In a stunning flip of occasions, famend crypto fanatic Ran Neuner, as soon as a die-hard altcoin maximalist, just lately revealed on a podcast that he’s liquidating his altcoin holdings in favor of Bitcoin.

Neuner’s change of coronary heart outcomes from a profound realization in regards to the potential narrative of the following bull market.

Bitcoin: The Future’s Gold

Neuner believes that because of impending governmental blunders, starting from economic collapses to escalating geopolitical tensions, buyers will flock to safe property.

“I think that governments are going to do crazy things. And I think when governments are going to want to do crazy things, I think that people are going to flock to gold,” Neuner explained.

Gold, historically the popular secure haven throughout turbulence, has seen important appreciation just lately. The rising gold prices, Neuner believes, point out that buyers are bracing themselves for possible governmental missteps.

However, Neuner additionally foresees a “ragged moment” for gold—some extent when Bitcoin will surpass it as a most popular secure haven. Gold, regardless of its longstanding standing, shouldn’t be verifiable on-chain.

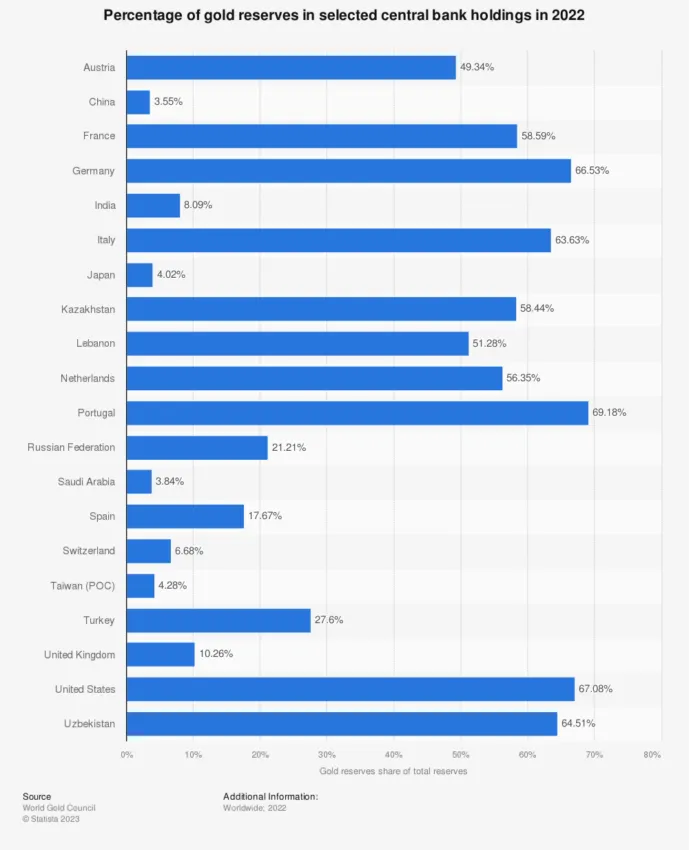

Central banks could declare to have a specific amount of gold, however with out on-chain verification, this can’t be confirmed conclusively.

Neuner theorized, “somewhere, a government or a central bank will do something stupid around gold…. People are going to flock to Bitcoin.” This important shift in investor behavior could possibly be an instrumental second for Bitcoin.

Bitcoin’s Evolution: A New Investment Frontier

Not solely is Bitcoin an impending safe haven, however its current evolution additionally excites Neuner. He identified the launch of Ordinals, giving Bitcoin increased functionality similar to Ethereum.

“Bitcoin has pivoted from being a store of value only to being a competitor to Ethereum,” he enthused.

Indeed, the flexibility to situation tokens on Bitcoin, run sensible contracts, and the introduction of a Bitcoin digital machine have considerably modified the crypto panorama. Even Michael Saylor, the previous CEO of MicroStrategy, has declared the emergence of BRC-20 tokens “bullish.”

Neuner’s pleasure, nonetheless, doesn’t finish with Bitcoin’s technical developments. His determination to promote his altcoins stems from his perception that investing in Bitcoin and the infrastructure being constructed round it presents a greater prospect than small altcoins.

“We have really, really, really gone into a new era now on Bitcoin… Would I rather be investing in small altcoins somewhere else? Or would I rather be investing on amazing infrastructure being built on the Bitcoin ecosystem?” he requested rhetorically.

When to Sell Altcoins to Prepare for a Bitcoin-Dominated Future

Although excited, Neuner additionally foresees challenges forward, notably round Bitcoin’s scaling talents. Nonetheless, he believes buyers should put together for this impending revolution by accumulating “dry powder” or investable money.

Neuner warned that ready may imply seeing different token costs drop whereas Bitcoin and its tokens skyrocket. His recommendation? Get into Bitcoin and its burgeoning ecosystem now.

This sudden shift in perspective from a devoted altcoin fanatic underscores the quickly altering dynamics within the crypto market. As Bitcoin evolves, it may dominate the following bull market narrative. Still, solely time will inform.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. However, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material.