The Bitcoin value at the moment stays in a susceptible place. Meanwhile, latest on-chain knowledge means that Bitcoin whales are accumulating, however opposite to standard rumors, BlackRock isn’t amongst them. Meanwhile, analysts are divided on whether or not the worst is behind for Bitcoin’s value.

Whales Accumulate Bitcoin, But It’s Not BlackRock

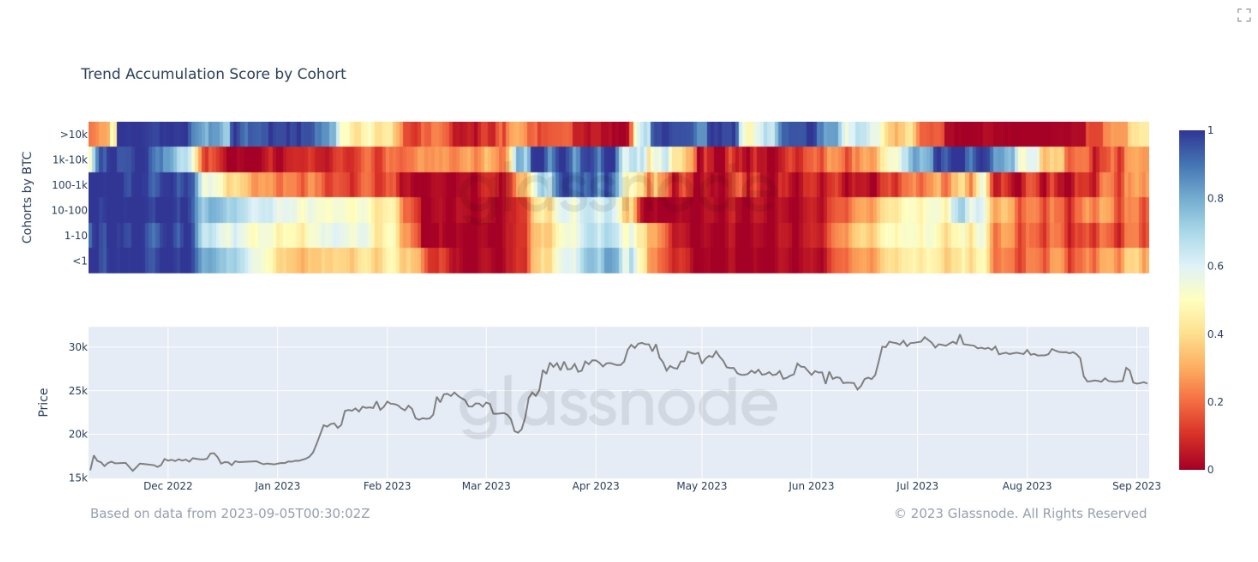

On-chain analyst James V. Straten not too long ago highlighted a development within the accumulation rating by cohort chart. He remarked, “Seems like peak Bitcoin distribution is behind us, as we can see a slight tick-up in accumulation. This is the most aggressive accumulation since June/July for whales that have over 10k BTC.”

However, the waters are muddied by rumors surrounding BlackRock’s involvement. Speculation has been rife that BlackRock has been suppressing Bitcoin costs to purchase low cost. But these claims are unfounded. “Many individuals don’t realize that BlackRock would require actual Bitcoin to back their Spot ETF. They might have already purchased their Bitcoin months ago when prices were lower,” is an announcement that’s been debunked.

The actuality is that BlackRock, being a monetary behemoth managing folks’s cash, undergoes audits each three months. This means they’ll’t disguise Bitcoin purchases from auditors. If they had been to put money into Bitcoin, it could be via an exchange-traded fund.

In truth, BlackRock has already proven curiosity within the house by investing in Bitcoin mining shares and MicroStrategy as a proxy. Remarkably, BlackRock is a serious shareholder in 4 out of the 5 largest Bitcoin mining corporations.

Is The Worst Behind For BTC Price?

