Yesterday’s weekly shut of the Bitcoin worth beneath the $26,000 mark has raised issues amongst analysts and merchants. This transfer might probably sign an additional decline for the main cryptocurrency, because it seems to be step one to confirming a double prime formation on the weekly chart.

Rekt Capital, a outstanding determine within the crypto evaluation sphere, took to Twitter to share his insights, stating, “BTC has officially Weekly Closed below the ~$26,000 support. Technically, BTC has begun the first step in the process of validating this Double Top formation. Turn $26,000 into new resistance and the breakdown will likely be confirmed.”

How Low Can The Bitcoin Price Drop?

Remarkably, this isn’t the primary time Rekt Capital has voiced issues about this worth degree. Already on August 7, the analyst warned, “If BTC drops to $26,000 by mid-September then a Double Top may be forming. A breakdown from $26,000 would validate the Double Top.”

Diving deeper into potential worth actions, Rekt Capital has speculated {that a} breach of the $26,000 base might see Bitcoin tumble in the direction of the $22,000 area. The analyst emphasised the significance of observing the value motion this week, noting, “if we see a weekly close below $26,000, followed by a rejection from $26,000, then we probably see a confirmed breakdown from this double top.”

However, it’s not all gloom and doom. Rekt Capital additionally highlighted the hazards of getting overly bearish, advising merchants, “So it’s really important not to get caught in these downside wicks (below $26,000).” On a brighter notice, the analyst pointed to the inverse head and shoulders sample on Bitcoin’s weekly chart which performed out in mid-March this 12 months, suggesting {that a} retest of its neckline, round $24,000, may point out the underside of Bitcoin’s upcoming transfer.

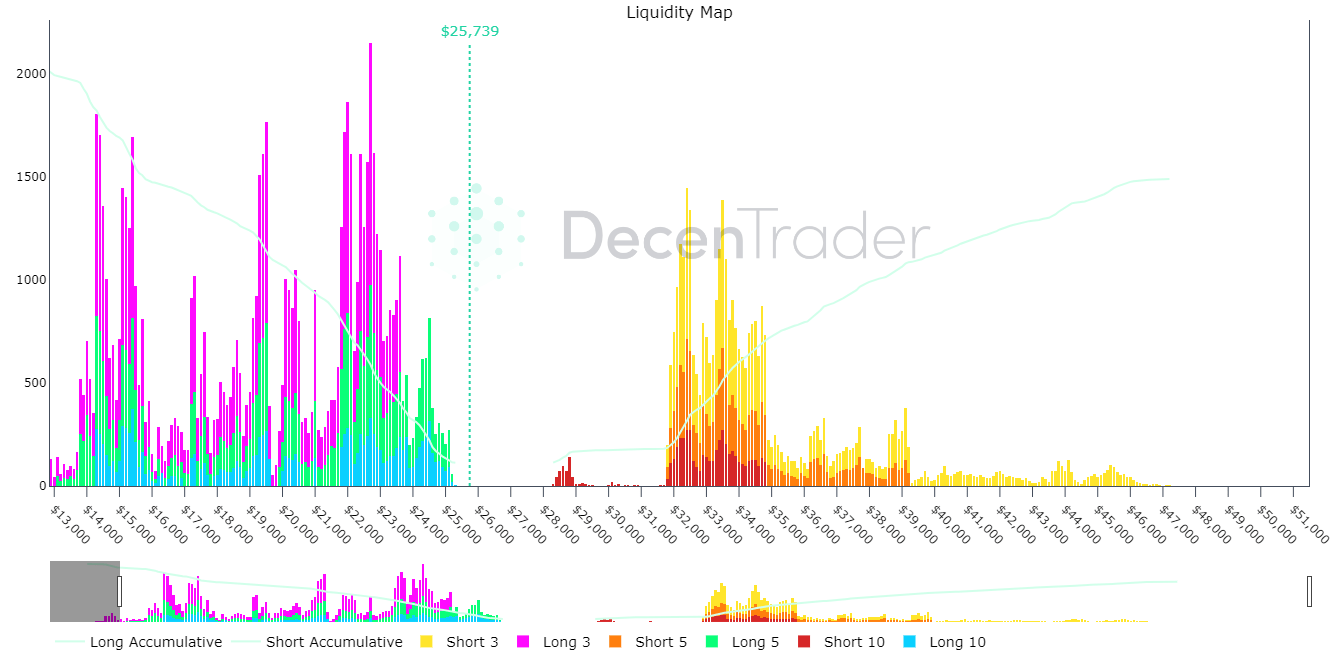

Decentrader, a crypto intelligence platform, weighed in on the present market circumstances, tweeting, “The market is currently experiencing the most sustained period of #bitcoin on-chain losses since the bear market lows. Is this a buy the dip opportunity or the start of a deeper pullback?”

They additional highlighted potential worth actions, stating, “Bitcoin Liquidity Map: There is a significant amount of 3x, 5x, 10x liquidity from $23,500 down to $21,600. IF price did get down to $23,500 we could see a fairly swift liquidity escalation event that could move price down fast.”

Final Correction?

Michaël van de Poppe, one other esteemed analyst, supplied a complete historic perspective. He emphasised the importance of September as a traditionally difficult month for Bitcoin, stating, “There’s a level which #Bitcoin must hold in order to avoid a significant crash. Bitcoin is currently holding onto a significant level of support. It’s around the $25,500 barrier.”

Van de Poppe delved into the historic and cyclical points of Bitcoin’s worth actions. He highlights that the months of August and September, particularly in a pre-halving 12 months, have historically been robust for Bitcoin. In August 2015, Bitcoin skilled a considerable correction in the direction of the 200-EMA however managed to remain above it. An analogous sample was noticed in August 2019, with a major correction adopted by a smaller one in November 2019.

Drawing parallels between the present market cycle and that of 2015, van de Poppe prompt that given the inflow of latest institutional individuals, the present market may very well be mirroring the 2015 cycle. If this correlation holds, the present downturn may very well be the ultimate correction earlier than a possible rebound.

At press time, BTC traded at $25,692.

Featured picture from iStock, chart from TradingView.com