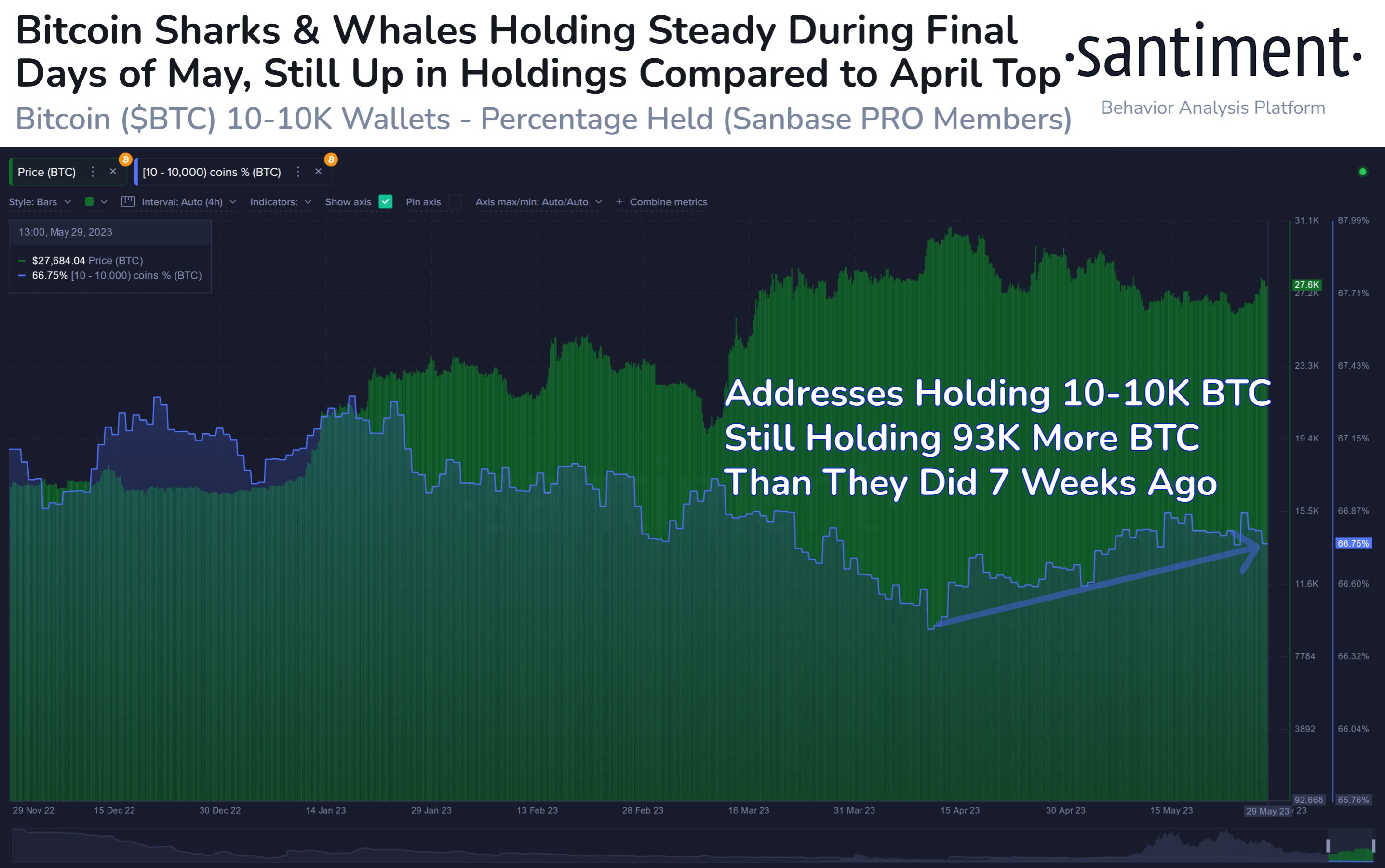

On-chain knowledge from Santiment exhibits that Bitcoin sharks and whales have gone on a 93,000 BTC shopping for spree for the reason that native high again in April.

Bitcoin Sharks & Whales Have Accumulated Since The April Top

According to knowledge from the on-chain analytics agency Santiment, these holders have turn out to be a bit extra cautious in the previous few weeks. The related indicator right here is the “Supply Distribution,” which measures the entire quantity of Bitcoin that every pockets group available in the market is holding proper now.

The addresses are divided into pockets teams primarily based on the entire variety of cash that they’re carrying of their balances presently. The 1-10 cash cohort, for instance, contains all traders which can be holding at the very least 1 and at most 10 BTC.

In the context of the present dialogue, there are two investor teams which can be of curiosity: the “sharks” and the “whales.” The former of those is a cohort that features the traders holding a reasonable quantity of cash, whereas the latter contains massive holders.

Due to the quantity of provide that the mixed wallets of those teams maintain, they are often fairly influential available in the market. Naturally, the whales are the extra highly effective entities, as they maintain considerably bigger quantities.

Here, Santiment has outlined the mixed pockets ranges of those sharks and whales as 10-10,000 BTC. Here is a chart that exhibits the development within the Supply Distribution of this handle group over the previous few months:

The worth of the metric appears to have been climbing prior to now month or so | Source: Santiment on Twitter

From the above graph, it’s seen that the mixed holdings of the Bitcoin sharks and whales began observing some decline when the surge passed off again in March.

As these traders had been distributing, the worth moved principally sideways, implying that it was this promoting from these cohorts which will have slowed down the rally. Then, in the midst of April, because the cryptocurrency hit an area high across the $31,000 mark, the availability of the sharks and whales conversely reached an area backside.

These traders then started to build up, because the asset’s value registered a downtrend. This sample would suggest that these holders well started to take the chance provided by the dips to purchase once more.

Since this shopping for began following the native high in April, the Bitcoin sharks and whales have added a complete of about 93,000 BTC ($2.6 billion on the present change price) to their wallets.

In current weeks, nonetheless, their provide has gone stagnant because the asset has confronted some struggle. This new sideways development of the indicator could also be an indication that these massive traders are actually cautious in shopping for extra, as they’re not sure about the place the coin may go subsequent.

Bitcoin has tried to mount collectively a transfer prior to now couple of days, and thus far, these traders haven’t proven any important response to it. Naturally, if they begin accumulating once more, it will be a sign that they’re supportive of the surge.

BTC Price

At the time of writing, Bitcoin is buying and selling round $27,900, up 2% within the final week.

BTC has made a restoration push | Source: BTCUSD on TradingView

Featured picture from Jake Gaviola on Unsplash.com, charts from TradingView.com, Santiment.internet