Bitcoin miners have been raking in traditionally excessive quantities of transaction charges lately, however on-chain information exhibits this cohort nonetheless isn’t promoting.

Bitcoin Miners Haven’t Transferred Much Volume Towards Exchanges Recently

The transaction charges on the Bitcoin community have shot up lately due to the elevated site visitors brought on by the Ordinals, a protocol that permits information to be inscribed into the Bitcoin blockchain with transactions.

Generally, the transaction charges stay low throughout occasions when there’s little exercise on the blockchain as buyers don’t have any have to pay larger charges to get transfers via shortly.

However, when the community is congested, nonetheless, ready occasions within the mempool can stretch longer, so the senders who need their transfers to be processed sooner connect a excessive quantity of charges with them. This supplies miners with an incentive to deal with such transfers first.

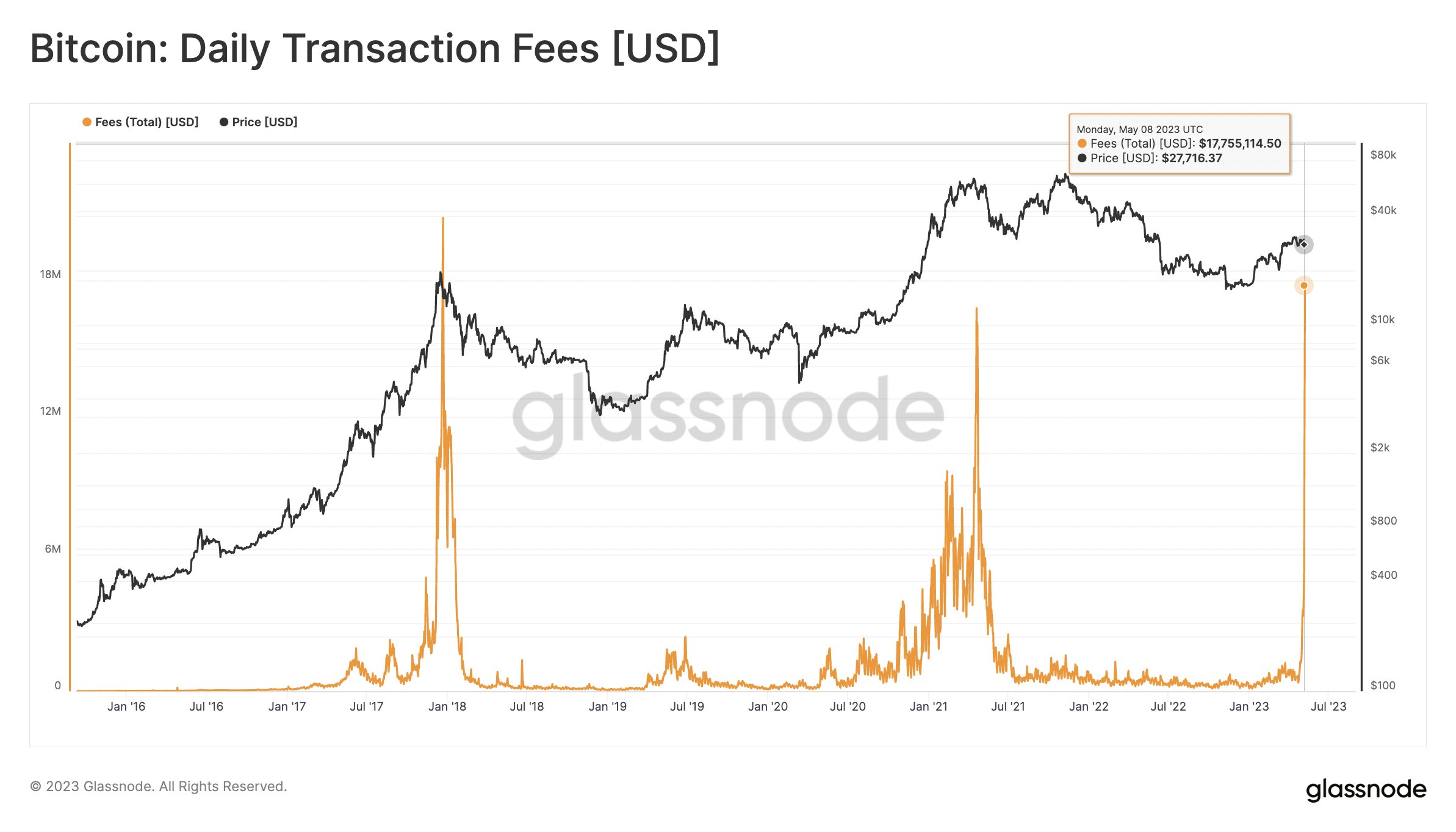

There have been some extraordinary congestion on the blockchain lately, so it’s not a shock that the transaction charges have blown as much as some fairly excessive ranges, because the beneath chart from Rafael Schultze-Kraft, the co-founder of Glassnode, shows.

The worth of the metric appears to have been fairly excessive in latest days | Source: Rafael Schultze-Kraft on Twitter

As displayed within the above graph, the Bitcoin transaction charges have shot as much as $17.7 million lately, which is an especially excessive quantity even when in comparison with the peak of the previous bull runs.