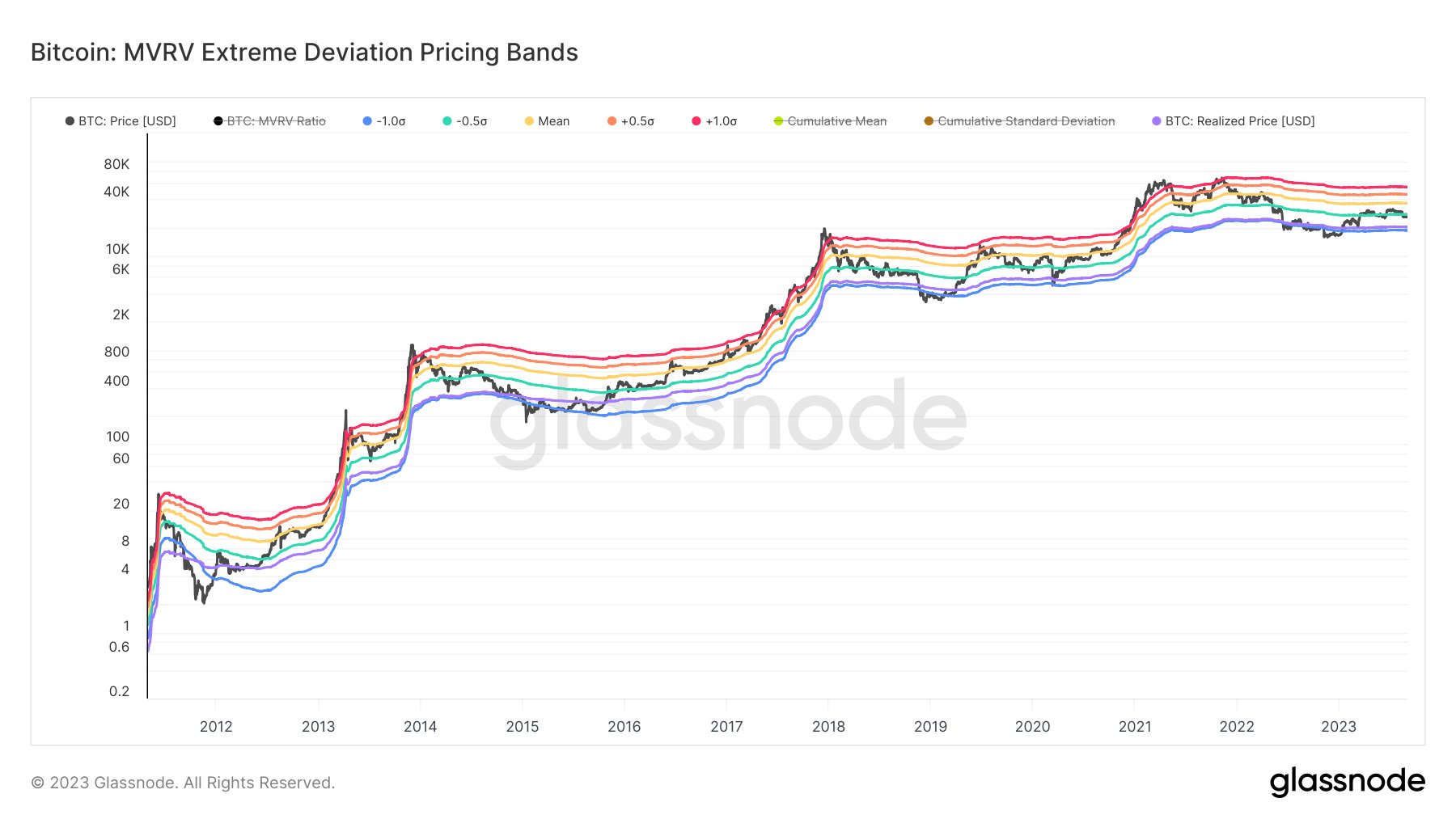

The Bitcoin value trajectory stays a subject of intense debate amongst analysts. Will Clemente, a distinguished determine within the house, shared the chart beneath and commented, “From a high-time-frame valuation perspective, Bitcoin’s position is intricate. While it’s not overheated relative to historical values, there’s a tangible risk of retesting the lows akin to Q1 2020.”

He additional emphasised the prevailing market apathy, pointing to the bottom aggregated buying and selling quantity since 2020, the dwindling Google search tendencies for Bitcoin at multi 12 months lows and realized volatility, implied volatility, weekly Bollinger Bands all close to document lows.

Joe Burnett of Blockware Solutions chimed in with a compelling observation, “A staggering 94.6% of all Bitcoin remained stationary in the last 30 days. We set a record high at August’s end, and this might soon be surpassed. Historically, bear markets conclude when supply dries up. A mere spark of demand could ignite the next explosive bull market.”

Crypto merchants, too, are intently monitoring key ranges. @DaanCrypto remarked the importance of the $26K-26.1K vary because it marks the each day, weekly and month-to-month open, excessive quantity node and weekly VWAP. Therefore, for bulls, it’s the road of motion, and for bears, it’s the fortress to defend.

