In the dynamic realm of Bitcoin, the flexibility to discern patterns and developments from uncooked knowledge is invaluable. Glassnode’s newest report, “Exhaustion and Apathy,” serves as a beacon, illuminating the intricate nuances of the present state of the market. Let’s delve deeper into the numbers and their implications.

Historic Lows In Bitcoin Volatility

The overarching theme of Glassnode’s findings is the unprecedented stagnation in Bitcoin’s volatility. The knowledge reveals that the digital asset has been buying and selling inside a remarkably slender $29,000 to $30,000 vary. Historically, Bitcoin has been synonymous with volatility, making this present section an anomaly.

The report underscores this by highlighting the Bollinger Bands’ tightness, noting, “The upper and lower Bollinger Bands are currently separated by just 2.9%.” Such constricted motion has been a rarity in Bitcoin’s tumultuous historical past.

Meanwhile, the dynamics between short-term holders (STH) and long-term holders (LTH) supply a fascinating narrative. Glassnode’s knowledge signifies a big shift in wealth between these two cohorts. The STH’s wealth has burgeoned by +$22B this 12 months, whereas the LTH has witnessed a near-identical discount of -$21B. This shift just isn’t merely about numbers but in addition about market sentiment and technique.

The value foundation additional elucidates this dynamic. The STH value foundation has surged by +59% YTD, settling at $28.6k. In stark distinction, the LTH value foundation lingers significantly decrease, round $20.3k. This divergence means that current market entrants is likely to be paying a premium, doubtlessly as a result of FOMO (Fear of Missing Out) or speculative habits.

