On-chain knowledge exhibits the Ethereum trade provide has declined to an all-time low lately, suggesting that traders could also be accumulating.

Ethereum Supply On Exchanges Has Continued Its Downtrend Recently

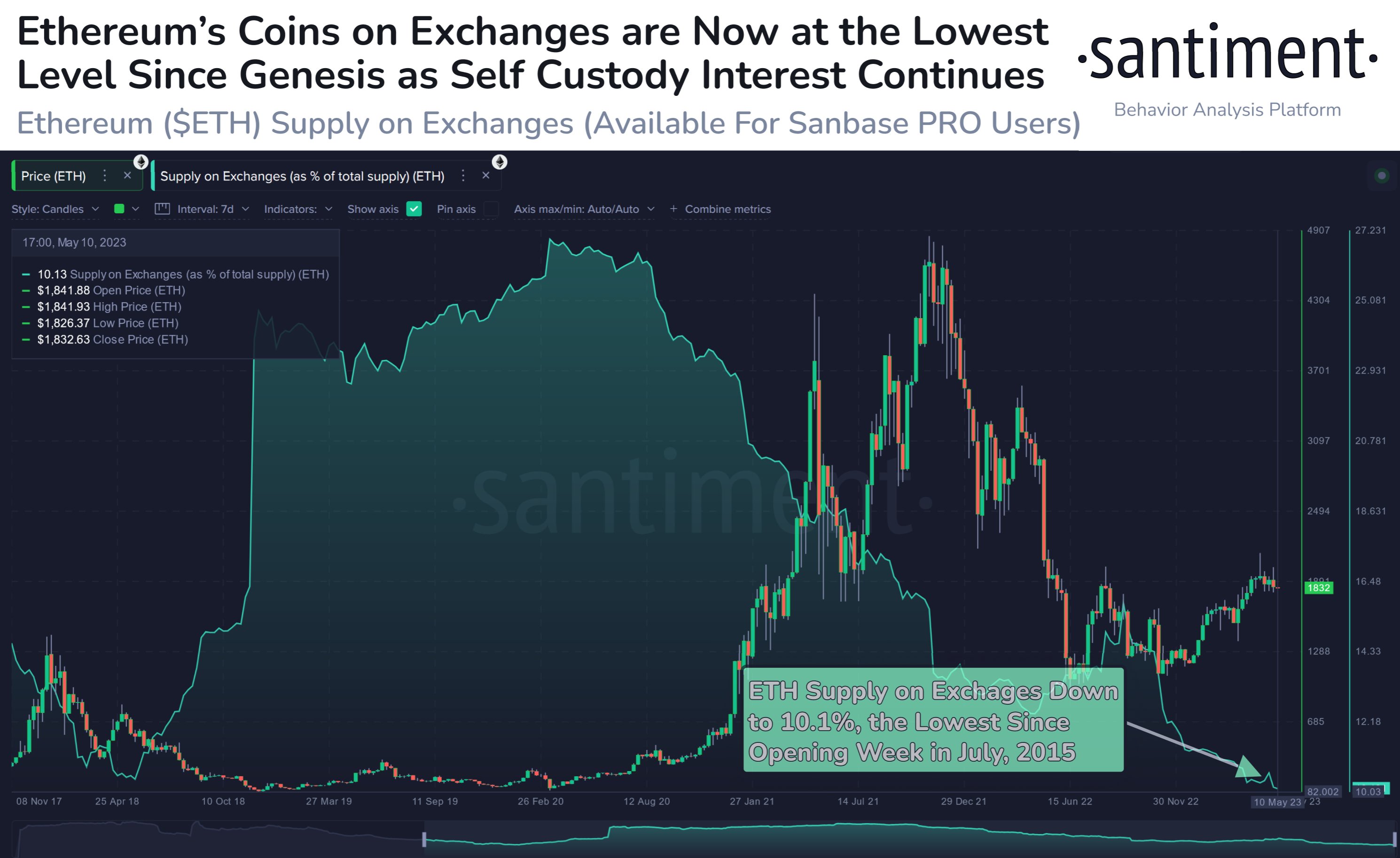

According to knowledge from the on-chain analytics agency Santiment, ETH on exchanges is now at its lowest for the reason that cryptocurrency began buying and selling publicly in July 2015. The “ETH supply on exchanges” is an indicator that measures the proportion of the entire Ethereum circulating provide that’s at present sitting within the wallets of all centralized exchanges.

When the worth of this metric goes up, it means the traders are depositing their cash within the wallets of exchanges at present. Since one of many major explanation why holders might switch their ETH to those platforms is for selling-related functions, this type of development can have bearish implications for the worth.

On the opposite hand, a lower within the indicator’s worth implies the exchanges are observing the withdrawal of a web quantity of the asset proper now. Such a development, when extended, is usually a signal that the traders are accumulating, and therefore, can have a bullish impact on the cryptocurrency’s worth.

Now, here’s a chart that exhibits the development within the Ethereum provide on exchanges over the previous few years:

The worth of the metric appears to have been taking place since some time now | Source: Santiment on Twitter

As displayed within the above graph, the Ethereum provide on exchanges has been going downhill for just a few years now, suggesting that traders have been continually withdrawing from these platforms.

The indicator has continued the drawdown whereas the rally has been happening, however there was a short lived breakage within the development only recently, the place the metric briefly noticed a rise. This rise wasn’t something important, however the truth that it occurred simply as the newest decline within the value of the cryptocurrency got here (which has now taken it under the $1,800 stage) could also be an indication that these deposits have been made for promoting.

However, it wasn’t lengthy earlier than the provision on exchanges resumed its downtrend, implying that contemporary purchases might have taken place on the present comparatively low costs.

Following this newest continuation within the total downtrend of the Ethereum provide on exchanges, there’s now simply 10.1% of the entire circulating provide left within the wallets of those platforms, which is the bottom worth that the coin has seen since its opening week means again in July 2015.

This important all-time low within the indicator could possibly be a constructive signal for the cryptocurrency in the long run, because it exhibits rising consciousness out there across the dangers of retaining their cash on centralized exchanges.

It’s at present unclear how lengthy the present value drop might go on, however new withdrawals happening would possibly on the very least be an indication that there’s nonetheless an availability of patrons out there.

ETH Price

At the time of writing, Ethereum is buying and selling round $1,700, down 10% within the final week.

ETH has plunged lately | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web