Binance, the world’s largest crypto alternate, dominates the crypto market as a result of huge buying and selling volumes it data on the alternate. However, Bitcoin spot and derivatives buying and selling volumes on Binance are declining in the previous few months.

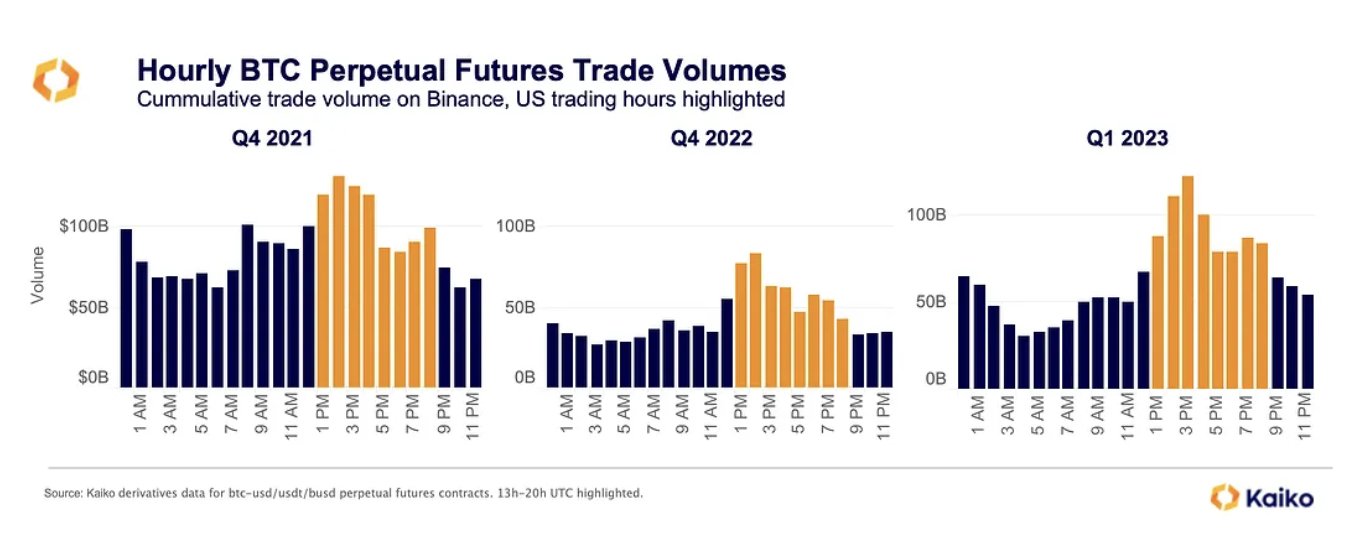

Over the previous few years, Binance recorded increased derivatives buying and selling quantity within the U.S. hours compared to different hours. However, the volumes are dropping through the U.S. hours for the reason that CFTC lawsuit in March, reported Kaiko on April 13.

Bitcoin derivatives buying and selling quantity knowledge for BTC-USD, BTC-USDT, and BTC-BUSD perpetual futures contracts indicated buying and selling quantity often rises between 13:00 and 20:00 UTC. The Q1 2023 knowledge was in contrast with This fall 2021 and This fall 2022 figures, with Binance’s Bitcoin buying and selling volumes virtually doubled in U.S. hours.

“However, not charted, we noticed a drop in volumes during U.S. hours since the CFTC lawsuit,” noted Kaiko.

Will Binance’s Trading Volume Drop Impact Bitcoin Price?

