After the Bitcoin value reached a three-month low of $24.835 final week, the bulls presently appear to be gaining the higher hand once more. The BTC value has continued its upward development within the final 24 hours and has risen by 1.6% to presently $26,795. At one level, BTC had already hit $27,203 earlier than a corrective transfer passed off.

Why Is Bitcoin Up Today?

As all the time, one can solely speculate in regards to the explanation why the Bitcoin value is rising. But because of the submitting by BlackRock, the world’s largest asset supervisor, for a Bitcoin Spot ETF within the US, bullish sentiment has returned to the market. A Bitcoin Spot ETF is predicted to open the flood gates for institutional buyers.

As NewsBTC reported, the historical past of the primary gold ETF within the US in 2004 might be an indicator of the bullish affect that the approval of a spot ETF may have. The gold ETF has been instrumental within the adoption of gold by establishments. Within eight years of the primary ETF, the value of gold greater than quadrupled.

Basically, the US Securities and Exchange Commission has 240 days (about eight months) to determine on the appliance. However, David Attley, CEO of Bitcoin Magazine, asserted yesterday that he had heard a compelling argument that the BlackRock Bitcoin ETF might be accredited shortly (“days to weeks”).

This information could have had as constructive an affect in the marketplace as yesterday’s information that Fidelity may quickly apply for a Bitcoin Spot ETF alongside the traces of BlackRock. Obviously, crypto Twitter has turn out to be rather more bullish on account of the BlackRock information.

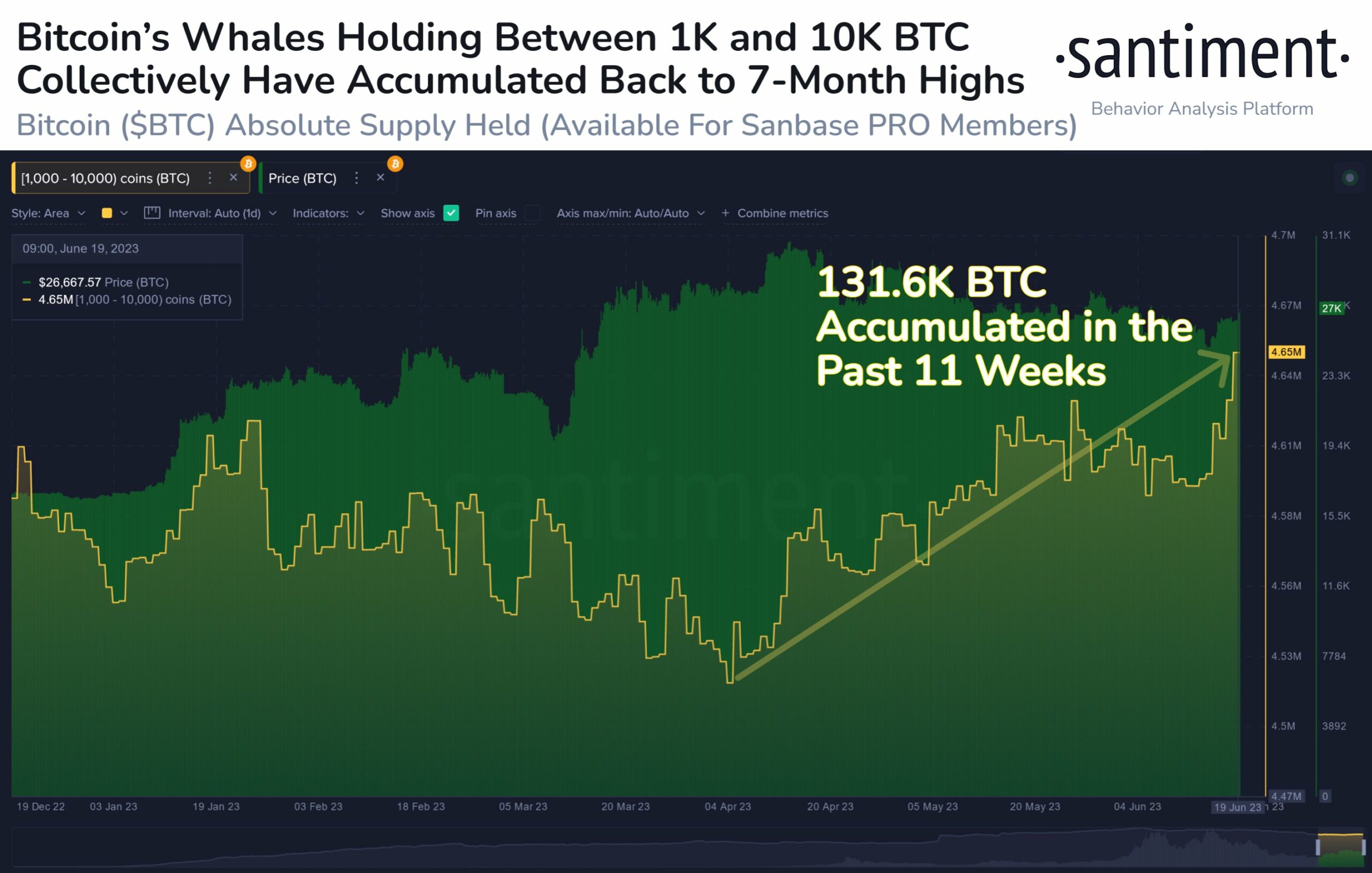

And massive buyers in BTC, so-called whales, have additionally turned bullish on the main cryptocurrency for fairly a while. As reported by on-chain information analytics service Santiment, whales have been busy over the previous two months as the group watched the value fall.

“Now back above $27k once again, it’s far from coincidence that wallets holding 1K to 10K $BTC have accumulated a combined $3.5B since the first week of April,” Santiment states.

Intraday dealer @52Skew makes an analogous remark with regard to BTC perp CVD buckets & delta orders: “Whales mostly driving price still, longs aped on this bounce, shorts still twaping on every bounce.”

Moreover, the dealer noticed in the previous few hours that there was lots of demand within the spot market on Binance, the most important crypto trade. According to him, spot shopping for is an indication of a sustained rally, so ideally spot shopping for must persist.

In phrases of the Binance open curiosity and funding, Skew states that many shorts are chasing the value after the longs had been squeezed earlier.

Outlook For H2 2023

Another bullish affect in the marketplace might be the technical chart outlook for the second half of the 12 months. As Aksel Kibar, Chartered Market Technician (CMT), writes by way of Twitter, BTC might be on the verge of a breakout from the correction that has been happening since mid-April:

Looks like we’ve a sound downward sloping channel on $BTCUSD with the higher boundary appearing as short-term resistance at 27K. Breakout from the channel can full the present pullback to the bigger scale H&S backside reversal.

At press time, the Bitcoin value noticed a slight correctional transfer and was buying and selling at $26,795.

Featured picture from iStock, chart from TradingView.com