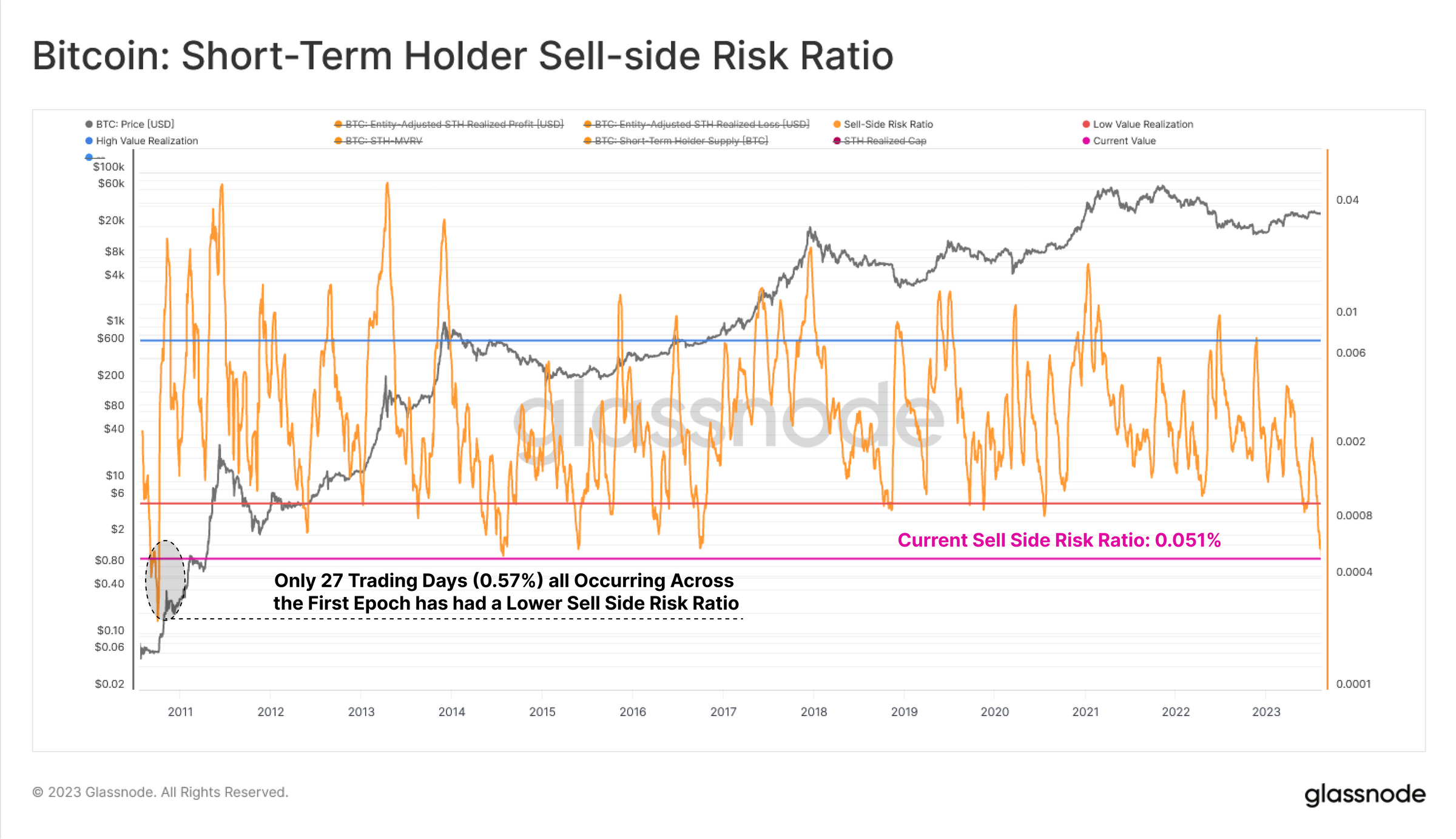

Glassnode’s exploration into spending patterns on this low volatility surroundings can be notably enlightening. The knowledge means that in such intervals, the vast majority of cash moved on-chain have a value foundation that hews intently to the spot charge, leading to minuscule realized earnings or losses.

The Sell-Side Risk Ratio, a pivotal metric on this context, is languishing at an all-time low. To put it in perspective, fewer than 27 buying and selling days (0.57%) have recorded a price decrease than the present one, signaling a market teetering on the sting of a possible volatility resurgence.

Segmented View Of BTC’s Supply

The report’s segmented evaluation of Bitcoin’s provide, primarily based on ‘investor holding time,’ provides a layered understanding of market habits. The ‘Hot Supply,’ representing probably the most lively cash, constitutes a mere 2.8% of all invested worth in BTC. This suggests a market dominated by holders relatively than merchants.

The ‘Warm Supply,’ spanning from per week to 6 months, has seen a modest uptick year-to-date, now accounting for round 30% of Bitcoin’s wealth. This section’s habits is essential because it typically acts as a bridge between short-term reactions and long-term convictions.

