The Securities and Exchange Commission (SEC) named these cryptos as securities in its lawsuit in opposition to Binance and Coinbase on June 8. While this triggered an preliminary sell-off, most of them have recovered since to pre-crash ranges.

On June 8, the SEC launched lawsuits in opposition to cryptocurrency exchanges Binance and Coinbase. The expenses in opposition to them vary from a easy lack of disclosure to critical regulatory violations. The essence of this lawsuit boils all the way down to the Howey Test, a authorized framework that determines if an funding is a “security.”

The full listing of cryptocurrency tokens which have been labeled as securities is as follows:

- Cosmos (ATOM)

- Binance Coin (BNB)

- Binance USD (BUSD)

- COTI (COTI)

- Chiliz (CHZ)

- Near (NEAR)

- Flow (FLOW)

- Internet Computer (ICP)

- Voyager Token (VGX)

- Dash (DASH)

- Nexo (NEXO)

- Solana (SOL)

- Cardano (ADA)

- Polygon (MATIC)

- Filecoin (FIL)

- The Sandbox (SAND)

- Decentraland (MANA)

- Algorand (ALGO)

- Axie Infinity (AXS)

If these tokens are in the end categorized as securities, they’d be delisted from US exchanges.

SEC chairman Gary Gensler states that “everything other than Bitcoin” might be labeled as a safety. While Mr. Gensler is now a proponent of cracking down on cryptocurrencies, he was a extra constructive determine throughout his educating interval in 2018 when he taught a blockchain course at MIT.

At the time, he stated in a lecture, “Three-quarters of the market is non-securities. It is just a commodity, a cash crypto.”. Thus, his place now could be a direct contradiction to that of 2018.

However, not all within the monetary neighborhood share Mr. Gensler’s perception. He has not too long ago come below hearth from various lawmakers, who’re introducing a invoice that might change him as the pinnacle of the SEC.