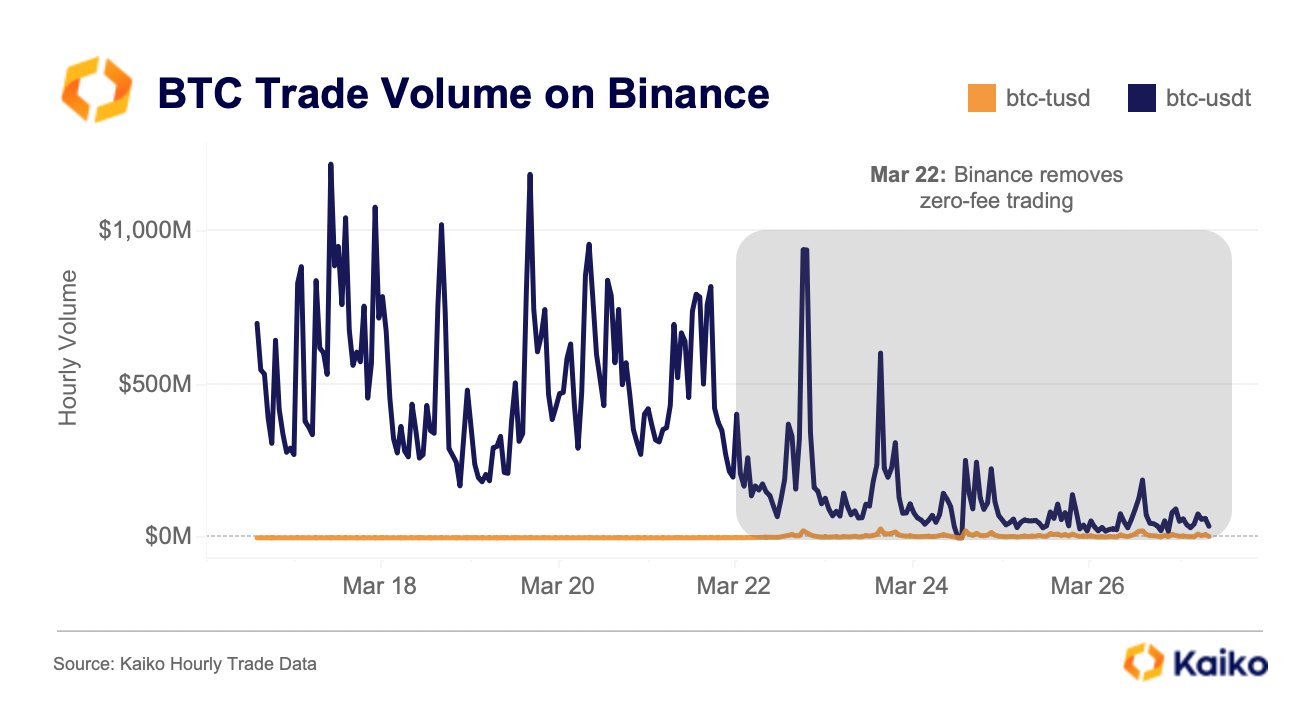

Bitcoin buying and selling quantity for the BTC-USDT pair fell 90% on crypto alternate Binance after it ended the zero-fee Bitcoin trading for all buying and selling pairs besides TrueUSD (TUSD). While the each day buying and selling quantity on BTC-TUSD pair has elevated to $170 million, it’s nonetheless comparatively decrease.

Binance made main adjustments to its zero-fee Bitcoin buying and selling program and BUSD zero-maker payment promotion as a part of eradicating Binance USD (BUSD) after the crackdown by U.S. regulators.

Binance‘s market share dropped to 54% from 70% two weeks ago, the lowest level since November 5, after the CFTC lawsuit and ending some zero-fee trading. Kaiko earlier clarified that CFTC had no impact on Binance’s buying and selling volumes, however at present it agreed that it does have some affect.

While Bitcoin has jumped over $30,000, the upcoming value rally is prone to be restrictive. The BTC value is presently buying and selling at $30,255, up 1% within the final 24 hours. Meanwhile, the ETH price has hit $2,000 after the Shanghai improve because of huge shorts liquidation.

Also Read: London Stock Exchange To Offer Bitcoin Futures And Options Trading

The offered content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.