With at this time’s launch of the Personal Consumption Expenditure (PCE) worth index by the Bureau of Economic Analysis, the Bitcoin market simply skilled a very powerful macro occasion of the week. Ahead of the Federal Open Market Committee (FOMC) of the US Federal Reserve (Fed) on May 2-3, all eyes had been on the PCE at this time.

The latter is called the Fed’s favourite inflation gauge. (versus CPI). It measures costs paid by shoppers for home purchases of products and companies and excludes meals and vitality.

The baseline was as follows: February’s core PCE index was +0.3% on a month-to-month foundation, under the forecast of +0.4%. For March, analysts anticipated a rise of +0.3%. On an annualized (YoY) foundation, a rise of 4.5% was anticipated, a slight drop from the earlier month’s 4.6%.

Hitting expectations or any “positive” surprises had been anticipated to be bullish for the Bitcoin market. Renowned analyst Ted (@tedtalksmacro) stated up entrance: “Bulls want to continue seeing it trend south!” and added the probabilities for a bullish shock had been good: “CPI + PPI prints earlier in the month, at least for now, suggests that the path of least resistance is for lower inflation numbers.”

PCE Slightly Impacts Bitcoin Price

These expectations weren’t met. As reported by the Bureau of Economic Analysis, core PCE got here in at 0.3% on a month-to-month foundation, as anticipated. On an annual foundation, core PCE fell to 4.6%, additionally delivering the anticipated quantity.

BREAKING: US PCE knowledge is out!

Headline y/y 4.2% vs 4.1% expectation

Headline m/m 0.1% vs 0.1% expectation

Core y/y 4.6% vs 4.58% expectation

Core m/m 0.3% vs 0.3% expectation

— Markets & Mayhem (@Mayhem4Markets) April 28, 2023

Bitcoin worth reacted in keeping with expectations. At the time of writing, BTC was sticking to the worth degree round $29,300.

The large query, nonetheless, shall be whether or not progress in preventing inflation is sufficient for Fed Chairman Jerome Powell. In a cellphone prank with a pretend Ukraine President Volodymyr Zelenskyy yesterday, Powell acknowledged that there are at the very least two extra charge hikes coming, adopted by a protracted interval of excessive rates of interest with vital damaging results on the US economic system and the US labor market.

Powell additionally said {that a} recession within the United States is probably going. “This is what it takes to get inflation down. By cooling off the economy and cooling off the labor market inflation comes down. We don’t know of any painless way for inflation to come down.”

In a prank name with a pretend Zelenskyy Jerome Powell, Chairman of the Federal Reserve, admits at the very least 2 extra upcoming rate of interest hikes adopted by a protracted interval of excessive charges with vital damaging results on the US economic system and the US labor market. https://t.co/vDb19Ed5ux

— Kim Dotcom (@KimDotcom) April 27, 2023

What Will The Fed Make Of The Data?

After the most recent macro knowledge, Fed Funds Futures merchants count on a likelihood of greater than 80% for a 25 foundation factors (bps) charge hike subsequent Wednesday. The likelihood in response to the CME FedWatch Tool was at 88% earlier than the discharge of the PCE and remained at this degree afterwards.

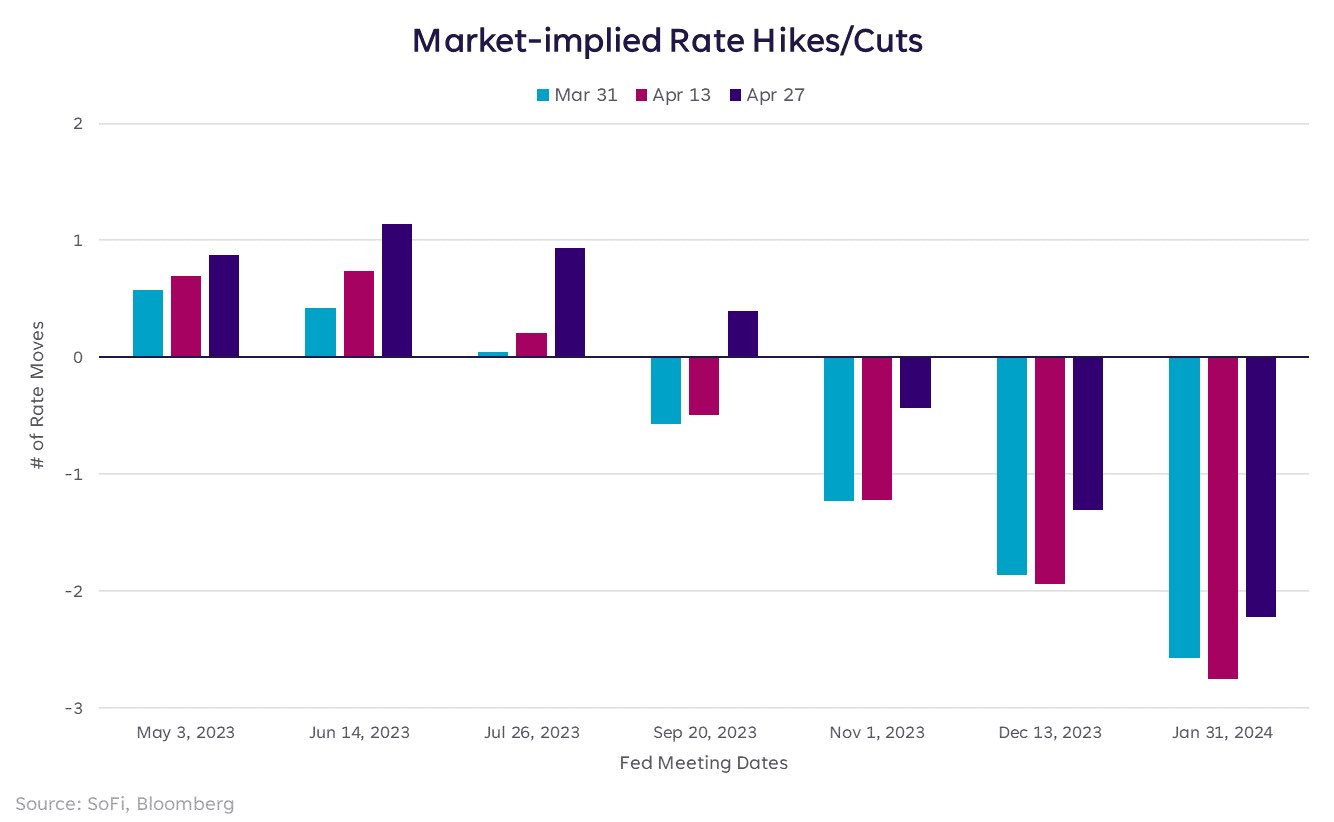

Still, the market is looking Powell’s bluff. Liz Young, head of funding technique at SoFi shared the chart under and stated previous to the PCE launch:

Market pricing implies 88% odds of a charge hike subsequent week, up from earlier within the month. Some merchants are beginning to guess on a hike in June as properly, however that’s much less sure. Either approach, markets nonetheless suppose we’re going to get a number of cuts later in 2023 & early 2024.

Today’s launch just isn’t anticipated to vary this. On the opposite hand, a second wave of financial institution failures is at present brewing within the US. Higher rates of interest are prone to push extra regional banks to their restrict. Bitcoin might as soon as once more be the beneficiary, because the Fed can’t hike as excessive as they’d need to.

At press time, the Bitcoin worth stood at $29,314.

Featured picture from iStock, chart from TradingView.com