The important purpose behind this surge has been the spike within the utilization of Ordinals. In explicit, the rise within the reputation of the BRC-20 tokens, fungible tokens which were created utilizing the Ordinals protocol, has been on the middle of this exercise. Many meme cash have come up which are primarily based on this protocol, together with the explosively standard Pepe Coin (PEPE).

From the chart, it’s seen that solely the 2017 bull run high noticed the whole transaction charges on the blockchain hitting larger values. The first half of the 2021 bull run high noticed comparable, however nonetheless barely decrease ranges to the present spike.

Naturally, the miners are having fun with the burst of exercise being seen on the community proper now, as transaction charges make up for one of many two important income streams for these chain validators (the opposite being the block rewards).

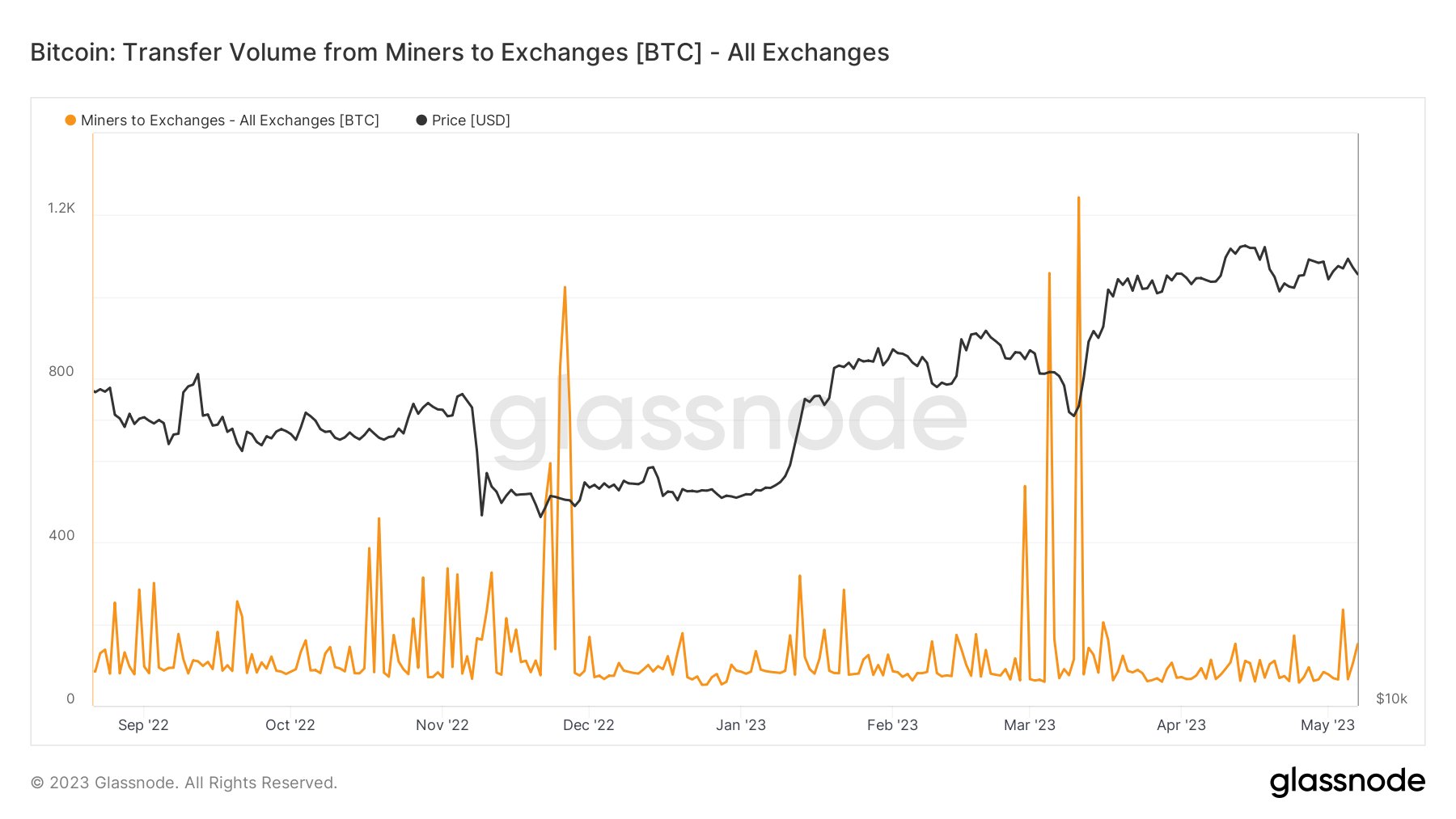

In such a interval of booming enterprise, there could also be issues about whether or not the miners would promote a few of their reserves right here to comprehend these excessive revenues. But to this point, the transaction quantity from the miners going in direction of centralized exchanges has remained low, based on the chart shared by Mitchell from Blockware Solutions.

Looks like the worth of the metric has stayed low lately | Source: MitchellHODL on Twitter

Usually, these buyers switch their cash to exchanges at any time when they need to take part within the distribution of the asset. Since they haven’t been sending any suspicious quantities to those platforms lately, it’s potential that they don’t intend to promote their Bitcoin but.

This is usually a optimistic signal for the market, as it would imply that this BTC cohort has determined to build up the additional income that they’ve been receiving lately.

BTC Price

At the time of writing, Bitcoin is buying and selling round $27,600, down 4% within the final week.

BTC has noticed some decline in the previous couple of days | Source: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com