A sample within the Bitcoin trade reserve ratio that has traditionally preceded the beginning of bull runs hasn’t fashioned for the cryptocurrency but.

Bitcoin Exchange Reserve Ratio Has Continued To Decline Recently

As identified by an analyst in a CryptoQuant post, bull markets previously have began with US exchanges rising their holdings. The related indicator right here is the “exchange reserve ratio,” which measures the ratio between the trade reserves of any two trade platforms or teams of them.

The “exchange reserve” right here refers to a metric that tells us concerning the whole quantity of Bitcoin that’s at present sitting within the wallets of a centralized trade (or within the mixed wallets of a number of platforms).

In the context of the present dialogue, the trade reserve ratio is being taken between the mixed reserve of the US-based platforms and that of the international ones.

When the worth of this ratio will increase, it means the overall variety of cash on the American exchanges goes up relative to the worldwide platforms proper now. On the opposite hand, a lower implies that offshore platforms are receiving extra deposits (or simply observing fewer withdrawals) at present.

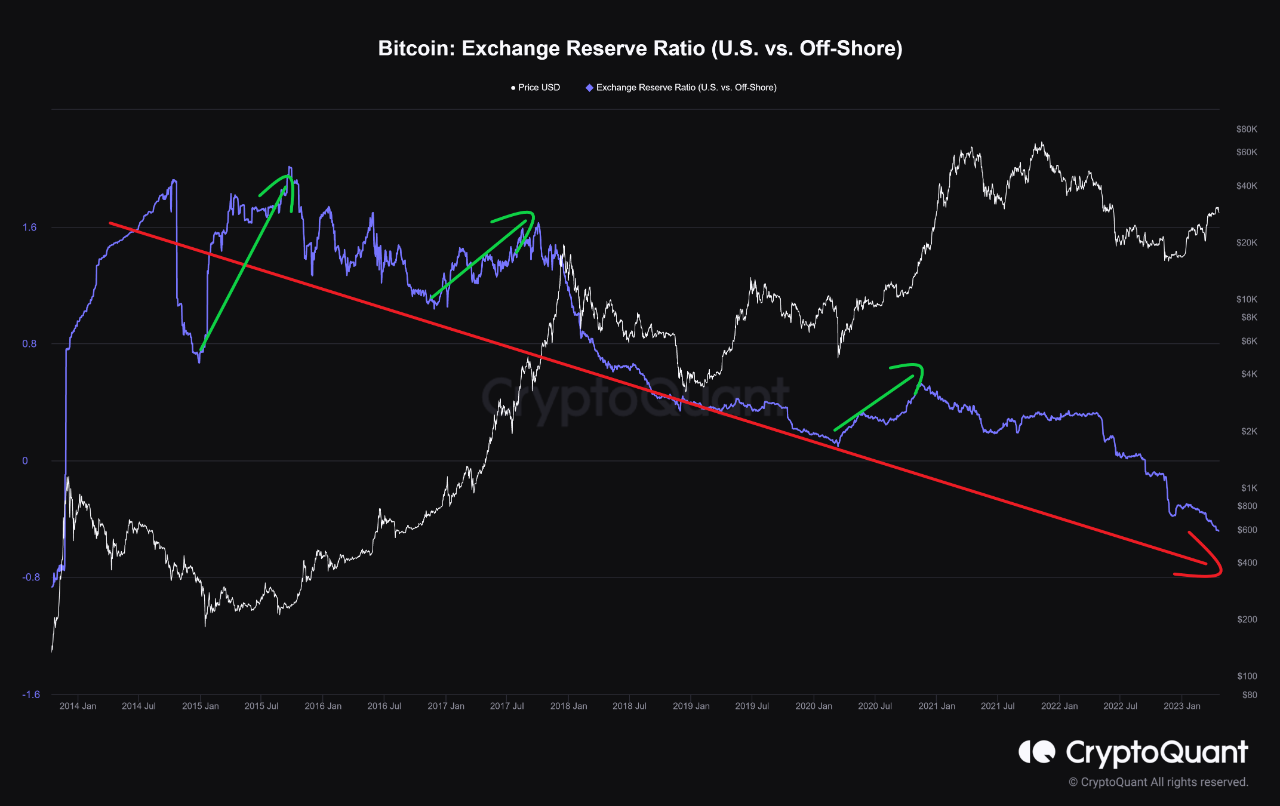

Now, here’s a chart that exhibits the pattern within the Bitcoin trade reserve ratio for the US versus offshore platforms over the previous couple of cycles:

The worth of the metric appears to have been happening in latest months | Source: CryptoQuant

As proven within the above graph, the Bitcoin trade reserve ratio for these units of platforms has been always lowering in latest months. In truth, the indicator has been driving an total downtrend since 2014, which signifies that the share of the US-based exchanges has been shrinking over time.

This pattern would make sense as many new offshore exchanges have come up (and have grown to appreciable sizes) throughout this era because the cryptocurrency has grow to be widespread worldwide.

There have been some stretches previously, nonetheless, the place the metric has deviated from this downtrend line. The quant has highlighted these occurrences within the chart.

Interestingly, these durations of an uptrend for the Bitcoin trade reserve ratio have come as bear markets have ended, and the buildup in direction of bull markets has taken place.

This would counsel that the US-based platforms have traditionally grown their holdings relative to the international exchanges when the asset has been heading towards bull markets.

Recently, nonetheless, the Bitcoin trade reserve ratio has proven no indicators of a breakdown away from the downtrend construction but, implying that the holdings of those platforms are nonetheless lowering.

“The percentage of Bitcoin held by U.S.-based exchanges, banks, and funds has not yet risen,” notes the analyst. “I believe it is still too early for a true bull market to arrive.”

BTC Price

At the time of writing, Bitcoin is buying and selling round $28,000, down 9% within the final week.

Looks like the worth of the asset has plunged throughout the previous couple of days | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com