Bitcoin worth is struggling to recuperate above $26,500. BTC is clearly struggling and there’s a danger of a draw back break within the close to time period.

- Bitcoin is going through lots of hurdles above the $26,200 resistance zone.

- The worth is buying and selling effectively under $26,000 and the 100 hourly Simple shifting common.

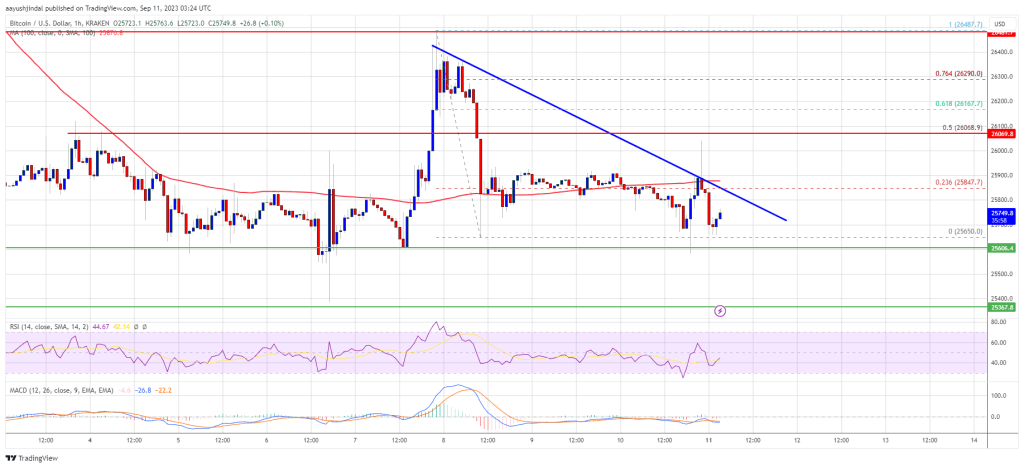

- There is a key bearish pattern line forming with resistance close to $25,800 on the hourly chart of the BTC/USD pair (information feed from Kraken).

- The pair may take a significant hit if there’s a shut under $25,350.

Bitcoin Price Remains At Risk

Bitcoin worth remained in a bearish zone and all makes an attempt to start out an honest recovery failed. BTC peaked close to $26,500 and began a contemporary decline.

There was an in depth under the $26,000 pivot stage. The worth even spiked under $25,650. A base appears to be forming close to the $25,600 stage however upsides are nonetheless capped. The worth is consolidating under the 23.6% Fib retracement stage of the downward transfer from the $26,487 swing excessive to the $25,650 low.

Bitcoin can also be buying and selling effectively under $26,000 and the 100 hourly Simple moving average. Besides, there’s a key bearish pattern line forming with resistance close to $25,800 on the hourly chart of the BTC/USD pair.

Immediate resistance on the upside is close to the $25,800 stage. The first main resistance is close to the $26,050 stage or the 50% Fib retracement stage of the downward transfer from the $26,487 swing excessive to the $25,650 low.

Source: BTCUSD on TradingView.com

The subsequent key resistance is close to $26,200. A correct shut above the $26,200 stage would possibly begin an honest improve. The subsequent main resistance is close to $26,500, above which the bulls may acquire energy. In the said case, the value may take a look at the $27,000 stage.

More Losses In BTC?

If Bitcoin fails to clear the $26,200 resistance, it may proceed to maneuver down. Immediate assist on the draw back is close to the $25,600 stage.

The subsequent main assist is close to the $25,350 stage. A draw back break and shut under the $25,350 stage would possibly improve promoting stress. In the said case, the value may drop towards $24,500 and even $24,000.

Technical indicators:

Hourly MACD – The MACD is now shedding tempo within the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now under the 50 stage.

Major Support Levels – $25,600, adopted by $25,350.

Major Resistance Levels – $25,800, $26,050, and $26.200.