On-chain information reveals the Ethereum day by day energetic addresses indicator has not too long ago registered its second-highest spike.

Ethereum Daily Active Addresses Has Observed A Sharp Spike Recently

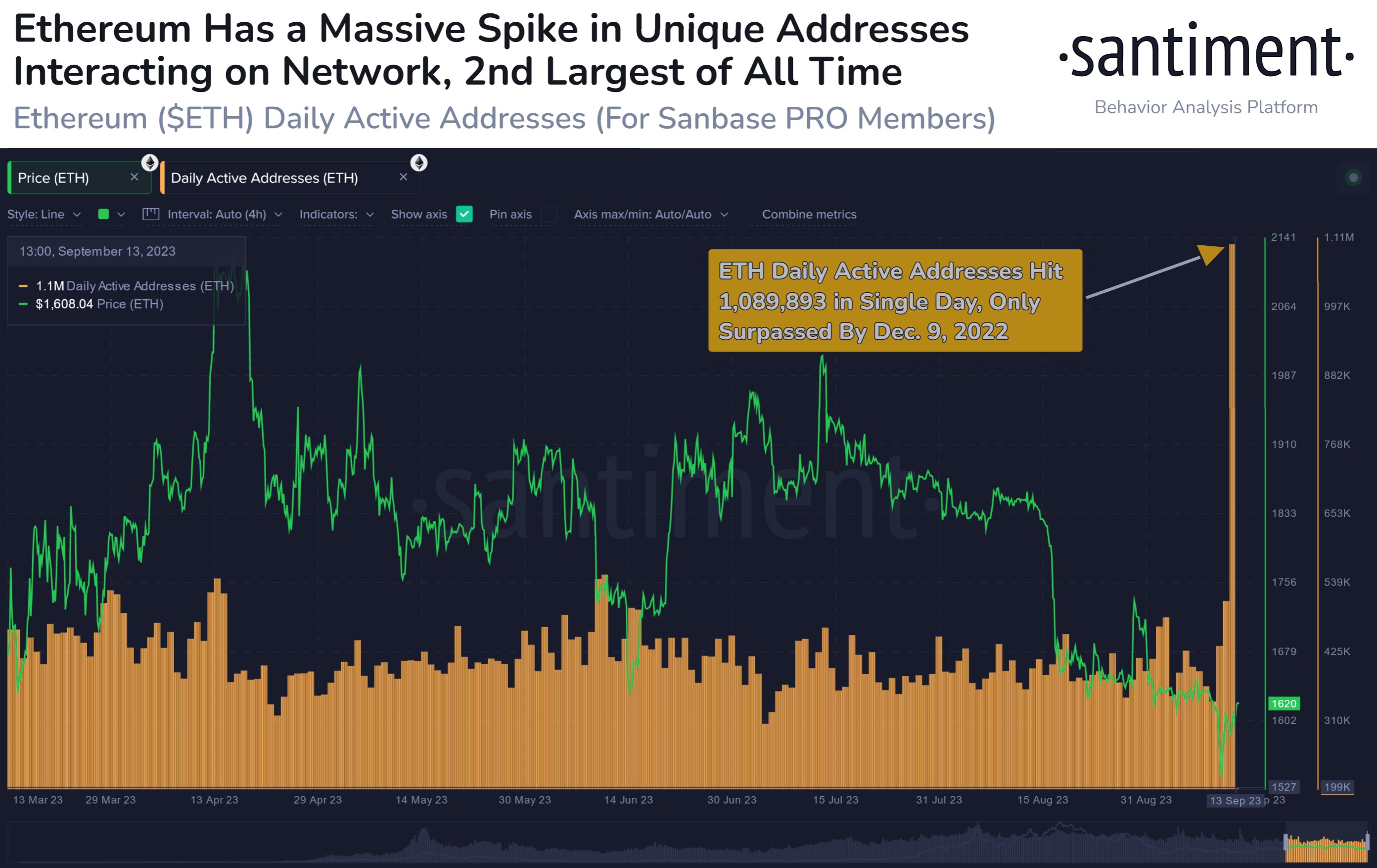

According to information from the on-chain analytics agency Santiment, the energetic addresses metric solely achieved the next worth in December 2022. The “daily active addresses” indicator measures the day by day whole variety of distinctive Ethereum blockchain addresses that work together indirectly.

This metric naturally accounts for each senders and receivers. Note that “unique” implies that even when an handle makes a number of transactions in a single day, its contribution in direction of the energetic addresses metric will stay only one unit.

The advantage of this restriction is that distinctive addresses will be thought of analogous to distinctive customers, so the indicator’s worth can present hints concerning the quantity of site visitors the ETH blockchain has obtained through the previous day.

When the metric has a excessive worth, many customers at the moment are interacting with the community. This can signify that the merchants are actively fascinated about making strikes on the asset.

Now, here’s a chart that reveals the pattern within the Ethereum day by day energetic addresses over the previous few months:

Looks like the worth of the metric has been fairly excessive in latest days | Source: Santiment on X

As displayed within the above graph, the Ethereum day by day energetic addresses indicator has seen a price of multiple million through the previous day. This would indicate that greater than 1,000,000 customers have simply made a transfer on the blockchain.

This is a particularly excessive worth and is, the truth is, the second highest that the metric has noticed within the eight years or so of the cryptocurrency’s historical past. The all-time excessive of the indicator (that’s, the one time the indicator had been increased) was registered on December 9, 2022.

Interestingly, again then, Ethereum had been within the post-FTX crash lows, and because it has turned out, that interval was the bear market backside for the asset. It’s potential that the sudden reignition of curiosity within the coin was what helped it hit the underside and equipment up for the rally that will begin in January 2023.

During the previous few months, the indicator’s worth has remained comparatively low as traders have held low curiosity within the asset. With this newest spike, although, issues have modified in a flash.

Suppose the instance of the December energetic addresses spike is something to go by. In that case, Ethereum could possibly flip itself round off the again of this newest elevation in consumer exercise.

ETH Price

Ethereum has continued to indicate general flat motion through the previous week as ETH continues to be buying and selling round $1,600.

ETH has bounced shortly from its lows | Source: ETHUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, charts from TradingView.com, Santiment.web