Peer-to-peer crypto exchanges, which function in a decentralized method, have skilled a major decline of their spot buying and selling volumes over the previous yr.

This decline is a hanging contradiction to the optimistic forecasts made by crypto lovers, who anticipated a “golden age” for decentralized exchanges following the collapse of crypto trade FTX, eroding confidence in centralized platforms.

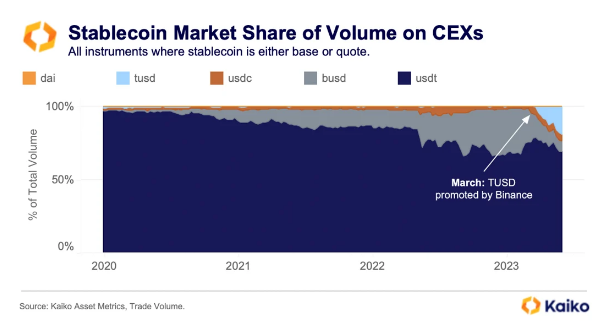

Surprisingly, these decentralized exchanges’ month-to-month spot buying and selling volumes have plummeted by a staggering 76% to $21 billion between January 2022 and June of the present yr. In comparability, centralized crypto platforms witnessed almost 70% in lower throughout the identical interval, as reported by Bloomberg News, citing knowledge supplied by Kaiko.

The surprising downward development has raised questions concerning the prospects of peer-to-peer decentralized crypto exchanges.

Peer-To-Peer Crypto Exchanges: Balancing Appeal And Challenges

Decentralized platforms have garnered a devoted following amongst crypto lovers preferring avoiding intermediaries in conventional monetary techniques.

However, these platforms usually want assist in the type of extra intricate person interfaces, slower transaction speeds, and decrease liquidity in comparison with main centralized venues like Binance or Coinbase.

Recent knowledge reported by Bloomberg signifies that the market share of peer-to-peer digital-asset platforms has skilled a decline from its peak of seven% achieved in March 2023, dropping to five%. This development hints on the challenges confronted by decentralized exchanges in sustaining their aggressive edge within the crypto market.

Despite fighting buying and selling volumes, decentralized exchanges have witnessed a gentle enhance in month-to-month energetic customers since 2020. The report notes that the variety of energetic customers has constantly surpassed 1 million this yr.

This surge in person exercise could reply to the uncertainties surrounding centralized platforms, notably within the aftermath of FTX’s chapter and the next allegations of large fraud, resulting in heightened scrutiny from regulatory authorities.

Bitcoin threatening to lose its grip on the $29K deal with. Chart: TradingView.com

Decentralized Finance’s Quest For Market Share

Kaiko’s latest report coincides with the emergence of protocol-native stablecoins launched by prime DeFi groups Curve and Aave. A major growth on this area is Aave’s governance approval for the mainnet launch of its GHO stablecoin, which launched in July.

These modern protocols allow customers to mint stablecoins by depositing collateral belongings and incurring low ongoing charges. This method empowers customers to entry fiat-denominated liquidity whereas nonetheless incomes DeFi yields, presenting a lovely proposition for these looking for stability and returns.

Since its inception, crvUSD has skilled a surge in adoption, solidifying its place because the sixth-most traded stablecoin, in keeping with CoinGecko knowledge.

One of its key options is introducing a gentle liquidation mechanism, which robotically converts a person’s collateral into stablecoins after they method a liquidation occasion. While this mechanism affords a security internet, customers should still encounter slippage in the course of the gentle liquidation.

Despite the success and rising recognition of protocol-native stablecoins, the decentralized stablecoin market faces a formidable problem.

The market capitalization of centralized stablecoins has reached a formidable 12-figure determine, posing whether or not decentralized options could make vital inroads into the stablecoin market share dominated by their centralized counterparts.

Featured picture from Keyring Pro