MicroStrategy, the world’s largest company holder of Bitcoins, appears to planning for a $750 million inventory sale, thereby elevating funds for buying extra Bitcoins.

On Tuesday, August 1, MicroStrategy unveiled its second-quarter results asserting its holds 152,800 BTC as of July 31, 2023. In a filing with the U.S. Securities and Exchange Commission (SEC) on the identical day, MicroStrategy introduced that it has signed a gross sales settlement with three firms – Cowen and Company, Canaccord Genuity, and Berenberg Capital. The settlement is for the sale of its class A typical inventory.

The firm added that the proceeds of the MSTR inventory sale can be used for quite a lot of basic company functions. This consists of the acquisition of extra Bitcoins in addition to some working capital.

During the second quarter, MicroStrategy added a complete of 12,333 Bitcoins price $364.1 million. This was the corporate’s second-largest BTC buy in a single quarter since Q2 2021. During the Q2 earnings name, MicroStrategy Chief Financial Officer Andrew Kang stated:

“As with prior programs, we may use the proceeds for general corporate purposes, which include the purchase of Bitcoin as well as the repurchase or repayment of our outstanding debt”.

MicroStrategy Turns Profitable on Its Bitcoin Investments

After going through promoting stress earlier this week, the Bitcoin (BTC) value shot as much as $30,000 ranges afterward Tuesday. MicroStrategy’s common BTC holding value is at the moment at $29,672 per Bitcoin. this places the corporate’s complete $4.53 billion funding in Bitcoin, beneath profitability.

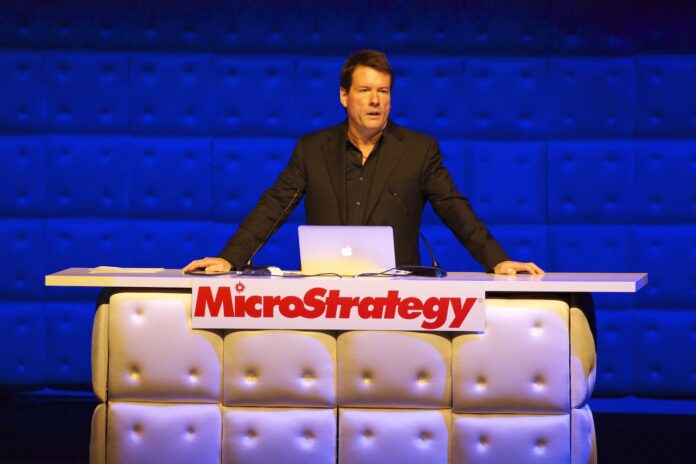

“Our objective is to find ways to generate incremental Bitcoin for our shareholders and do that with either cash flow from the business or do it through intelligent accretive financings of equity or debt or other intelligent operations,” MicroStrategy Chairman Michael Saylor instructed buyers on Tuesday.

In the second quarter, the value of Bitcoin elevated by 7% to succeed in $30,390. This development follows a big surge of practically 72% within the first quarter. However, within the second quarter of the earlier 12 months, Bitcoin skilled a pointy decline of 59% and dropped to $18,731.

MicroStrategy, which is taken into account a proxy for Bitcoin by many buyers, noticed little change in its share value, closing at round $434 after common buying and selling hours. This 12 months, the inventory has greater than tripled in worth, however in 2022, it dropped by 74%. The inventory reached an all-time excessive of $1,315 in February 2021.

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty for your private monetary loss.