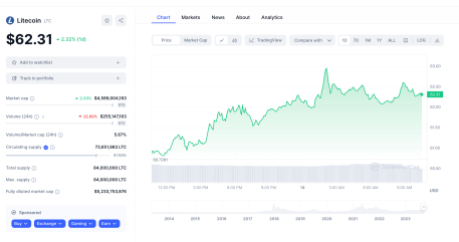

Just just like the buying and selling quantity, the value of LTC has additionally plunged considerably. From its pre-halving peak of $112, the altcoin has fallen over 50% to its present degree simply above $60. This implies that the asset has misplaced all of its positive factors gathered between June and July 2023, only one month after the halving was accomplished.

So relatively than being a bullish occasion as initially anticipated, the halving has proven to be more bearish than most. It additionally didn’t assist that it befell in the course of the bear market and LTC has fallen quickly alongside bigger property equivalent to Bitcoin and Ethereum.

LTC value returns to pre-halving ranges | Source: LTCUSD on Tradingview.com

Will LTC Fall Continue To $50?

At the present charge, the forecast doesn’t look too good for the LTC value. Litecoin has understandably seen a 3% improve prior to now day as Bitcoin recovered above $26,000. But this doesn’t look sustainable by its present metric.

The first indicator of that is that falling day by day buying and selling quantity implies that curiosity within the asset is waning. As traders transfer to different property they consider present higher prospects, this can have an effect on the LTC price and will set off additional draw back from right here. Add to this that the coin’s value is under its 50-day and 100-day shifting averages and it spells a recipe for catastrophe.

If LTC bulls are unable to hold support above $60 and it falls as soon as once more because it did on September 11, then $50 turns into a really doable touchdown level. Such a decline would put it again at November 2022 ranges and sign a protracted bear development for the digital asset.

At the time of writing, LTC value remains to be sitting above $62 however the tug-of-war for management between bulls and bears continues to rage on.