Key Takeaways

- Volatility briefly rose in crypto markets final month however is again close to all-time lows

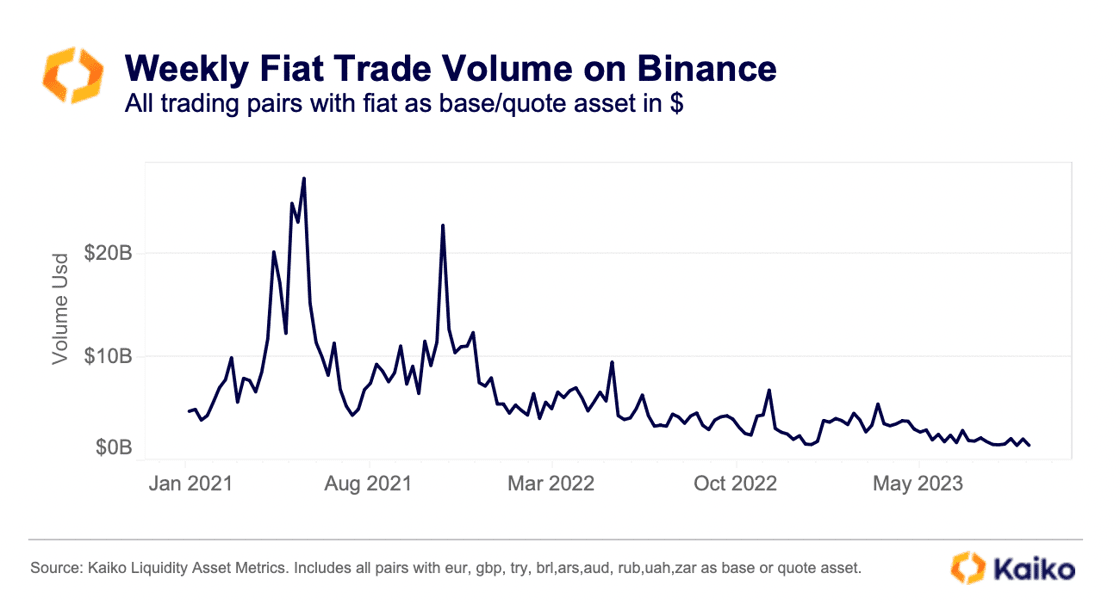

- Capital flight out of the area has been monumental, with liquidity additionally at multi-year lows

- Trading volume continues to decline, with Binance’s volume down 95% from the height in 2021

- Ethereum is now buying and selling at an analogous volatility to Bitcoin

- A mixture of tight financial circumstances within the financial system, in addition to crypto-specific scandals and a regulatory crackdown, have all made their mark on the area

Volatility within the crypto markets is again to multi-year lows. After a brief pickup amid the constructive ruling on the Grayscale ETF case final month, markets are again to the placid state now we have change into acquainted with this 12 months.

Looking at 90-day annualised volatility, each Bitcoin and Ethereum are shut to the bottom ranges now we have seen. The chart beneath reveals that, apart from three remoted episodes, now we have seen volatility in a near-constant state of decline since Q1 of 2022. That marks the infelxion level for the broader financial system, once we transitioned to a decent financial environmen, kicking off what would show to be a grotesque time in crypto.

The three episodes of reprieve with regard to volatility had been the Terra collapse and subsequent summer time of bankruptcies (from May 2022), the FTX collapse in November 2022 and, most lately, the banking contagion in March 2022. Otherwise, it has been a downhill journey.

The muted state of the once-volatile asset class is hurting market makers and liquidity. While your entire ecosystem has been ravaged, it can be crucial to word that the macro setting has additionally pared down in volatility this 12 months, as might be seen on the beneath chart the place now we have included the 90-day volatility of the Nasdaq for reference.

However, the size of the decline in crypto has gone above and past. While digital belongings stay extremely correlated with danger belongings (the tech-heavy Nasdaq being the basic instance), the capital flight and drain of each volatility and liquidity kind the blockchain sector have been unmatched elsewhere.

Such is the shortage of volatility that we’re now even seeing Ethereum commerce with related volatility to Bitcoin (for a quick interval, Ethereum’s volatility was even even lower than Bitcoin’s), regardless of the previous historically working at volatility ranges above the world’s greatest crypto.

On the one hand, that is constructive for Ethereum and demonstrates a rising maturity. On the opposite hand, the convergence is emblematic of the drain in general volatility from the area at giant.

Yet, within the context of what’s occurring throughout the area, the drawdown isn’t a surprise. We maintain mentioning the capital flight and dearth of liquidity; in wanting at the numbers, the chasm in contrast to earlier years is big.

Fiat commerce volume on Binance, the world’s greatest change with an approximate two-thirds market share of whole volume, is down to its lowest degree in additional than two years. Fiat commerce volume on Binance has declined by greater than 60% since early January and is down 95% relative to its 2021 peak, in accordance to knowledge from Kaiko.

While Binance is going through myriad points which can have exacerbated the decline, the underlying reality stays: liquidity has fled the area at the velocity of sunshine, to the extent which has stunned maybe even probably the most bearish of crypto analysts’ predictions. Not to point out, one of many many accusations levelled in opposition to Binance by way of a number of lawsuits is an alleged manipulation of commerce volume, so maybe the dropoff is even worse than these above numbers suggest.

Given volume and volatility go hand-in-hand, the following drawdown within the latter is, due to this fact, not stunning. Crypto resides as far out on the danger spectrum as might be, and in a world that has seen rates of interest soar from 0% to above 5% – and at a tempo among the many quickest in trendy financial historical past – the fallout is sensible. And that’s with out even layering within the quite a few scandals and crypto-specific episodes which have pushed market makers and buyers alike away.