After Ethereum (ETH) as soon as once more failed to interrupt the $2,000 degree within the 1-day chart, the worth has been on a downward slide in current days. However, this might now change, as a traditionally correct pattern indicator reveals.

Crypto merchants and analysts continuously search dependable indicators to navigate the turbulent market. One such indicator gaining consideration is the Tom Demark 9 (TD9), which has flashed a purchase sign for Ethereum (ETH) on the day by day chart. Renowned analyst Joe McCann shared his insights through Twitter, revealing an intriguing success charge of 78% for ETH’s historic TD9 purchase alerts.

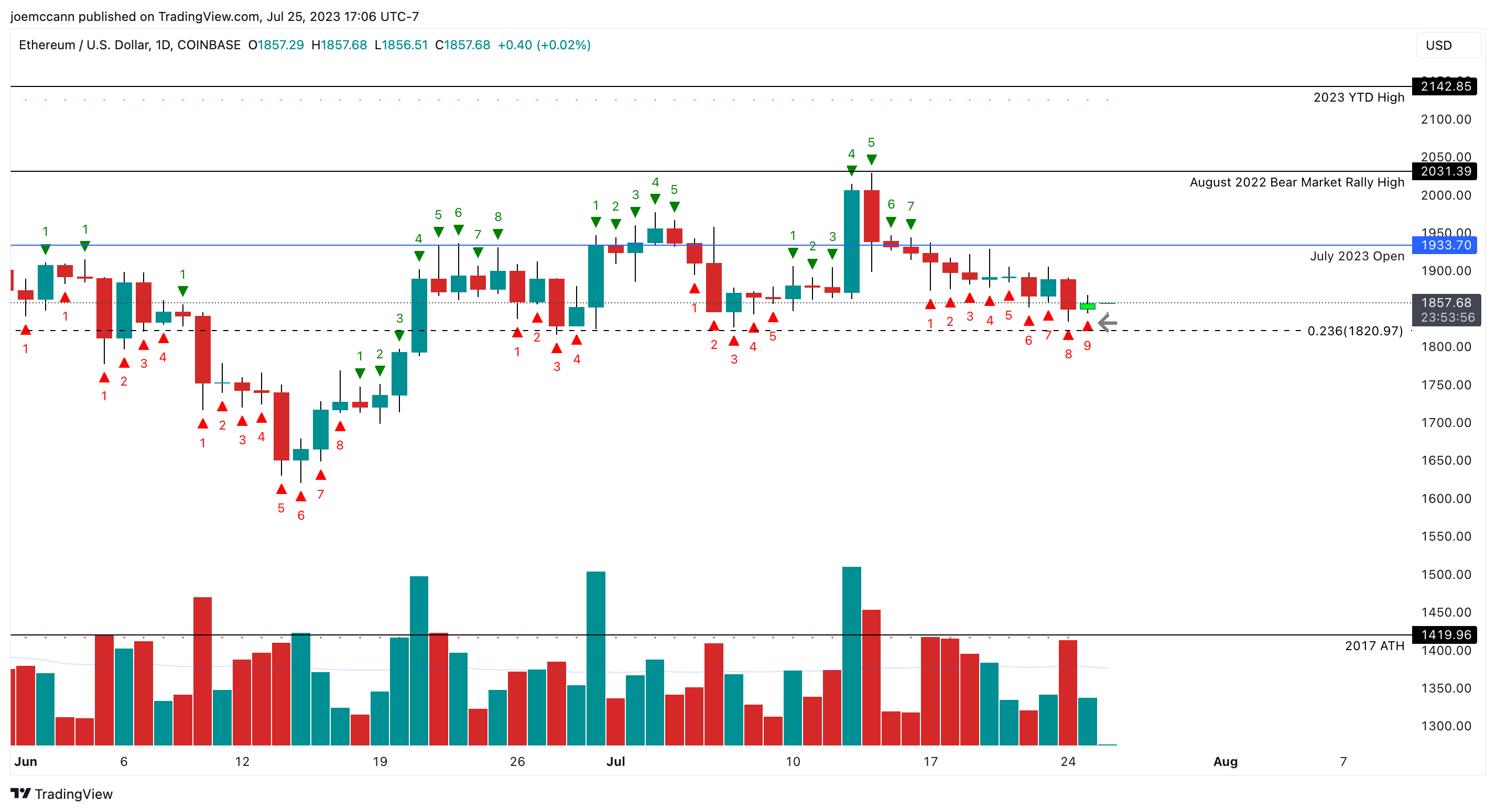

Ethereum (ETH) Buy Signal

Joe McCann’s tweet introduced the highlight on ETHUSD’s TD9 purchase sign, which occurred after the asset dropped 8.7% from its current excessive. The TD9 indicator, an indicator that additionally measures whether or not an asset is overbought or oversold, just like the RSI, goals to establish potential pattern reversals. According to McCann, historic knowledge showcases the TD9 purchase sign’s outstanding accuracy for ETH, with a win charge of practically 78%.

Possible value targets embrace the July open at $1,933, the August 2022 bear market rally excessive at $2,031, and the year-to-date 2021 excessive at $2,142, in line with the analyst.

Digging deeper into the info, McCann highlights the spectacular efficiency of ETH following TD9 purchase alerts. The statistics reveal that, on common, the asset surged by over 2.6% within the seven days following the sign, with a median return of just about 5%. These figures alone might pique the curiosity of merchants in search of an edge within the crypto market.

To present a extra nuanced image, McCann narrowed the info to look at the yr 2019, a interval he deems analogous to the 2023 crypto market cycle. The outcomes are much more fascinating, displaying a outstanding win charge of practically 90% for TD9 purchase alerts throughout this era.

However, if we trim the info again to beginning in 2019 (a yr similar to 2023 by way of crypto market cycles), ETH has a win charge of practically 90% with the typical return over +7%.