Coins are Pumping Despite SEC Lawsuit

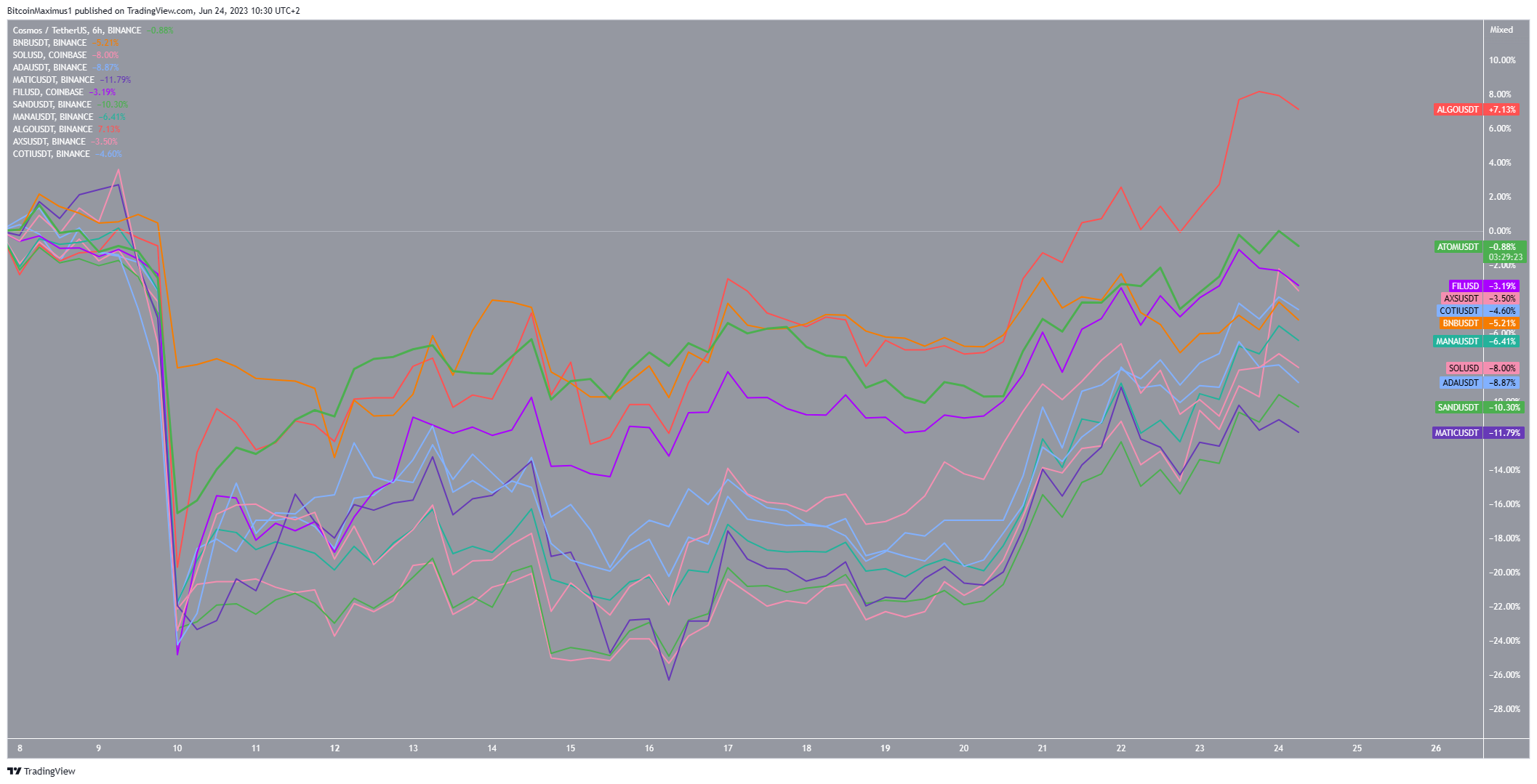

While the introduction of the lawsuit triggered a pointy crash on June 8, the market has recovered since. Interestingly, a few of the tokens named as securities are main this cost.

Algorand (ALGO) has elevated by practically 6% (crimson) since June 8, whereas Cosmos (ATOM), Filecoin (FIL), Axie Infinity (AXS), and Coti Network (COTI) have recovered practically all of their losses because the crash.

