Here’s the on-chain indicator that will have foreshadowed the current dip within the value of Ethereum beneath the $1,800 degree.

Ethereum Has Plunged After Multi-Collateral Dai Repaid Metric Spikes

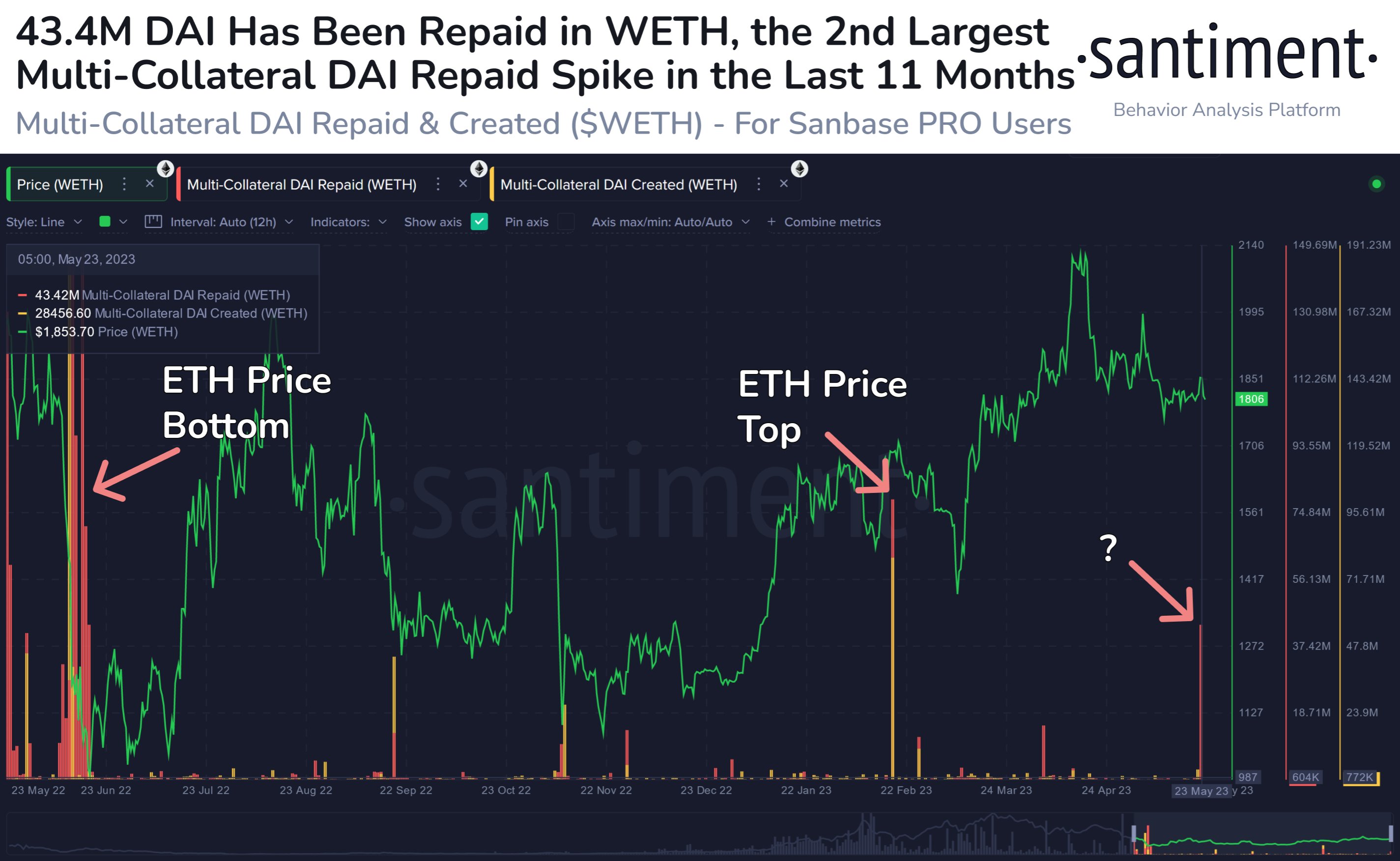

According to information from the on-chain analytics agency Santiment, 43.4 million Dai was repaid in Wrapped ETH (WETH) through the previous day. Multi-Collateral Dai (DAI) is a decentralized stablecoin constructed on the Ethereum blockchain that’s tender pegged to the US Dollar, that means that its worth stays mounted at $1.

The coin is known as multi-collateral as a result of it’s backed by a mixture of cryptocurrencies. An earlier model of the coin was Single-Collateral Dai (SAI), and it was solely backed by one asset.

When Dai is minted (that’s, new cash enter into circulation), customers must deposit their collateral into the good contract vaults. In the context of the present dialogue, the stablecoin tokens minted utilizing WETH as collateral are of curiosity.

The “Multi-Collateral DAI created” is an indicator that measures the entire quantity of cash of the stablecoin which are being minted utilizing WETH proper now. The counterpart metric of this indicator is the “Multi-Collateral DAI repaid,” which naturally tracks the situations of WETH being returned after the issued tokens are destroyed.

Here is a chart that exhibits the pattern in these two Wrapped Ethereum indicators over the previous yr:

One of the metrics appears to have noticed a big worth in current days | Source: Santiment on Twitter

As you possibly can see within the above graph, Santiment has highlighted an attention-grabbing sample that the Ethereum value has adopted in response to spikes within the Multi-Collateral Dai repaid indicator.

It appears to be like like each time a considerable amount of Dai has been destroyed to launch WETH, the value of the cryptocurrency has registered both a high or a backside. In the previous yr, there have been two situations of this pattern.

The first of them befell nearly one yr in the past, proper after the ETH value crashed as a result of 3AC bankruptcy. This spike coincided with the underside formation of the cryptocurrency.

The different one was earlier in February of this yr and in contrast to the primary one, this spike coincided with the asset forming a neighborhood high.

Recently, the indicator has as soon as once more noticed a big spike, that means that somebody has withdrawn a considerable amount of the wrapped type of Ethereum that was beforehand getting used to again Dai tokens.

In complete, 43.4 million DAI has been destroyed with this newest spike. This is the third largest that the indicator’s worth has been through the previous 12 months and solely the aforementioned situations of the metric registered withdrawals of bigger scales.

If the sample of the earlier spikes holds any weight in any respect, then the present Dai WETH repayments may result in Ethereum observing both a neighborhood high or a neighborhood backside.

Yesterday, Ethereum plunged beneath the $1,800 degree, so maybe the decline was as a result of indicator’s spike. Today, nonetheless, the cryptocurrency has already rebounded again above this degree, so it’s exhausting to say whether or not the metric’s affect is already carried out with, or if the true impact is but to return.

ETH Price

At the time of writing, Ethereum is buying and selling round $1,800, down 1% within the final week.

ETH has already recovered immediately | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web