Data from the on-chain analytics agency Glassnode has revealed the all-time-aggregate revenue margin for the Bitcoin miners; right here’s what it’s.

Bitcoin Miners Have Made A Profit Of 37% On Their Total Investment

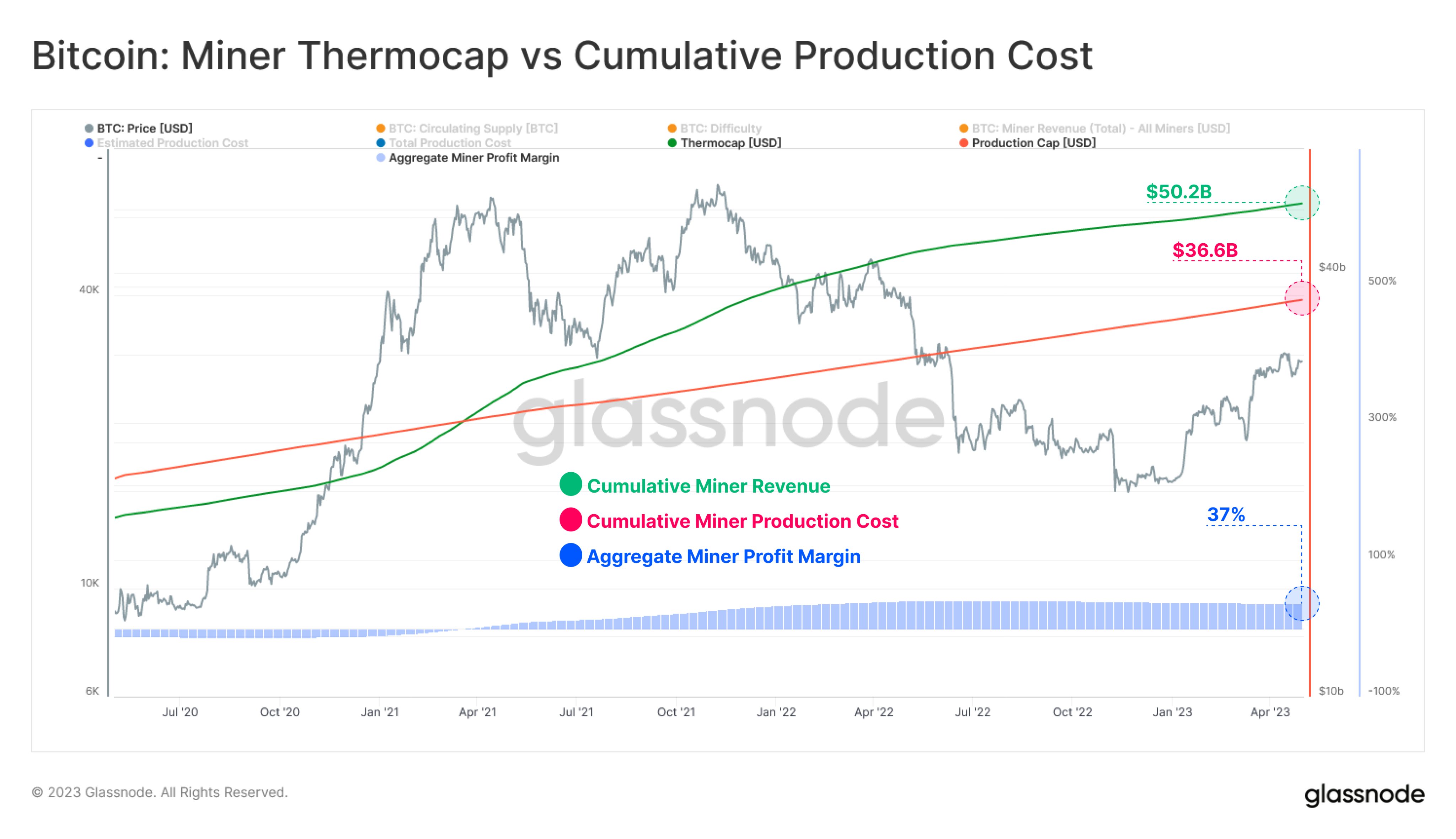

In a current tweet, Glassnode posted the newest knowledge on the place the miners at the moment stand relating to their income, value, and revenue. First, to calculate the income of those chain validators, the analytics agency has taken the sum of the “thermocap” and the transaction charges that this cohort has earned all through their lifetime.

The thermocap is an indicator that measures the cumulative sum of the issuance multiplied by the spot value of Bitcoin. In easier phrases, this metric tells us the entire worth of the block rewards that the miners have earned over the community’s lifetime.

To discover the prices incurred by this group, Glassnode has used its “difficulty regression model.” This is a mannequin for locating the price of manufacturing for Bitcoin, and it’s primarily based on the “mining difficulty.”

The mining problem is a characteristic of the BTC blockchain that controls how onerous miners discover it to mine on the community. Such an idea exists as a result of the chain needs to maintain its block manufacturing price (the velocity at which miners hash blocks) at a continuing worth.

Whenever the computing energy related by the miners (the “hashrate“) modifications, their capacity to mine naturally modifications with it. For instance, miners can carry out their duties quicker in the event that they join extra machines to the community.

However, as already talked about, the community doesn’t need miners to turn out to be quicker (or slower) than the usual price, so it adjusts the issue to neutralize this variation. In the case of this instance, the chain’s problem would go up in response, thus slowing down the miners again to the specified velocity.

The problem regression mannequin assumes that the issue encapsulates all the prices miners need to pay, as it’s immediately associated to the quantity of computing energy these validators have related to the community.

Now, here’s a chart that exhibits what the cumulative miner income and cumulative manufacturing value of the Bitcoin miners seem like proper now:

The prices, revenues, and the earnings of the miners | Source: Glassnode on Twitter

As displayed within the above graph, the Bitcoin miners have raked in lifetime revenues of about $50.2 billion, whereas their cumulative manufacturing value is round $36.6 billion.

The revenues have been greater than the prices for this group, which means that the BTC miners have made some good points. In numbers, the miners have made all-time combination earnings of $13.6 billion. This determine represents a acquire of 37% on the investments of those chain validators.

BTC Price

At the time of writing, Bitcoin is buying and selling round $28,700, up 4% within the final week.

Looks like the worth of the asset has surged prior to now day | Source: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, charts from TradingView.com, Glassnode.com