On-chain information reveals the Ethereum whales have not too long ago gone on a $425 million purchasing spree, an indication that might be optimistic for the asset.

Ethereum Whales Have Participated In Accumulation Recently

As identified by analyst Ali in a post on X, the ETH whales have made some large purchases not too long ago. The related indicator right here is the “ETH Supply Distribution,” which tracks the full provide quantity every investor group holds.

Investors or addresses are divided into these teams based mostly on the full variety of tokens they carry of their steadiness. For occasion, the 1 to 10 cash cohort consists of all buyers holding no less than 1 and at most 10 ETH.

In the context of the present dialogue, the group of curiosity is that of the whales. The pockets vary of those humongous holders could be assumed to be 10,000 to 100,000 cash.

Since the whales maintain important quantities of their wallets (the vary converts to about $16.3 million on the decrease finish and $163 million on the higher finish), they’ll naturally be influential entities on the community.

Now, here’s a chart that reveals how the full provide held by the Ethereum whales has modified over the previous week:

Looks like the worth of the metric has noticed some uplift in latest days | Source: @ali_charts on X

As displayed within the above graph, the provision held by the Ethereum whales has registered a notable improve not too long ago. During this rise, these humongous holders have purchased round 260,000 ETH, value roughly $423 million on the present trade charge, inside 24 hours.

With this newest shopping for spree, the full provide of this cohort has reached about 27.03 million ETH, which means that these buyers now carry about 22.5% of the complete circulating provide of the cryptocurrency.

This accumulation from the Ethereum whales is of course a constructive signal for the coin, because it signifies that these holders help the present costs, so the chance of a rebound might have change into boosted.

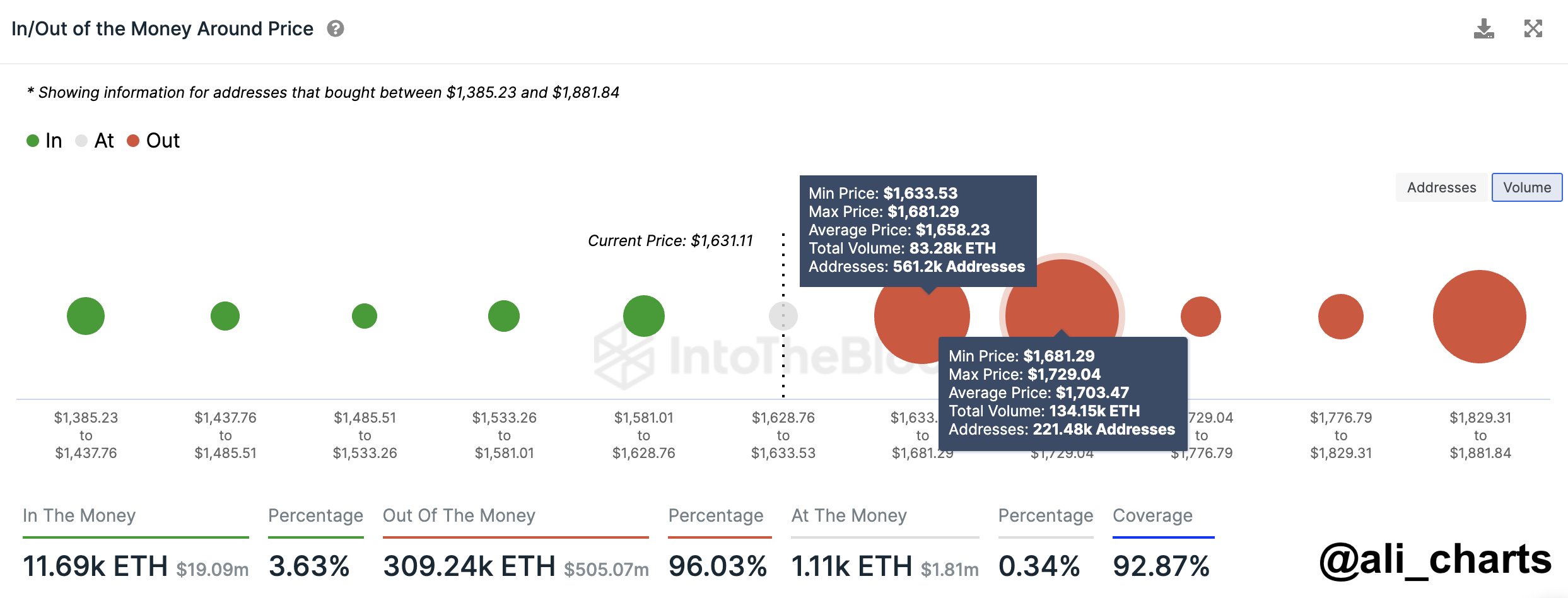

However, the identical analyst has identified that Ethereum’s present value is dangerous, as not many buyers have their cost basis at this stage.

The density of buyers who bought on the completely different ETH value ranges | Source: @ali_charts

The above information reveals the variety of buyers that purchased in every Ethereum value vary. From it, it’s obvious that the present stage is comparatively skinny on holders, and the ranges under don’t host the fee foundation of that many holders.

The most dense teams are located within the value ranges simply above the present one, which means that on the present costs, all these buyers can be sitting at losses on common.

Generally, zones with a excessive focus of value bases help the worth, however no such zone exists within the decrease ranges. Ali notes that this might result in a correction in the direction of the $1,200 stage, the following stage, with some help.

Buying from the whales on the present costs is of course a step in the fitting route for the asset, however it would nonetheless have to recuperate a bit to the extra dense value foundation zones if a strong rebound has to construct up.

ETH Price

At the time of writing, Ethereum is buying and selling at round $1,600, down 5% within the final week.

ETH has continued to commerce sideways not too long ago | Source: ETHUSD on TradingView

Featured picture from Todd Cravens on Unsplash.com, charts from TradingView.com, Santiment.web