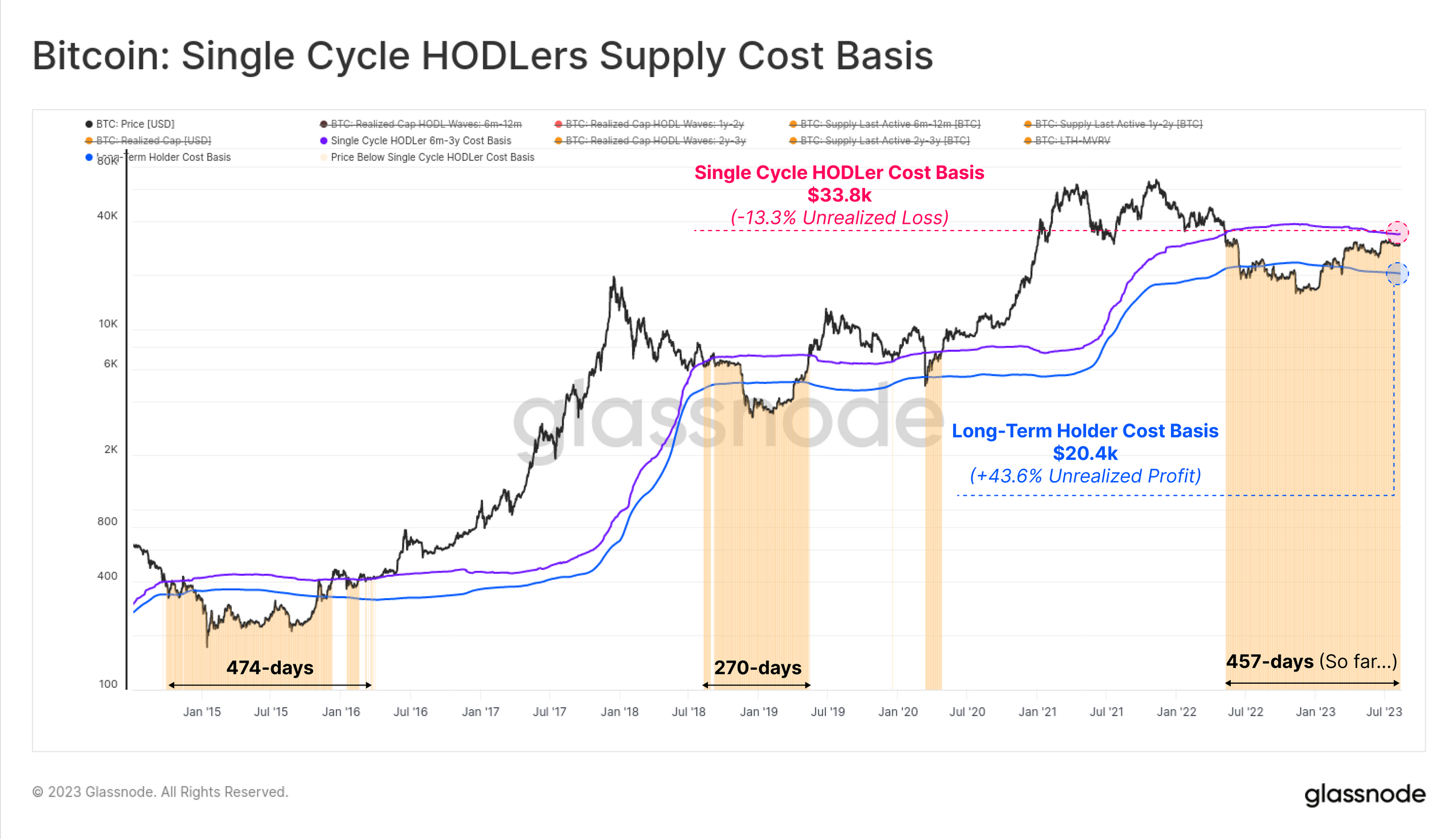

The ‘Single-Cycle Long-Term Holders,’ these entrenched within the 2020-23 cycle, are the behemoths, holding a staggering 63% of the invested capital. Their value foundation, as per Glassnode, stands at $33.8k, indicating a mean unrealized lack of -13.3%.

In juxtaposition, the basic LTH cohort, which incorporates the long-dormant and deep HODLed provide, boasts a value foundation of $20.4k, translating to an unrealized revenue of +43.6%. This stark distinction underscores the lingering influence of the 2022 bear market and the cautious optimism of early adopters.

In conclusion, Glassnode’s data-driven insights paint a nuanced image of the Bitcoin market. The dominance of long-term holders, the historic lows in volatility, and the evident investor apathy all converge to recommend a market in a state of stasis. The numbers point out a market that’s ready, maybe for a Goldman Foresees Q2 2024 Fed Rate Cut: A Boost For Bitcoin? or a big occasion, to find out its subsequent route.

At press time, Bitcoin was buying and selling simply above the 50-day EMA.

Featured picture from iStock, chart from Buying and sellingView.com