The recognition of meme cash has led to a surge in value manipulation and different fraudulent actions. Deployers are recognized to build up massive quantities of the cash earlier than including liquidity to the market, which may trigger the worth to skyrocket and depart unsuspecting traders with nugatory cash.

Meme cash have gained popularity lately. People usually make these cash as a joke or for enjoyable, they usually sometimes have little to no sensible use. Despite this, meme cash have grow to be successful, with many individuals investing in them in hopes of a fast revenue.

However, the darkish facet of meme cash won’t go away. Many deployers of those cash have been accumulating massive quantities of funds earlier than including liquidity to the market. This conduct can result in value manipulation and different unhealthy outcomes.

Understanding the “Memecoin” Frenzy

Launching meme cash with little to no growth behind them is likely one of the issues right here. This means they’re weak to cost manipulation, as there may be usually no real-world worth to assist their value. Furthermore, launching such cash with a restricted provide could make them weak to cost manipulation.

A tactic deployers use is accumulating a considerable amount of the cash earlier than including liquidity to the market. They do that by shopping for up massive volumes of the coin from early traders or utilizing bots to inflate the worth. Once the deployer has gotten a major variety of the coin, they will add liquidity to the market, which may trigger the worth to skyrocket. This value manipulation could be devastating for unwitting traders. Many folks want to understand the dangers concerned in investing in meme cash, since they will lose a fortune when the worth crashes.

Meme cash usually lack regulation by any governing physique, presenting one other drawback. This means there isn’t a oversight to bar value manipulation or different fraudulent actions. Additionally, as a result of many meme cash launch anonymously, holding the deployer accountable for any wrongdoing could be exhausting.

In some instances, deployers of meme cash have used their affect to pump the coin’s value after which promote their holdings for a major revenue. This may cause the worth to crash, leaving traders with nugatory cash. In excessive instances, deployers of meme cash have engaged in exit scams, the place they disappear with the traders’ funds.

Examining Live Cases

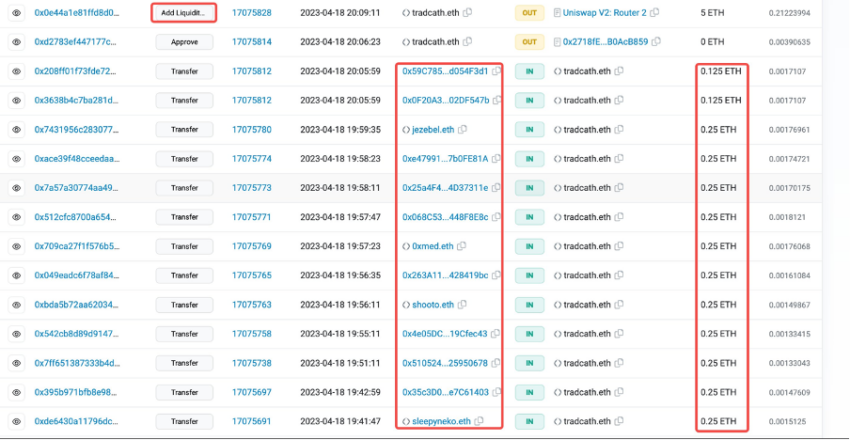

Some MEME coin deployers have collected many funds earlier than growing liquidity. This means that there’s a risk of manipulation by a selected group. For occasion, a Twitter profile with the deal with ‘X-explore’ raised issues concerning the conduct exhibited by completely different cohorts.

Herein, meme cash with comparable conduct embrace WOJAK, TRAD, and NEET. Here are just a few examples:

Token title: WOJAK with deployer tackle: 0x8591F46A5E9B081289a3CFC4b5381F3c6e88389B

Another one is TRAD with deployer addresses: 0x4fE6ac27C8B992356D5fB8547b1dEb2540efA34E

Last, is NEET exhibiting similar actions.

Additionally, the frog-themed PEPE token noticed one fortunate purchaser flip a $250 funding into an on-paper revenue of over $1 million. Saw a large meme coin surge led by the newly-launched PEPE. The ensuing “meme coin frenzy” entailed high trading volumes snarling up the Ethereum community. Another fellow meme coin that witnessed a surge is REKT, which rose by 90% in a day.

These are just a few situations the place comparable meme cash can lure traders making an attempt to get instantaneous income. However, warning is so as. Most meme cash have little to no basic worth and commerce completely on recognition. Meme cash difficulty in massive portions with market costs of lower than a cent to make them look cheaper and entice potential patrons.

Serious Risks

Low-liquidity tokens and meme cash can pose points for traders. These cash usually launch with a restricted provide and might have extra buying and selling exercise on cryptocurrency exchanges. As a consequence, shopping for or promoting these cash at a good value can take time, resulting in extreme value fluctuations and different issues.

One of the problems with low liquidity tokens and meme cash is that they’re weak to cost manipulation. Because there may be little buying and selling exercise, it may be straightforward for a single investor or group of traders to govern the coin’s value. This can result in large losses for different traders unaware of what’s taking place.

Additionally, low-liquidity tokens and meme cash could be difficult to promote. If there are not any patrons, traders might find yourself holding onto the coin for an prolonged time, which could be dangerous. In some instances, traders might should promote the coin at a loss, which may wreck their portfolio.

Another space for enchancment with low liquidity tokens and meme cash has to do with real-world worth. Many of those cash are launched as a joke or for enjoyable and should have little sensible use. This could make it exhausting for traders to find out whether or not the coin is an efficient funding or not.

Finally, low-liquidity tokens and meme cash could be weak to hacking and different cybersecurity dangers. These cash want robust security measures to guard traders’ funds since they usually launch with little to no growth. This could make it straightforward for hackers to steal the cash and depart traders with big losses.

Take Precautions and DYOR

Users should do their due diligence before investing in any cryptocurrency to guard themselves from the dangers related to meme cash. This means researching the coin and the deployer to find out whether or not they have a strong monitor report or will doubtless have interaction in value manipulation or different fraudulent actions.

Additionally, it’s important to diversify your cryptocurrency portfolio. Investing in numerous cash can assist decrease threat and defend you from losses if one coin experiences a value drop.

Finally, it’s important to do not forget that investing in cryptocurrency is inherently dangerous. While some meme cash might provide the potential for large returns, in addition they include a excessive stage of threat. As with any funding, it’s important to rigorously take into account the dangers and rewards earlier than investing your cash.

Disclaimer

Following the Trust Project pointers, this characteristic article presents opinions and views from trade consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its workers. Readers ought to confirm data independently and seek the advice of with knowledgeable earlier than making selections based mostly on this content material.