The world’s largest crypto exchange Binance on Thursday stated it’s going to relaunch its hottest zero-fee buying and selling for a restricted interval from as we speak onwards. Users will be capable of take pleasure in zero buying and selling charges when buying cryptocurrencies from May 18-June 18, 2023. However, the restricted interval zero buying and selling price is simply relevant on Auto-Invest.

The transfer comes as Bloomberg reported that Binance continues to lose its dominance within the crypto market as a consequence of heightened scrutiny and regulatory motion by US regulators. Also, Binance is witnessing low liquidity as in comparison with earlier quarters as Jump Crypto and Jane Street are pulling again their market-making exercise from the US.

Also Read: Do Kwon and Terraform Labs Withdraw Millions A Year After Terra-LUNA Crisis

Binance Announces Zero Trading Fees After Losing Market Share

Crypto change Binance introduces zero-fee crypto buying and selling for Auto Invest buyers, in accordance with an official announcement on May 18. The zero buying and selling charges might be accessible just for a month, May 18-June 18.

Users will be capable of purchase over 210 cryptocurrencies together with Binance, Ethereum, Shiba Inu, PEPE, and others on Auto Invest. It has greater than 15 fiat currencies and stablecoins through the Single-Token, Portfolio, and Index-Linked plans.

Auto-Invest is a dollar-cost averaging (DCA) funding technique permitting customers to automate their crypto funding and earn passive revenue on the similar time.

Also Read: Binance Making These Efforts To Increase Bitcoin and Ethereum Liquidity

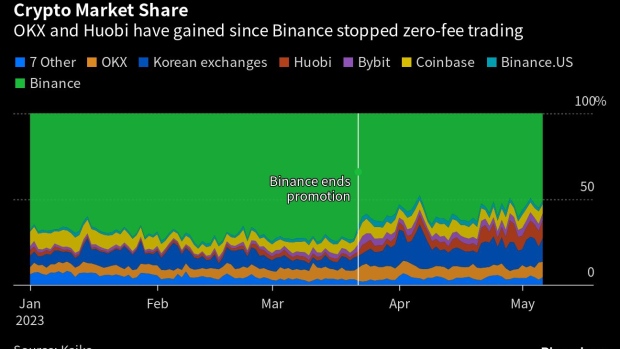

On March 15, Binance ended its zero-fee Bitcoin trading and BUSD zero-maker price applications, shifting the zero-fee Bitcoin buying and selling facility to TUSD solely as a consequence of a crackdown in opposition to Binance USD (BUSD). Since then, buying and selling quantity on the change has decreased considerably as most volumes got here from BTC/USDT pair. The CFTC lawsuit in opposition to Binance and CEO “CZ” added extra challenges.

According to Kaiko, Binance’s spot-trading volumes share fell to 51% in May, earlier in March it was 73%. The market share of Huobi elevated from 2% to 10% and OKX from 5% to 9%. Also, South Korean exchanges’ market shares elevated to 14% from 8%.

The US SEC can also be near bringing an enforcement action against Binance. In response, Binance CEO is planning to reduce his shareholding within the Binance.US crypto change to cut back the affect on its US arm.

Also Read: FTX Sues Sam-Bankman Fried, Michael Giles, And Silicon Valley VCs

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.