The market individuals are witnessing sudden Bitcoin worth actions as a result of the bear market is formally coming to an finish. While timing the market is a foul technique, the Bitcoin market has some benefits equivalent to on-chain historic information depicting precise days and patterns after which large BTC worth rallies might be anticipated.

BTC worth fell 10% final week after surpassing the $30,000 psychological stage, which alerts the beginning of the “overheated bull phase” as bulls takeover bears. The latest BTC price rally from $20,000 was truly supported by Bitcoin entering the bull market cycle in January and crossing the key 200-weekly moving average (WMA) in March.

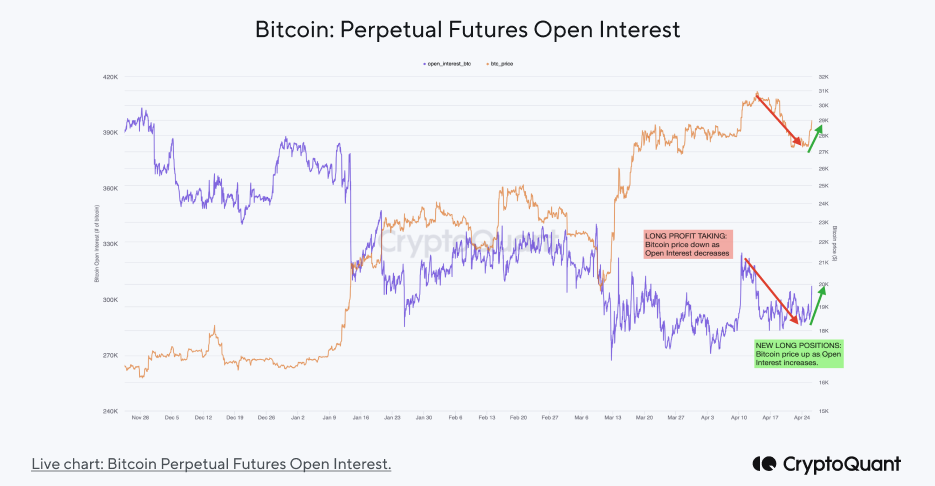

The recent declines in the Bitcoin price are attributable to profit-taking by merchants within the perpetual futures markets, with open curiosity falling. The “long squeeze” induced large liquidations, giving traders a possibility to “buy the dip.” Traders additionally took earnings because the ETH price jumped over $2,000 after the Shanghai upgrade on April 12 and Binance opened Ethereum withdrawals on April 19.

Traders have once more began opening lengthy positions and spending exercise of whales stays larger. Typically, worth rallies happen throughout whale spending exercise with not less than 20% of whole cash being moved, however Spent Output Value Bands point out whale spending exercise rose above 40%. In reality, whales with over 10k BTC had a spending exercise of 25%, the primary time for the reason that FTX fallout. This coincides with many dormant whales waking up after 8–10 years.

Bitcoin Price Begins Bull Run

Bitcoin worth at present buying and selling within the $28k-30k vary, with volatility rising because the bull market begins. The short-term value foundation or the realized worth is at $24,000, indicating the important thing help stage for this bull market.

Traders wait for 2 key occasions earlier than a rally can probably begin, Friday’s month-to-month expiry and the U.S. Fed fee hike resolution on May 2. This might be the final fee hike by the Fed earlier than it appears to be like to chop the funds fee from September.

While the worldwide market retains an eye fixed on the U.S. debt ceiling disaster, Republicans are actively working to extend the debt ceiling amid dangers of a recession. The US greenback can be weakening, which can seemingly enhance BTC costs.

With Bitcoin halving to occur in April 2024, the BTC worth is likely to surpass $135,000 and doubtless we’ll by no means see BTC beneath $20,000 once more.

Also Read: Crypto Market Recovery: Bitcoin and Ethereum Price Begins Major FOMO Rally

The introduced content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.