Crypto Market News: In the wake of the U.S. Securities and Exchange Commission’s (SEC) determination to revise the penalty on LBRY, the crypto startup commented on the company’s twin narrative round LBR being a safety. In current courtroom filings, the US SEC cited LBRY’s “inability to pay” the $22 million penalty as the rationale behind revising it to $111,614. In truth, the Commission said LBRY lacked funds and that it was in a close to defunct standing. The penalty was levied as a part of the lawsuit filed by the SEC over the sale of LBRY’s LBC alleged violation of the US securities legal guidelines.

Also Read: OpenAI CEO Altman Testifies Before US Congress, What It Means For Crypto

Meanwhile, LBRY responded to the SEC’s emphasis on LBC being a safety. The firm referred to the SEC’s feedback about its employees statements on the securities legislation.

LBRY Refers To SEC’s Coinbase Filing

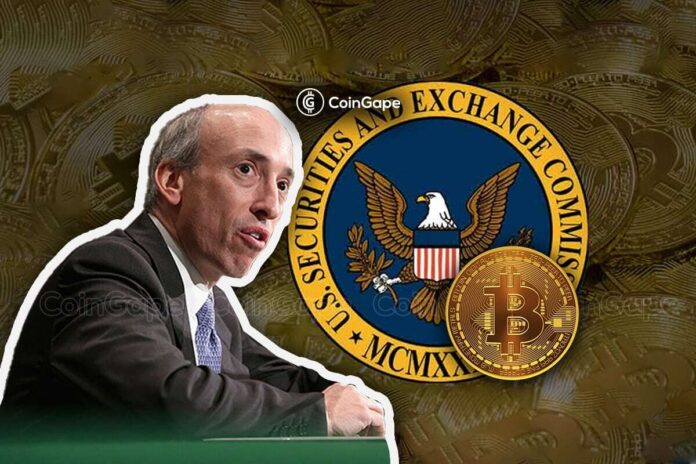

In a current growth, the SEC requested the decide to disclaim Coinbase’s request to compel the company to answer a rulemaking petition. The request basically sought readability about how securities legal guidelines apply to the crypto market. Gary Gensler, the SEC Chair, has been dealing with criticism for his stance {that a} majority of the crypto property are securities as per current guidelines. However, the SEC denied the request to make clear about the identical. LBRY’s newest statement is focused on the identical twin strategy by the SEC:

“The SEC repeatedly cited a single sentence from an unpaid volunteer moderator in our group chat as proof that LBC was a safety.

Meanwhile, the SEC argues in Coinbase submitting that even statements from senior employees of the SEC about securities legislation don’t imply something.”

Meanwhile, Gensler has additionally been dealing with the warmth from lawmakers over the dearth of readability within the crypto market.

Also Read: Here’s Why Memorial Day Could Mark Change In Bitcoin Trader Sentiment

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.