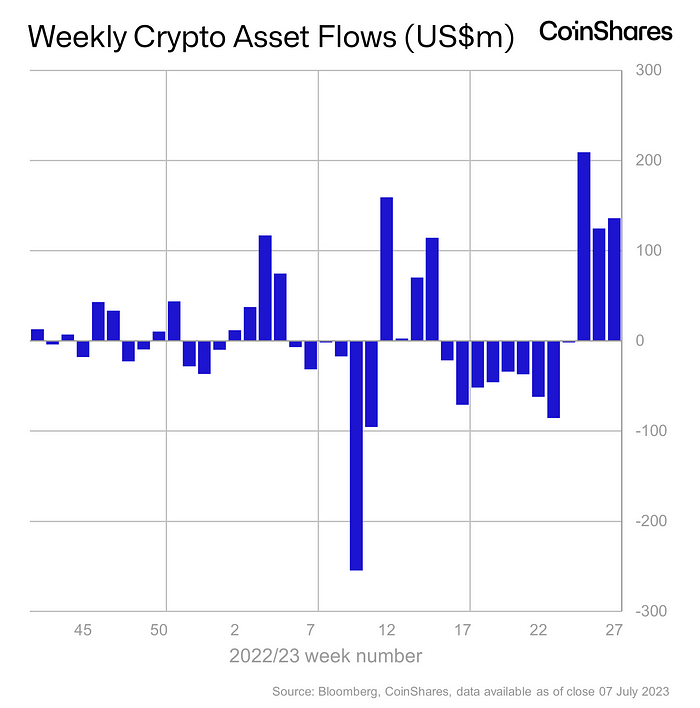

Crypto asset funding merchandise recorded $136 million in inflows final week, reported CoinShares on July 10. Another week of excessive influx signifies institutional and retail traders stay bullish on Bitcoin and different cryptocurrencies, as digital asset funding merchandise noticed three consecutive weeks of inflows after 9 consecutive weeks of outflows.

Crypto Funds Record Third Week of Inflow

Crypto asset funds noticed a complete of $470 million of influx within the final three weeks. Firstly, a $199 million inflow, adopted by a $125 million inflow, and $136 million within the final week. Also, it has introduced year-to-date flows to a web optimistic $231 million regardless of 9 weeks of outflows.

Bitcoin once more stays the favourite of traders, recording $133 million in inflows as in comparison with $123 million in an earlier week. It exhibits Bitcoin bulls are making ready to dominate and beginning to set off technical benefit this month. In addition, brief Bitcoin funding merchandise noticed an eleventh week of successive outflows regardless of a current worth bounce, with this week’s outflow of $1.8 million.

Surprisingly, blockchain equities noticed the biggest inflows of $15 million but recorded in a 12 months.

Meanwhile, altcoins equivalent to Ethereum, Solana, XRP, Polygon, Litecoin, and Aave noticed inflows, whereas each Cosmos and Cardano noticed minor outflows. Investors are additionally occupied with investing in Ethereum (ETH) as inflows rise to $2.9 million final week from $2.7 million in an earlier week.

ProShares ETFs, ETC Issuance GmbH, CoinShares Physical, and 21Shares AG recorded probably the most inflows final week. Germany leads the United States in crypto funds inflows final week, with Canada in third place.

Also Read: Bitcoin, Ethereum, USDT Trade At Discount On BinanceUS, Arbitrage Opportunity Or Trap?

Bitcoin Price Set For $50000

According to a CoinGape Markets analysis, Bitcoin has a long-term bullish outlook of $48,000, it would first tag highs round $38,000, adopted by a retracement to $35,000 earlier than the final word rally to $50k anticipated by the top of 2023.

Spot Bitcoin exchange-traded fund (ETF) functions by BlackRock, Fidelity Investments, and Others stay the principle space of debate within the crypto sphere since June.

In truth, Standard Chartered Bank increase its forecasts for Bitcoin worth to succeed in $50,000 this 12 months and $120,000 by the top of 2024.

Read More: Standard Chartered Revises Bitcoin (BTC) Price Prediction To $50000, $120K In 2024

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.