Crypto Market News: Amid speak of the crypto market‘s decoupling from the normal market, the wind is now shifting in direction of main regulatory modifications within the house. This is regardless of clear indicators of dwindling belief within the banks amid a banking disaster that’s shaking international markets. But the crypto costs noticed spectacular rally because the banking disaster unfolded over the previous couple of weeks. This scenario, nevertheless, doesn’t indicate any easing in regulatory surroundings for the crypto asset ecosystem within the United States, except lawmakers resolve the hurdles.

Also Read: Cardano Reaches Historic Milestone, Popular Analyst Predicts ADA Price To Hit $15

KBW Nasdaq Bank Index, which tracks efficiency of the main public banks within the U.S., fell by as a lot as 28% over the past three weeks. This coincided with an 18% rise for Bitcoin price over the identical interval.

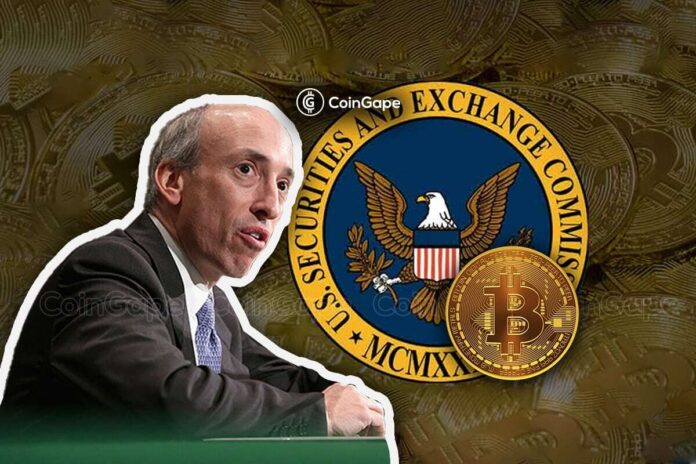

Gary Gensler’s Attempts To Influence UK Regulators

As CoinGape reported earlier, U.S. Securities and Exchange Commission (SEC) chair Gary Gensler is claimed to have lobbied along with his counterparts within the United Kingdom and Canada about sustaining a typical motion plan for crypto regulation. Reacting to this information, XRP lawyer John Deaton spoke on how totally different the regulators of US and UK operated previously, giving Ripple (XRP) token instance. Reports mentioned the UK’s Financial Conduct Authority (FCA) was making efforts to provide you with an announcement on this respect.

“It will be very interesting to see if the U.K.’s FCA plays ball with Gary Gensler and the SEC. To place in perspective just how far apart the two agencies are: the FCA labeled XRP a non-security token and called it a hybrid token — part exchange token and part utility token.”

Gensler had in current previous confronted heavy criticism for saying all cryptocurrencies count on Bitcoin are securities. The SEC had earlier within the week issued a Wells discover to high US based mostly crypto change Coinbase.

Also Read: Bitcoin To $1 Million: Ex-Coinbase CTO Assures Off Bet; But There’s A Catch

The offered content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.