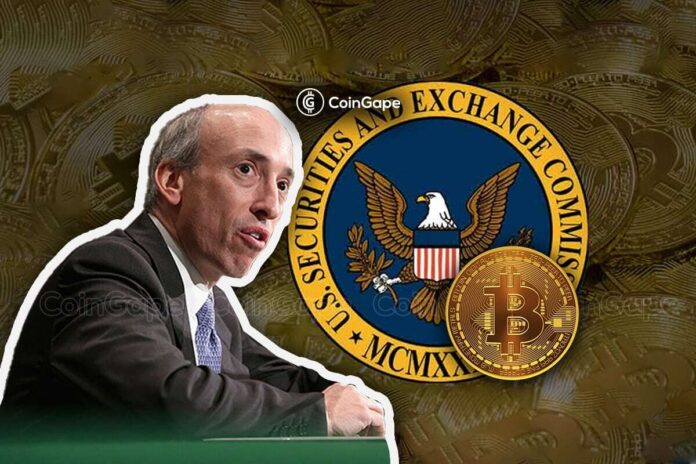

After stories of the US Securities and Exchange Commission (SEC) calling spot Bitcoin ETF filings by monetary giants “inadequate”, US House Financial Services Committee Chairman Patrick McHenry took to Twitter to warn Chair Gary Gensler. The crypto group mocks the US SEC for leveraged futures Bitcoin ETF, however nonetheless no spot Bitcoin ETF.

Patrick McHenry Criticized SEC Chair Gary Gensler

US House FSC Republican Chairman Patrick McHenry earlier said he’ll carefully watch the US SEC’s response to identify Bitcoin ETF submitting by monetary providers large BlackRock.

Patrick McHenry stated if the reports of the US SEC are true, then Gary Gensler has rather a lot to clarify concerning the motion. He urged the US SEC to look right into a spot Bitcoin ETF, claiming that it’ll present buyers with a regulated product.

In addition, he stated the one purpose behind rejecting it might be Gary Gensler desirous to kill crypto innovation within the US.

However, the US SEC solely knowledgeable Nasdaq and CBOE that they should refile purposes with respect to the “surveillance-sharing agreements” and spot Bitcoin trade that might be utilized by BlackRock, Fidelity, and different asset managers.

Later, Fidelity and different asset managers named Coinbase as the marketplace for its surveillance. The SEC authorized a leverage Bitcoin ETF final month, which induced the group to mock SEC for denying spot Bitcoin ETF. Several crypto influencers additionally famous that the group overreacted to the report.

Spot Bitcoin ETF purposes from BlackRock and Fidelity, amongst others, helped carry a restoration within the broader crypto market.

Also Read: Is Litecoin Price Poised For 700% Rally? Legendary Trader Peter Brandt Says This

BTC Price Sets for Bullish Momentum

BTC price fell 1% within the final 24 hours, with the value at the moment buying and selling at $30,532, down 1% within the final 24 hours. The 24-hour high and low for Bitcoin are $29,600 and $31,093, respectively.

Popular analyst Michael van de Poppe said the crypto market simply overreacted to the report of the US SEC calling the latest Bitcoin ETF filings insufficient. He predicts additional upside in BTC worth to $35k-$40k.

Also Read: US Treasury Silently Rebuilt $500 Billion, Will It Impact Bitcoin, Crypto And Stocks Rally?

The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.