Ethereum has registered some decline lately as on-chain information reveals an elevated quantity of deposits in direction of centralized exchanges.

Ethereum Exchange Deposits Have Spiked Recently

As identified by an analyst on Twitter, there are indicators of elevated short-term promoting stress within the ETH market for the time being. The related indicator right here is the “Ethereum active deposits,” which measures the every day whole variety of alternate addresses which are participating in some deposit exercise presently.

This indicator solely retains observe of the distinctive variety of such addresses, that means that it solely counts an deal with as soon as even when it has been concerned in a number of deposit transactions in a single day.

The benefit of this limitation is that distinctive addresses are analogous to distinctive customers on the community, so this metric can inform us in regards to the variety of customers making deposits to those platforms.

When the worth of this indicator is excessive, it means numerous alternate addresses are observing deposits proper now. This suggests {that a} excessive quantity of customers are transferring their cash to those platforms presently.

Since one of many predominant explanation why holders transfer their cash to the exchanges is for dumping-related functions, a excessive worth of this metric is usually a signal of a mass selloff out there.

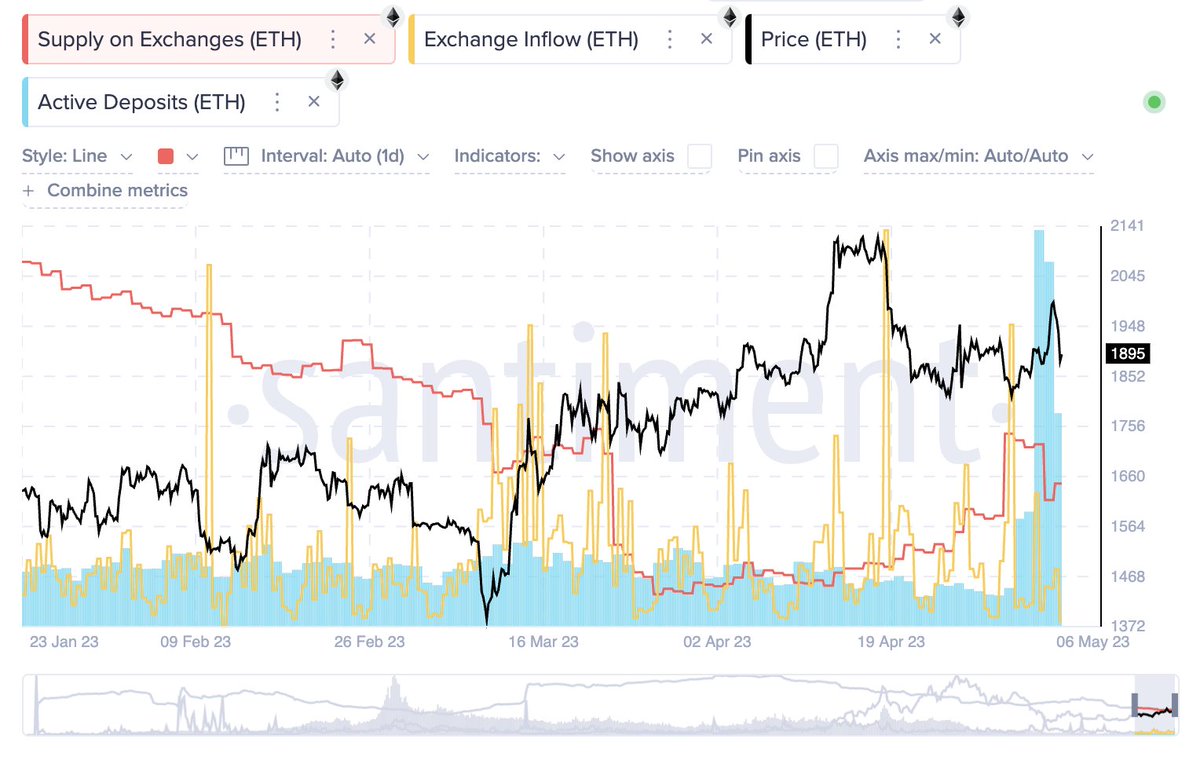

Now, here’s a chart that reveals the pattern within the Ethereum energetic deposits over the previous few months:

The worth of the metric appears to have been fairly excessive in current days | Source: Ali on Twitter

As proven within the above graph, the Ethereum energetic deposits metric surged to some fairly excessive values through the weekend. At the height of this spike within the indicator, there have been greater than 20,000 alternate addresses that have been participating in deposit exercise.

These newest values within the indicator have been considerably greater than the norm for the yr 2023 to this point, implying {that a} a lot greater quantity of customers have been making deposits lately.

The current peak worth has in truth additionally been the best that the Ethereum energetic deposits indicator has been since November 2021, the month when ETH set its all-time excessive worth.

In the chart, information for 2 different metrics, the supply on exchanges and the exchange inflow, can be displayed. The former of those measures the whole quantity of ETH sitting within the wallets of all exchanges, whereas the latter tracks the variety of cash being deposited into these platforms.

It seems to be like whereas there have been numerous customers making deposits lately, there has solely been a small alternate influx spike. This would indicate that many of the deposits made haven’t truly concerned a switch of any considerable quantity of ETH, suggesting that the inflows have primarily been coming from retail traders.

The provide on exchanges likewise hasn’t elevated after these deposits; it has relatively gone down, implying that there have been a lot stronger withdrawals lately.

Ethereum, nevertheless, nonetheless appears to have noticed a bearish impact from these mass deposits, as its worth has fallen beneath the $1,900 degree. Given the dimensions of the deposits, although, it’s attainable that this promoting stress was solely short-term, and thus, the drawdown might not go on for too lengthy.

ETH Price

At the time of writing, Ethereum is buying and selling round $1,800, down 2% within the final week.

ETH has gone down through the previous day | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web