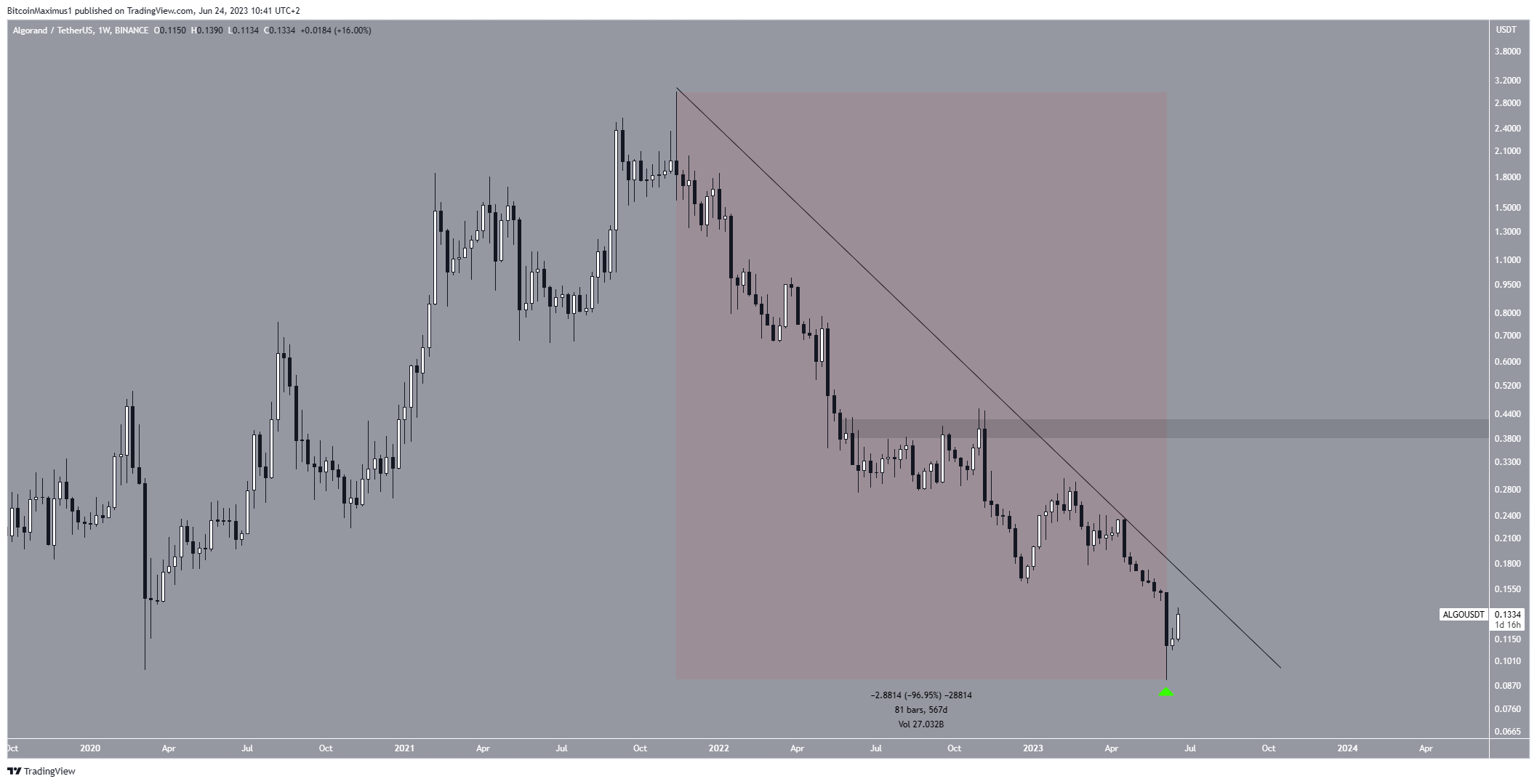

Algorand (ALGO) Price Leads the Charge

The ALGO worth has skilled a tough time since November 2021, falling by 97% in 567 days. During the week of the lawsuit (inexperienced icon), ALGO briefly fell beneath the March 202 lows of $0.095. However, the value has recovered admirably since and is now buying and selling at $0.13.

Moreover, the value is approaching the aforementioned long-term descending resistance line. If it breaks out, it can imply that the previous correction is full and a brand new upward development has begun. This might provoke a rally to the closest resistance space at $0.41.

However, if the value will get rejected on the resistance line once more, a drop to the following closest help space at $0.05 might ensue. This would quantity to an all-time low worth.

Cosmos (ATOM) Attempts to Reclaim Key Level

Unlike ALGO, the ATOM worth isn’t but near its 2020 lows. Rather, the value has fallen to a brand new yearly low however is significantly above even its 2022 lows.

During the week of the SEC lawsuit, ATOM briefly fell beneath its $8.50 horizontal help space. However, the value has recovered since, creating an extended decrease wick within the course of (inexperienced icon).

Additionally, it reclaimed the horizontal space and validated it as help. If the present shut holds, it might be a decisive bullish growth since it might point out that the earlier breakdown was not professional. In that case, the ATOM worth might enhance to the following closest resistance at $12.

On the opposite hand, if the ATOM worth reversed the development and closed beneath $8.50, a pointy fall to $6 might ensue.

Filecoin (FIL) Nearly Reaches Resistance

Similarly to ATOM, the FILE worth has fallen below a descending resistance line because the starting of February. More not too long ago, the road triggered a rejection at first of June, initiating a major drop (crimson icon). This coincided with the SEC lawsuit.

However, the identical week of the crash, FIL created a really lengthy decrease wick, which was thought of an indication of shopping for strain. This additionally validated the $2.90 horizontal space as help.

Currently, FIL is making an attempt to interrupt out from the resistance line. If profitable, it might surge to the following resistance at $3.90.

On the opposite hand, if the FIL worth will get rejected, it might fall to the $2.90 horizontal space once more, validating it as help.

For BeInCrypto’s newest crypto market evaluation, click here.

Disclaimer

In line with the Trust Project tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. Always conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices.