On-chain information exhibits the Bitcoin change whale ratio has spiked lately, one thing that might result in additional draw back within the asset’s worth.

Bitcoin Exchange Whale Ratio Has Sharply Surged Recently

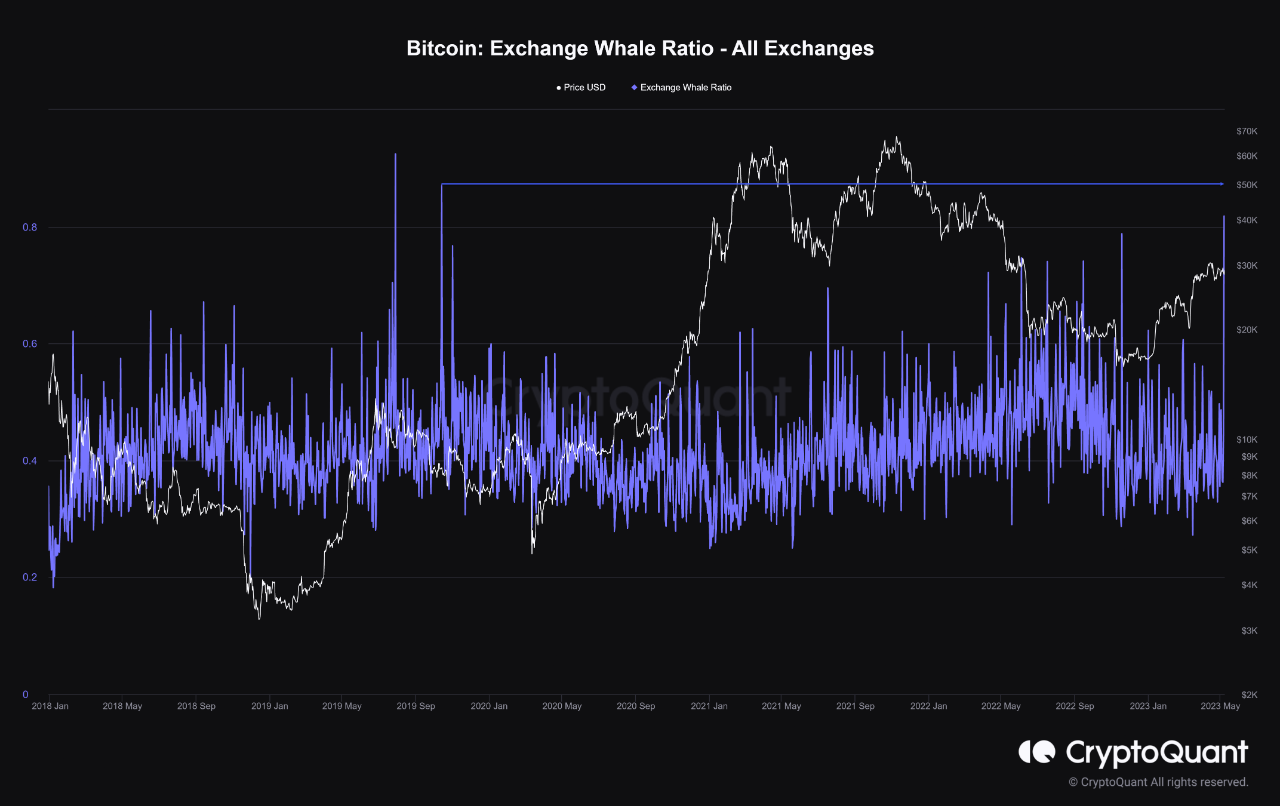

As identified by an analyst in a CryptoQuant post, the change whale ratio is presently at its highest stage since September 2019. The “exchange whale ratio” is an indicator that measures the ratio between the sum of the highest 10 inflows to exchanges and the entire change inflows.

An “exchange inflow” is any motion of Bitcoin in the direction of the wallets of centralized exchanges from addresses outdoors such platforms (like self-custodial wallets).

The high 10 inflows right here seek advice from the ten largest influx transactions going in the direction of these platforms. Generally, these largest transfers are coming from the whales, so the change whale ratio can inform us how the influx exercise of the whales presently compares with that of the whole market (the entire inflows).

When this indicator has a excessive worth, it means these humongous holders are making up a big a part of the entire inflows presently. As one of many important the reason why buyers transfer their cash to exchanges is for selling-related functions, this type of pattern is usually a signal that whales are promoting proper now.

On the opposite hand, low values of the metric indicate this cohort isn’t making too many inflows relative to the remainder of the market. Such a pattern might be both impartial or bullish for the cryptocurrency’s worth, relying on another market situations.

Now, here’s a chart that exhibits the pattern within the Bitcoin change whale ratio over the previous couple of years:

Looks like the worth of the metric has been fairly excessive in current days | Source: CryptoQuant

As displayed within the above graph, the Bitcoin change whale ratio has noticed a pretty big spike lately. This means that whales are making up a relatively massive a part of the entire change inflows presently.

The metric has crossed the worth of 0.8 on this spike, implying that greater than 80% of the inflows are coming from these humongous buyers proper now. This stage of ratio hasn’t been seen out there since approach again in 2019.

This earlier spike of comparable scale occurred as the value was winding down from the April 2019 rally, and shortly after it befell, Bitcoin registered an extension in its drawdown.

An even bigger spike within the ratio was additionally noticed earlier in the identical yr, round when the aforementioned April 2019 rally topped out. The timings of those two spikes might recommend that it was the dumping from the whales that influenced the market and brought on the value to go down.

If these earlier situations of whale influx exercise of comparable ranges are something to go by, then the Bitcoin worth might face a bearish decline within the close to time period as a result of present potential promoting strain from this cohort.

The drawdown might have presumably additionally already began, because the cryptocurrency’s worth has taken a dive beneath the $28,000 mark at this time.

BTC Price

At the time of writing, Bitcoin is buying and selling round $27,900, down 2% within the final week.

BTC has plunged previously day | Source: BTCUSD on TradingView

Featured picture from Thomas Lipke on Unsplash.com, charts from TradingView.com, CryptoQuant.com