On-chain information from Glassnode reveals the latest volatility hasn’t been sufficient to make the ‘diamond hands of Bitcoin’ budge.

Bitcoin Long-Term Holders Continue To Increase Their Holdings

According to information from the on-chain analytics agency Glassnode, HODLing has remained the primary dynamic among the many long-term holders. The “long-term holder” (LTH) group is a Bitcoin cohort that features all traders who’ve been holding onto their cash since at the least 155 days in the past.

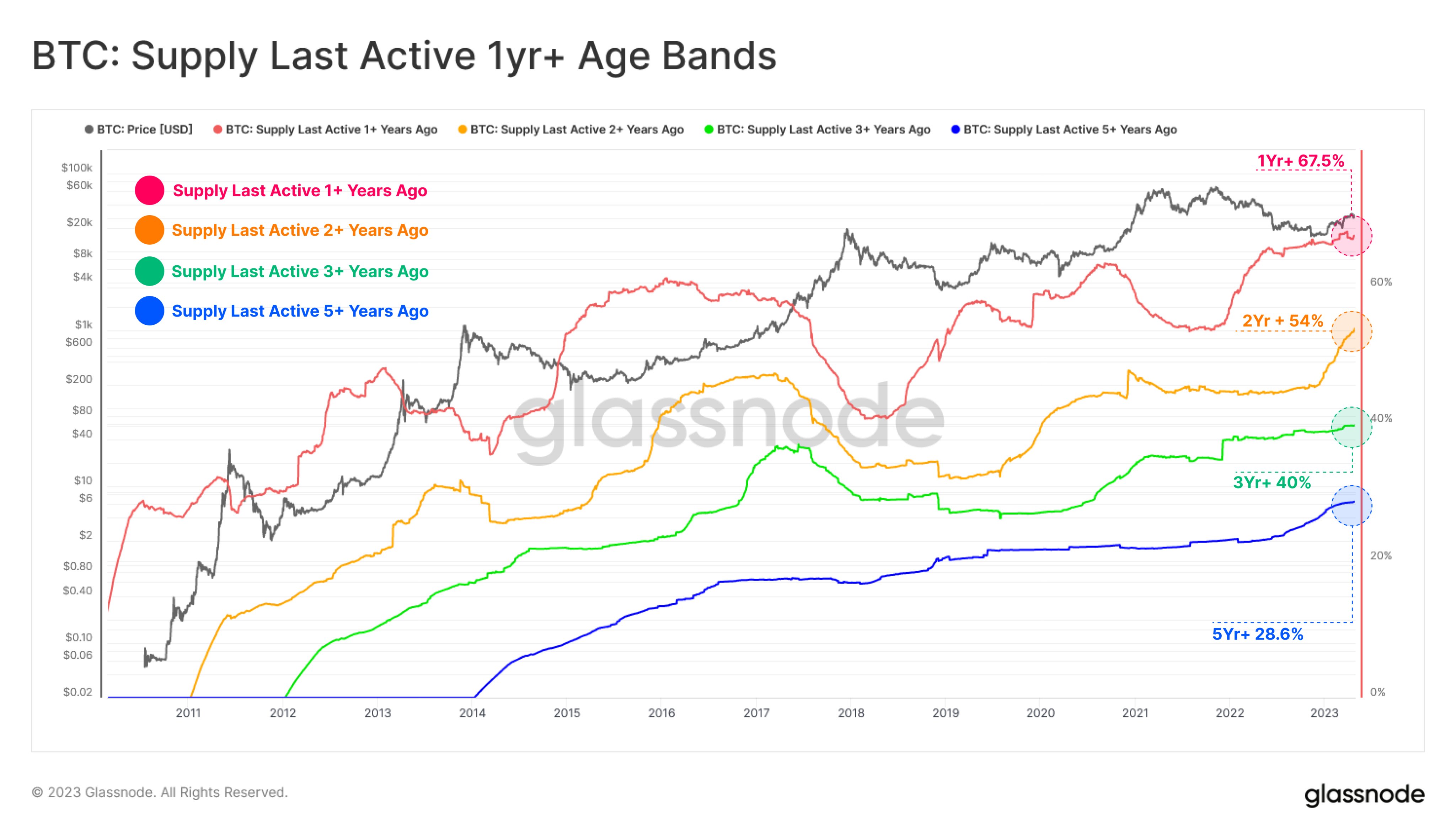

An indicator known as the “Supply Last Active Age Bands” can break down the entire quantity of provide that every “age band” available in the market is holding proper now. Coins are divided into these age bands based mostly on the entire period of time that they’ve been sitting dormant on the blockchain for.

With the assistance of this metric, not solely can the availability of the LTHs, basically, be tracked, however the conduct of the totally different segments of this group may also be studied.

In the context of the present dialogue, the related elements of the LTHs are these carrying cash since at the least one yr in the past. To be extra specific, the age bands being thought of listed below are the 1+ years, 2+ years, 3+ years, 4+ years, and 5+ years teams.

Here is a chart that reveals the development within the provide of those LTHs over all the historical past of the cryptocurrency:

The values of those metrics have solely gone up in latest days | Source: Glassnode on Twitter

Note that the age bands right here don’t have higher bounds. This implies that the youthful teams additionally embrace the provides of the age bands older than them. For instance, the 1+ years band contains the mixed information of all these different bands because it’s the youngest one.

Now, it’s seen from the above graph that every one these Bitcoin age bands have been rising in latest months, implying that the traders available in the market have been holding cash lengthy sufficient for them to mature into these ranges.

BTC has skilled some fairly high volatility just lately, however these traders nonetheless haven’t proven any important modifications of their provides. “This suggests that HODLing remains the primary dynamic amongst longer-term investors, insinuating that further volatility in price action is required to entice old hands to spend,” explains Glassnode.

Currently, the availability of the 1+ years cohort makes up for 67.5% of all the circulating BTC provide, a really important determine. The percentages naturally drop with every subsequent group, as their provide can’t be bigger than the group greater to them, as defined earlier than.

Generally, the longer an investor holds their cash, the much less doubtless they turn out to be to promote at any level. This is partially due to the truth that the extra aged cash are, the likelier they’re to have turn out to be completely misplaced (because of the keys of their wallets now not being accessible).

From the chart, it’s seen that the older age bands have usually noticed lesser fluctuations in comparison with the teams youthful than them. This fascinating development reveals the aforementioned statistical truth in motion.

BTC Price

At the time of writing, Bitcoin is buying and selling round $28,000, up 2% within the final week.

Looks like the worth of the asset has plunged within the final two days | Source: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Glassnode.com