Bitcoin has plunged beneath the $27,000 mark throughout the previous day. Here are the market segments which might be presumably collaborating on this selloff.

These Bitcoin Investors Have Been Spending Their Coins Recently

In a brand new tweet, the on-chain analytics agency Glassnode has damaged down the costs at which the typical cash offered right now have been purchased. Generally, the BTC market is split into two major segments: the long-term holders (LTHs) and the short-term holders (STHs).

The STHs comprise a cohort together with all traders who acquired their Bitcoin inside the final 155 days. The LTHs, then again, are traders who’ve been holding for greater than this threshold quantity.

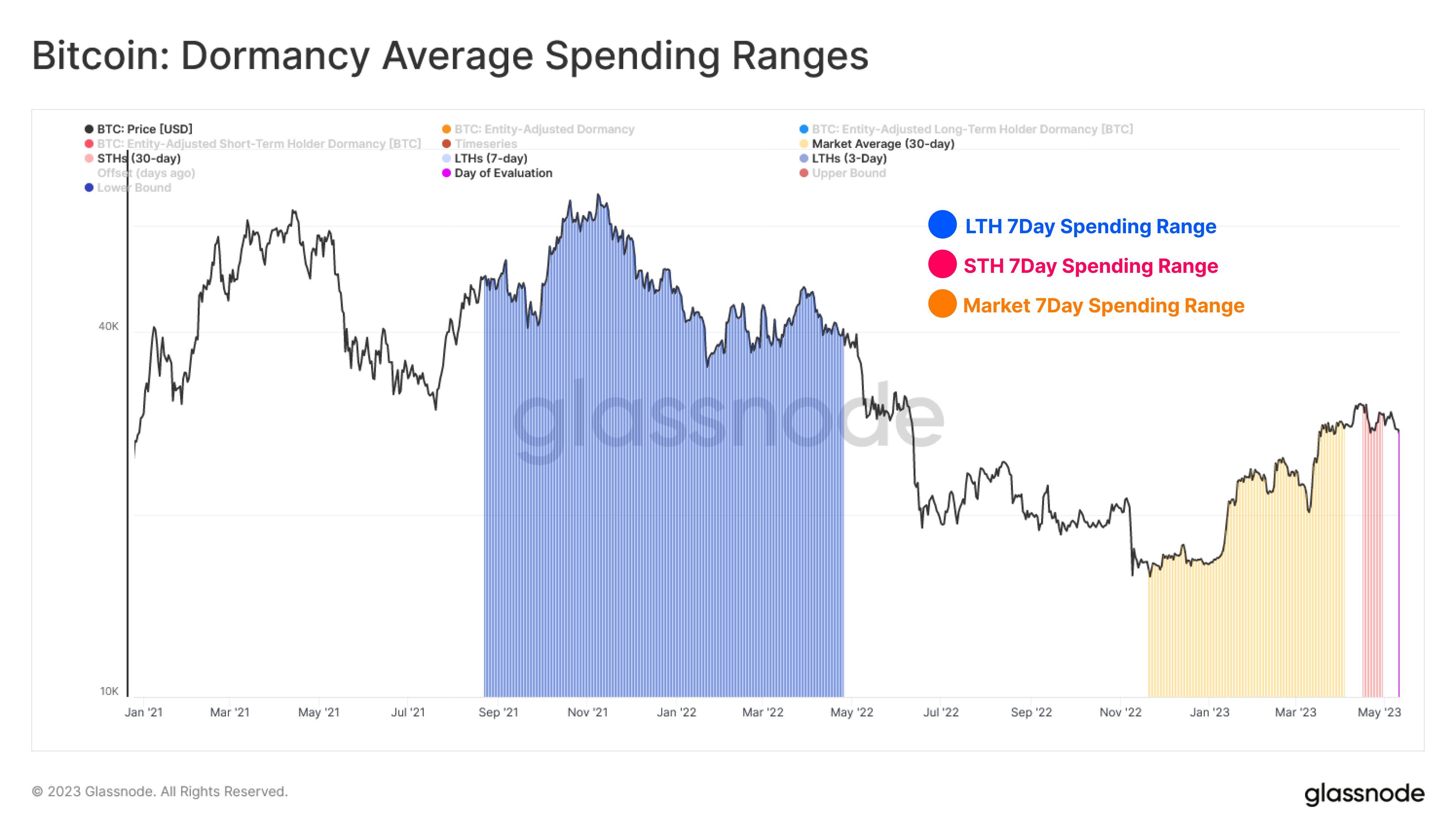

In the context of the present dialogue, the related indicator is the “dormancy average spending ranges,” which finds out the intervals wherein the typical cash being spent/transferred by these two teams have been first acquired.

For instance, if the metric reveals the 7-day spending vary for the LTHs as $20,000 to $30,000, it signifies that the cash these traders offered up to now week have been initially purchased at costs on this vary.

Here is a chart exhibiting the information for the present 7-day dormancy common spending ranges for the STHs and LTHs, as effectively for the mixed market.

The totally different common spending ranges of the primary segments of the sector | Source: Glassnode on Twitter

The graph reveals that the 7-day common spending vary for the STHs is kind of near the present costs at $30,400 to $27,300. Some of those sellers purchased at larger costs than these noticed up to now week, in order that they should have been promoting at a loss (though not a very deep one).

The indicator places the LTHs’ acquisition vary at $67,600 to $35,000. As highlighted within the chart, the timeframe of those purchases included the lead-up to the November 2021 price all-time high, the highest itself, and the interval when the decline in direction of the bear market first began.

It would seem that these holders who purchased on the excessive bull market costs have budged due to the stress the cryptocurrency has been beneath these days and have lastly determined to take their losses and transfer on.

Generally, the longer an investor holds onto their cash, the much less doubtless they change into to promote at any level. This would maybe clarify why the acquisition timeframe of the present STHs is so latest; the fickle ones are those that have solely been holding a short time.

For the BTC LTHs, nonetheless, the possible cause why the acquisition interval of the typical vendor from this group is to date again, fairly than nearer to 155 days in the past (the cutoff of the youngest LTHs), is that plenty of the youthful LTHs could be in earnings presently as they purchased throughout the decrease, bear-market costs.

As such, the Bitcoin traders extra more likely to waver of their conviction proper now could be these holding probably the most extreme losses, the 2021 bull run prime patrons.

The chart additionally consists of the 7-day common spending vary for the mixed BTC sector, and as one could count on, this vary lies in the midst of the 2 cohorts ($15,800 to $28,500), however the timeframe is nearer to the STHs, as plenty of the sellers are sure to be latest patrons.

BTC Price

At the time of writing, Bitcoin is buying and selling round $26,300, down 10% within the final week.

Looks like BTC has taken a plunge throughout the previous day | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com