But, as with every indicator, there are exceptions and occasional inaccuracies. McCann’s knowledge reveals a number of cases the place the TD9 purchase sign didn’t predict ETH’s value motion precisely.

Noteworthy is March 13, 2018, when the ETH value slid massively after the purchase sign. The ETH value plummeted by 19.3% inside seven days and by as a lot as 34.8% throughout the subsequent 14 days. The sign was equally dangerous on May 8, 2018, after which ETH fell by 22.1% within the following seven days and 26.7% within the following 14 days.

On the opposite hand, the TD9 purchase sign has predicted some large rallies. For instance, on December 10, 2018, following the sign, ETH initially rose by 3.7% within the first seven days, however then got here a superb 53.0% rise in 14 days and 64.5% in 30 days. The most up-to-date TD9 purchase sign on March 11, 20223 delivered a value enhance of 18.8% within the first seven days and 29.9% after 30 days.

In common, it may be seen that the accuracy of the TD9 indicator decreases over time. While the indicator has a hit charge of 78% within the first seven days with a mean 7-day ahead return of +2.65% and a median return of just about 5%, the success charge falls within the subsequent time frame. After 14 days, the TD9 indicator has a hit charge of solely 55.5% (imply 3.8%, median 5.7%), after 30 days of 63.0% (imply 6.9%, median 3.8%) since 2018.

Federal Reserve Meeting Looms

While the TD9 purchase sign paints a constructive image for ETH, the crypto market stays susceptible to exterior elements, together with the upcoming FOMC assembly at this time. There is a 98.9% likelihood that there might be a 25 foundation level charge hike. But the massive query is whether or not this would be the final hike on this cycle. McCann writes:

July twenty sixth is the most recent assembly of the Federal Reserve and Jerome Powell is predicted to hike charges one other 25 bps. Will Jerome Powell smash the occasion for the ETH bulls on the press convention?

At press time, the Ether (ETH) value stood at $1,859.

Featured picture from iStock, chart from TradingView.com