Crypto Market News: Empower Oversight Whistleblowers & Research (EMPOWR), a company targeted on enhancing unbiased oversight, on Thursday filed a grievance towards the US Securities and Exchange Commission (SEC) over alleged selective enforcement on crypto market companies by high company officers. The group filed a grievance within the United States District Court for the District of Columbia looking for to compel the SEC to adjust to a December 2022 Freedom of Information Act (FOIA) request concerning conflicts of curiosity by excessive degree officers within the company.

Also Read: Binance Cuts ETH Staking Withdrawal Time, Will Prices Go Down?

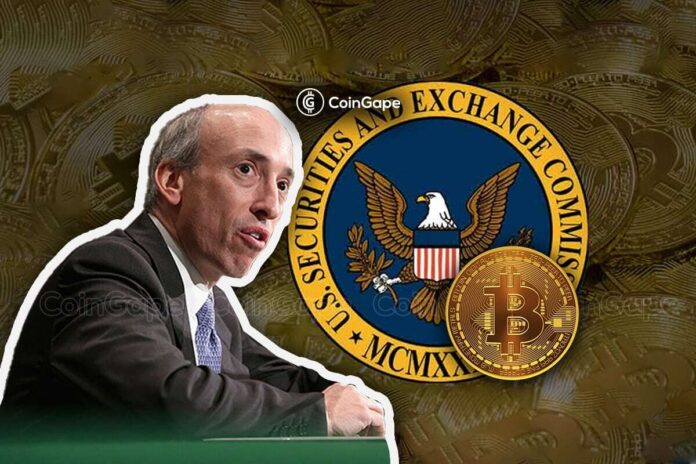

This grievance comes at a time when the regulatory company faces criticism from not simply crypto dealer communities but additionally high lawmakers within the United States. Recently, Patrick McHenry, Chairman of the House Financial Services Committee, stated to SEC Chair Gary Gensler that there was clearly no readability on regulation for crypto associated actions within the US.

All Internal Commications Regarding Cryptocurrencies

The grievance pertains to an August 2021 request from Empower Oversight that sought “all communications between senior SEC officials and their former and future employers and related entities regarding cryptocurrencies.” An announcement from the group said former senior SEC official William Hinman acquired cash in compensation from his former employer Simpson Thacher, was a part of a bunch that promoted Ethereum. Hinman had publicly declared Ethereum (ETH) was not a safety whereas the SEC has been referring to ETH and the opposite comparable cryptocurrencies as unregistered securities, the assertion defined.

Hence, the allegation is that there was risk of battle of curiosity between the SEC officers, which explains the request for communications.

Also Read: Do Kwon Pleads Not Guilty To Allegations of Using Fake Passport

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.