The Bitcoin panorama is not any stranger to debates and predictions. Two dominant theories are at the moment on the forefront: the 4-Year Cycle and the Elliot Impulse Wave. However, a complete analysis by the esteemed crypto analyst CryptoCon, suggests an enchanting intersection of those two theories.

The Dueling Bitcoin Price Prediction Theories

At the center of the controversy are two camps. The first, the 4-Year Cycle proponents, imagine in Bitcoin’s 4-year journey from cycle tops to bottoms, with a predicted zenith in 2025. The second camp, the Elliot Impulse Wave advocates, are forecasting a robust parabolic prime both this 12 months or by early 2024.

CryptoCon’s meticulous evaluation, which encompasses TA, on-chain knowledge, market psychology, and extra, gives a recent perspective. “I believe it may be possible to see the best of both worlds for each group of thinkers,” he posited.

A good portion of the 4-Year Cycle idea hinges on the halving’s impression on Bitcoin’s worth. “When the Bitcoin supply is reduced approximately every 4 years, this should trigger a supply decrease which causes price to rise,” CryptoCon elucidated. However, he additionally raised a counterpoint, noting the diminishing affect of miner provide output on Bitcoin’s worth, particularly given its present market measurement.

Historical Parallels, Signals And Indicators

CryptoCon drew consideration to the 2011-2013 cycle, a interval that didn’t adhere to conventional patterns. This cycle skilled each an early and a later prime. Could this be a precedent for the present cycle? “Both of these groups of people seem to forget one particular cycle that seemingly defied all of the rules. 2011 – 2013,” he recalled.

Two compelling indicators have been central to his evaluation: the DXY Correlation Coefficient and the Vigor Signal. Historically, these have been precursors to a worth parabola. “The parabola signal has triggered. This has been the start of every price parabola by definition,” he emphasised, underscoring their reliability. Historically, when Bitcoin has proven a low correlation with the US greenback, vital worth actions have been noticed.

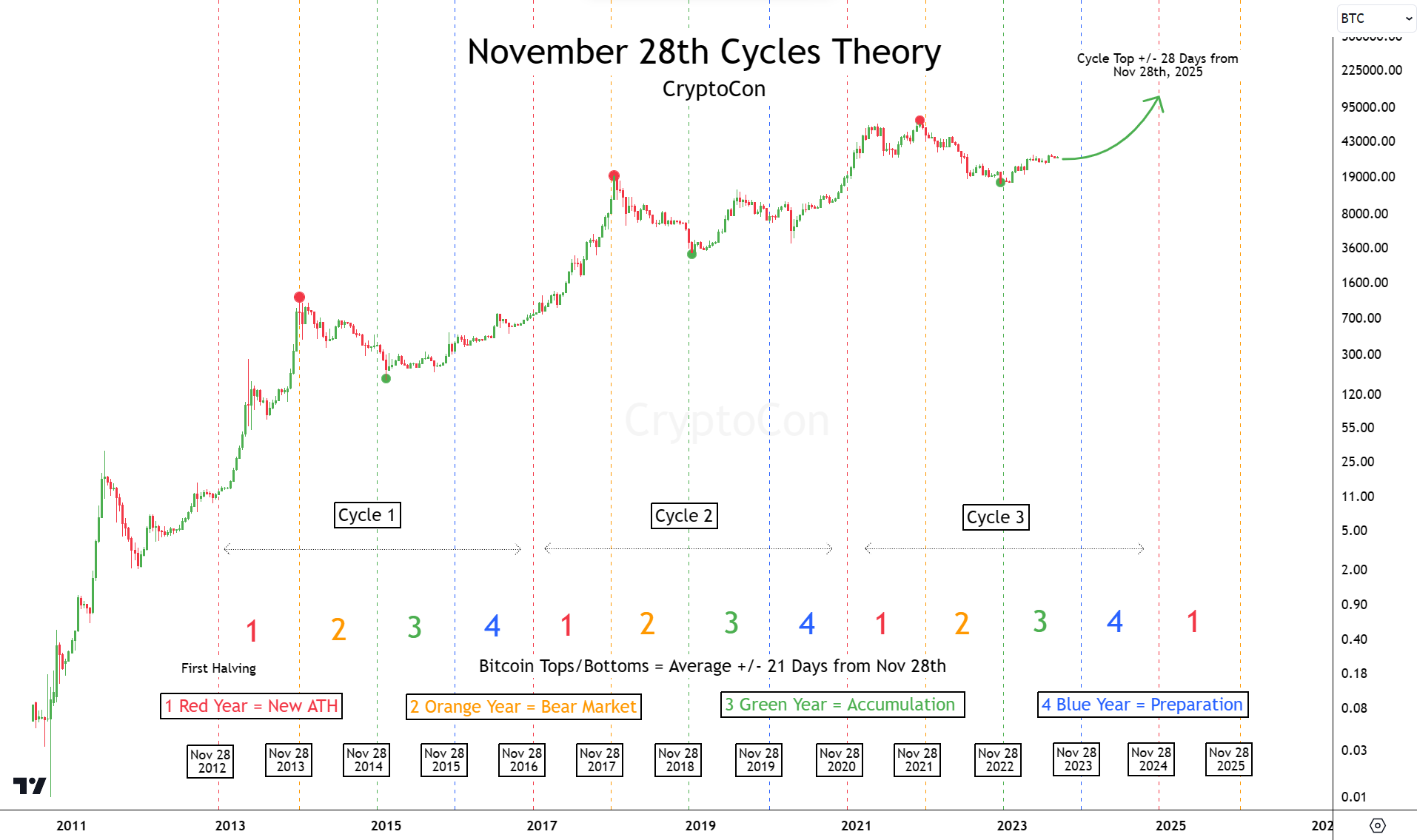

The November twenty eighth Cycles Theory, rooted within the date of Bitcoin’s first halving, has additionally been a constant predictor of Bitcoin’s worth actions for a decade. It segments the Bitcoin worth journey into 4 distinct phases: Green, Blue, Red, and Orange years (see chart beneath), every with its personal attribute worth habits. “With its level of accuracy, there’s no reason to expect it to fail this cycle. Telling us the true cycle top will come late 2025,” CryptoCon confidently acknowledged.

CryptoCon’s Trend Pattern Price Model, which makes use of patterns in angles levels from cycle highs and lows to foretell future ones, initiatives a worth of $130,000 by the top of the November twenty eighth Cycle’s Theory timeframe. He was fast to warning towards over-reliance on fundamentals, stating, “Although many would say there is no limit to price with fundamentals, I think this is an absolutely ridiculous argument.”

Converging BTC Predictions

Synthesizing all this knowledge, CryptoCon envisions a state of affairs the place each the 4-Year Cycle and the Elliot Impulse Wave theories may harmoniously coexist. He anticipates an early prime round April 2024, probably reaching $90,000, adopted by a mid-cycle bear market. The last prime, he predicts, may contact $130k by late 2025.

CryptoCon’s evaluation, whereas detailed and complete, additionally comes with a dose of humility. “This is what I believe is possible. Absolute? Hardly,” he remarked. As the Bitcoin group continues its fervent discussions, one factor stays clear: Only time will really reveal the course Bitcoin’s worth will take.

At press time, the BTC worth stood at $29,466.

Featured picture from iStock, chart from TradingView.com