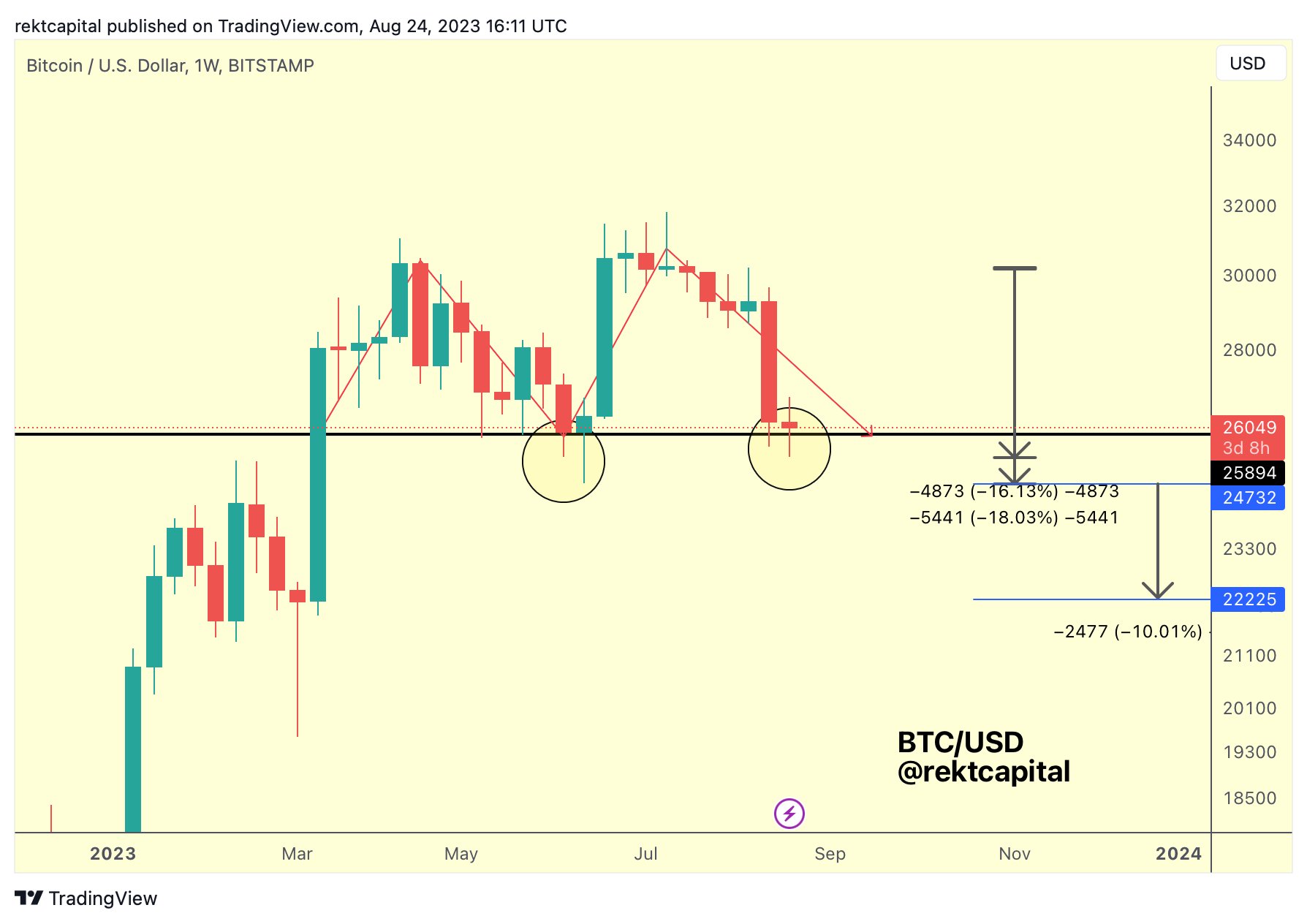

Rekt Capital, a well-regarded crypto analyst, has been intently monitoring Bitcoin’s value motion, particularly in relation to its quantity dynamics. He additionally highlights the importance of the $26,000 help stage on the weekly chart, mentioning that Bitcoin’s value has been hovering round this mark even after retracing most of its positive aspects from the earlier Grayscale rally.

However, the simultaneous decline in each buy-side and sell-side volumes is a trigger for concern, suggesting a market that’s at the moment directionless. “The declining sell-side volume coupled with a lackluster buyer volume is concerning. Without a volume breakout, neither from sellers nor buyers, the market lacks momentum,” the analyst states.

On the subject of the double top, a historically bearish sample, Rekt Capital indicated {that a} breach beneath the $26,000 mark on the weekly chart may probably ship BTC tumbling in the direction of $22,000. However, he additionally hinted at a silver lining: an inverse head and shoulders sample noticed earlier this 12 months. If Bitcoin approaches the $24,000 mark, which serves because the neckline for this sample, it may act as a strong help and probably sign a bullish turnaround.

At press time, BTC traded at $25,734.

Featured picture from Mike Doherty / Unsplash, chart from TradingView.com