On-chain knowledge reveals the Ethereum profit-taking transactions have surged just lately, an indication that may very well be bearish for the asset’s value.

Ethereum Profit-Taking Volume Has Spiked To Highest Levels Since January

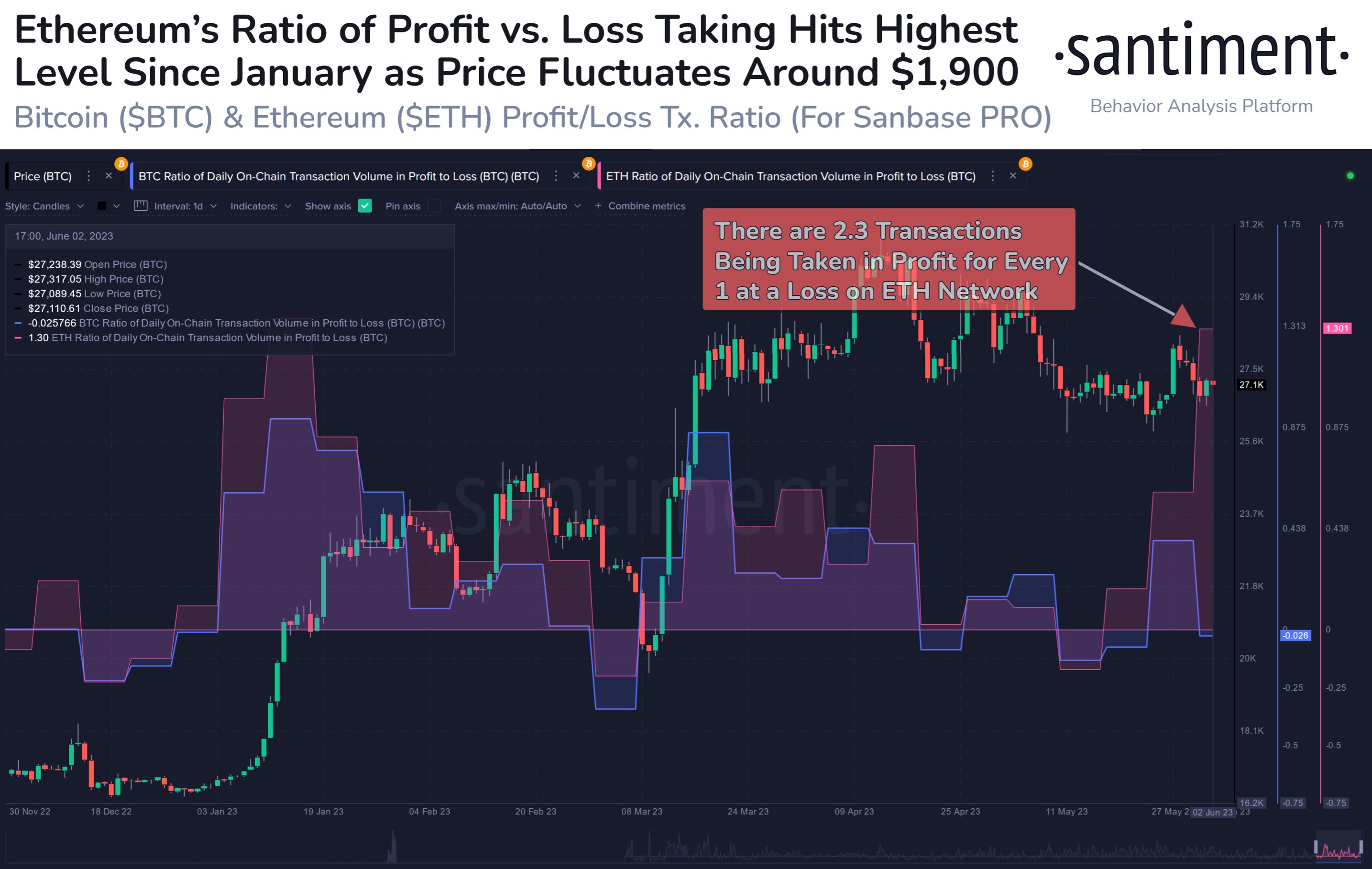

According to knowledge from the on-chain analytics agency Santiment, a considerable amount of profit-taking appears to have been occurring within the Ethereum market just lately. The related indicator right here is the “ratio of on-chain transaction volume in profit to loss,” which, as its identify already suggests, tells us about how the profit-taking transfers at the moment examine with the loss-taking ones.

The indicator separates these two volumes by wanting on the on-chain historical past of every coin being offered/moved to see what value it was final offered at. If this earlier value for any coin was lower than the value that it’s now being moved at once more, then the metric naturally counts this sale contained in the profit-taking quantity.

On the opposite hand, the final promoting value being extra implies that the coin is being offered at a loss, and therefore, the indicator provides its motion to the loss-taking quantity.

Now, here’s a chart that reveals the development on this ratio for Ethereum during the last half a 12 months:

The worth of the metric appears to have been fairly excessive in current days | Source: Santiment on Twitter

As displayed within the above graph, the Ethereum ratio between the revenue and loss transaction volumes has noticed an uplift through the previous couple of days. The metric now has extremely optimistic values.

Whenever the indicator has optimistic values, it implies that the profit-taking quantity is greater than the loss-taking one proper now. Thus, because the metric has inexperienced values at the moment, it could recommend that profit-taking transactions are the dominant drive out there.

During the spike within the ratio yesterday, the metric hit a peak worth of 1.3, which implies that there have been 2.3 instances as many profit-taking transfers taking place on the blockchain because the loss-taking ones.

These metric values have been the very best seen since again in January of this 12 months when the rally had gone by way of its first leg. Historically, every time buyers have achieved a considerable amount of promoting with the intent of harvesting earnings, the cryptocurrency’s value has felt a bearish pressure.

This phenomenon will also be seen within the chart, as again in January the Ethereum rally slowed down its fast upward trajectory when the profit-taking hit its peak.

When the profit-taking shot up yesterday, the value was above the $1,900 degree. Since then, nonetheless, the asset has slid down beneath the mark, implying that the profit-taking could already be displaying its affect.

Santiment believes that the ratio must cool again down if the value of Ethereum has to construct a cost in direction of the $2,000 degree.

ETH Price

At the time of writing, Ethereum is buying and selling round $1,800, down 2% within the final week.

ETH hasn't moved a lot in the previous couple of days | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web