A bug in decentralized Finance (DeFi) lending protocol Aave V2 on the Polygon community has made it inconceivable for customers to work together with about $110 million value of property on the platform.

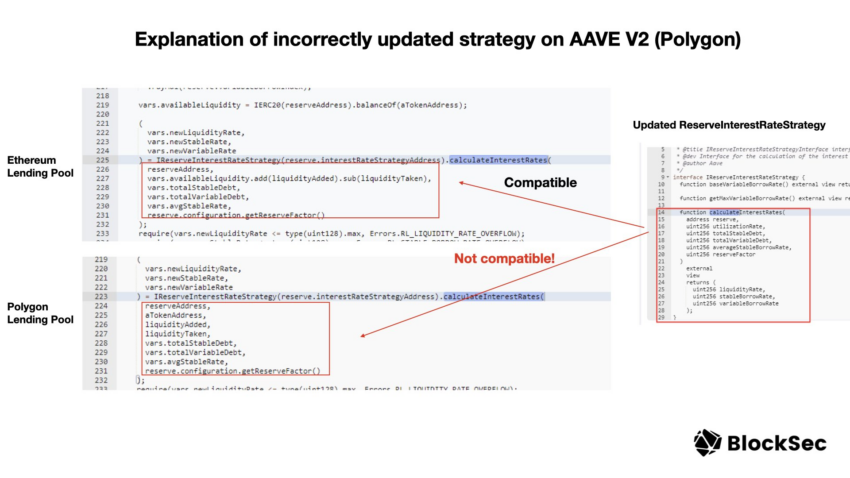

Blockchain security agency BlockSec reported on May 19 that the issue was due to the ReserveInterestRateStrategy contract deployed on Polygon. The improve was meant to allow a extra environment friendly rate of interest curve on Aave V2 and optimize the platform’s utilization.

However, as a result of its incompatibility with the community, Aave customers can not work together with their property on the protocol. This means customers can’t borrow, withdraw, repay, or provide extra of these property to the protocol as each name reverts.

Funds Remain Safe

Developers have acknowledged the issue noting that solely Aave V2 on Polygon was affected. The V2 on Ethereum and Avalanche are working completely, and so is the V3 protocol.

The builders additionally assured customers that their funds, together with the affected property, have been secure.

While the issue is just not a security concern, customers can not absolutely work together with the property till the issue is mounted. The solely method this may be achieved is thru governance.

Aave is Working on Solution

A brand new governance proposal has been submitted to repair the problem — the Aave DAO will begin voting on the proposal later right now.

“Considering governance times, if approved, the fix will be applied in approximately 7 days from now: 1 day of delay to start voting, 3 days of voting, 1 day of timelock on Ethereum, and 2 extra days of timelock on Polygon,” half of the proposal reads.

This incident additional highlights how advanced DeFi will be, with totally different Ethereum Virtual Machine-compatible (EVM) chains having their peculiarities.

Aave is among the many most outstanding DeFi protocols as a result of its many customers. The whole worth of property locked (TVL) on the crypto lending protocol sits at $5.18 billion, in keeping with Defillama. Aave V2 accounts for many of this TVL with $3.72 billion.

Meanwhile, the information has had minimal affect on AAVE’s value efficiency. The token is up 0.1% within the final 24 hours, buying and selling for $64.85 as of press time, in keeping with BeInCrypto knowledge.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. However, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material.