Despite the less-than-impressive efficiency over the previous couple of months, Bitcoin buyers are nonetheless digging their heels deeper into the digital asset. This is evidenced by the continual rise in pockets exercise that has been recorded throughout this time.

Bitcoin Wallet Activity Hits Highest In 5 Months

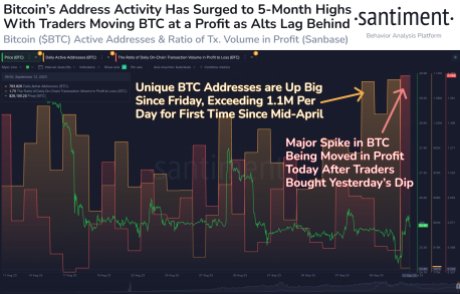

In a Tuesday put up, on-chain knowledge aggregator Santiment revealed that there was a big uptick in Bitcoin wallet activity regardless of the BTC worth downtrend. Apparently, whereas the market had fluctuated closely on account of regulatory uncertainties, Bitcoin buyers held their very own, particularly by way of new pockets handle exercise.

The Santiment studies present fluctuations on this metric over the months. However, the one constant factor was the tendency to leap again up even after dipping considerably. In September alone, the metric has moved from a low of round 860,000 to over 1.1 million distinctive every day Bitcoin addresses energetic.

Unique every day addresses hit 5-month excessive | Source: Santiment on X

Interestingly, this determine is the very best this metric has been since April, proving that the BTC price downtrend has not served as a deterrent for Bitcoin buyers. Rather, it appears as if buyers are utilizing the present low costs as a technique to enhance their footprint.

The uptick can be defined by the euphoria triggered by asset supervisor Franklin Templeton filing for a Spot Bitcoin ETF. While the hype across the submitting was short-lived, it triggered a short uptick within the worth of the digital asset, and sure aided the rising pockets exercise price as buyers rushed to make the most of the expansion.

Will BTC Price Follow Wallet Activity?

Even although pockets exercise is up, the BTC worth remains to be straining under $26,000. This may counsel that this metric does not likely have a lot bearing on the worth of Bitcoin. Rather, it simply factors to buyers not slowing down utilization of the community regardless of low costs.

BTC worth recovers above $26,000 | Source: BTCUSD on Tradingview.com

Presently, buyers are nonetheless eagerly awaiting a call on the quite a few Spot BTC ETFs that have been filed by fund managers. The consequence of those filings, whether or not rejected or accepted, will possible be the defining issue for the Bitcoin worth going ahead.

For now, there aren’t any massive strikes to be anticipated for the digital asset, particularly given the truth that it’s nonetheless ranging under its 50-day and 100-day moving averages. Mounting resistance between $26,000-$27,000 means that Bitcoin would possibly proceed to commerce sideways for the higher a part of September.

At the time of writing, Bitcoin is treacherously holding above $26,000 with meager positive aspects of 0.64% within the final day.