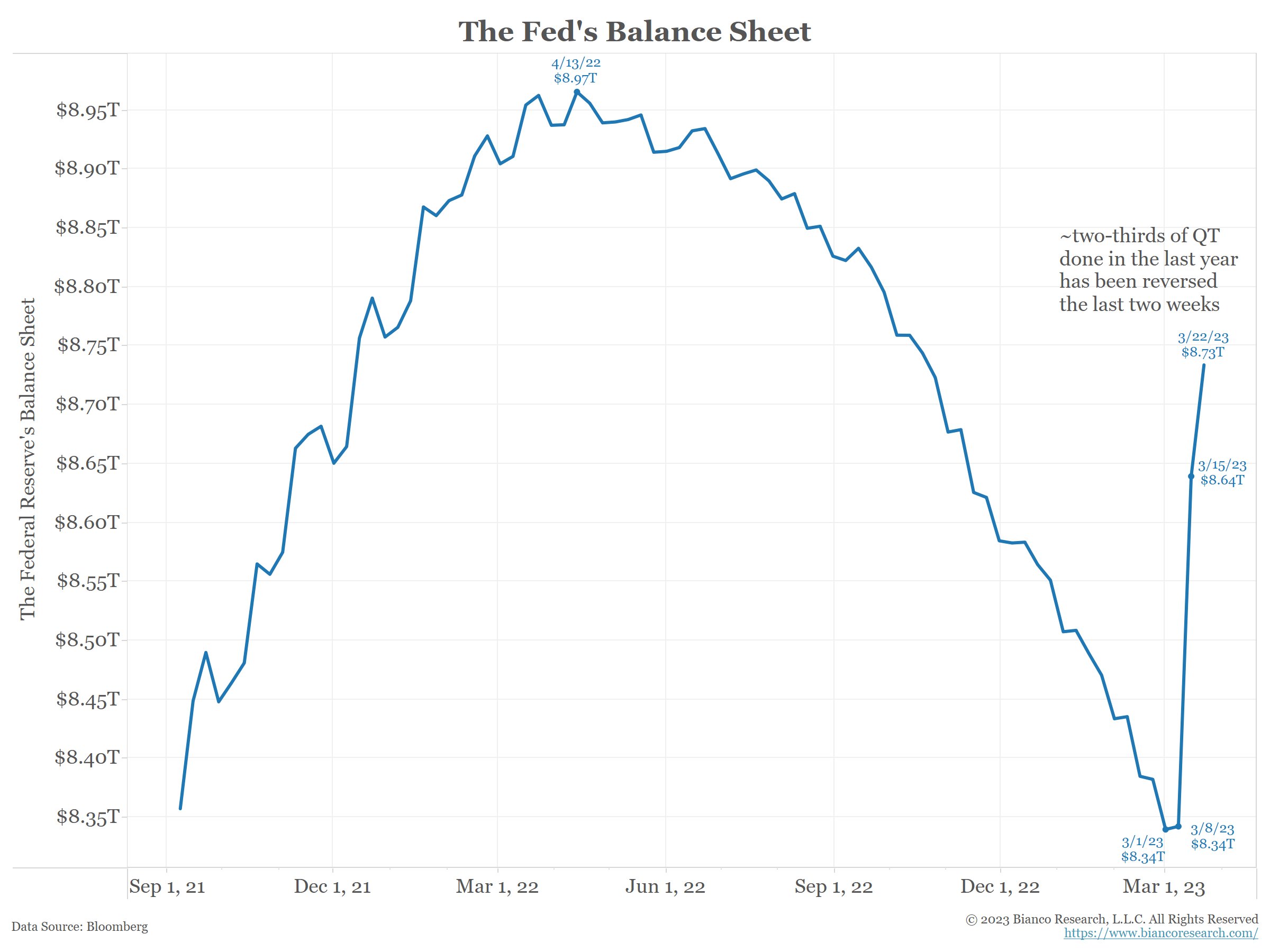

The U.S. Federal Reserve steadiness sheet rises nearly $100 billion this week, taking the full to $400 billion. The central financial institution continues to print extra money for rescuing cash-strapped banks for the reason that collapse of Silvergate, Silicon Valley Bank, and Signature Bank. Bitcoin and Ethereum costs have soared increased in consequence, with the crypto concern and greed index rising to 61.

US Banks borrowed a mixed $163.9 billion from the U.S. Federal Reserve, in opposition to $164.8 billion within the earlier week. Borrowing charges by banks have elevated after the Fed raised interest rates by another 25 bps to 4.75%-5% and Treasury Secretary Janet Yellen mentioned no blanket insurance coverage for all financial institution deposits.

Tesla CEO Elon Musk, billionaire Bill Ackman, former Coinbase CTO Balaji Srinivasan, and Ark Invest CEO Cathie Wood criticized the U.S. Federal Reserve’s charge hikes amid the banking crisis.

Bitcoin Price To Hit $35,000 and Ethereum Set For $2000?

Bitcoin value rises over 2% within the final 24 hours, with the worth at present buying and selling close to $28,100. The 24-hour low and excessive are $27,359 and $28,729, respectively. While the BTC price has elevated, the buying and selling quantity has decreased within the final 24 hours.

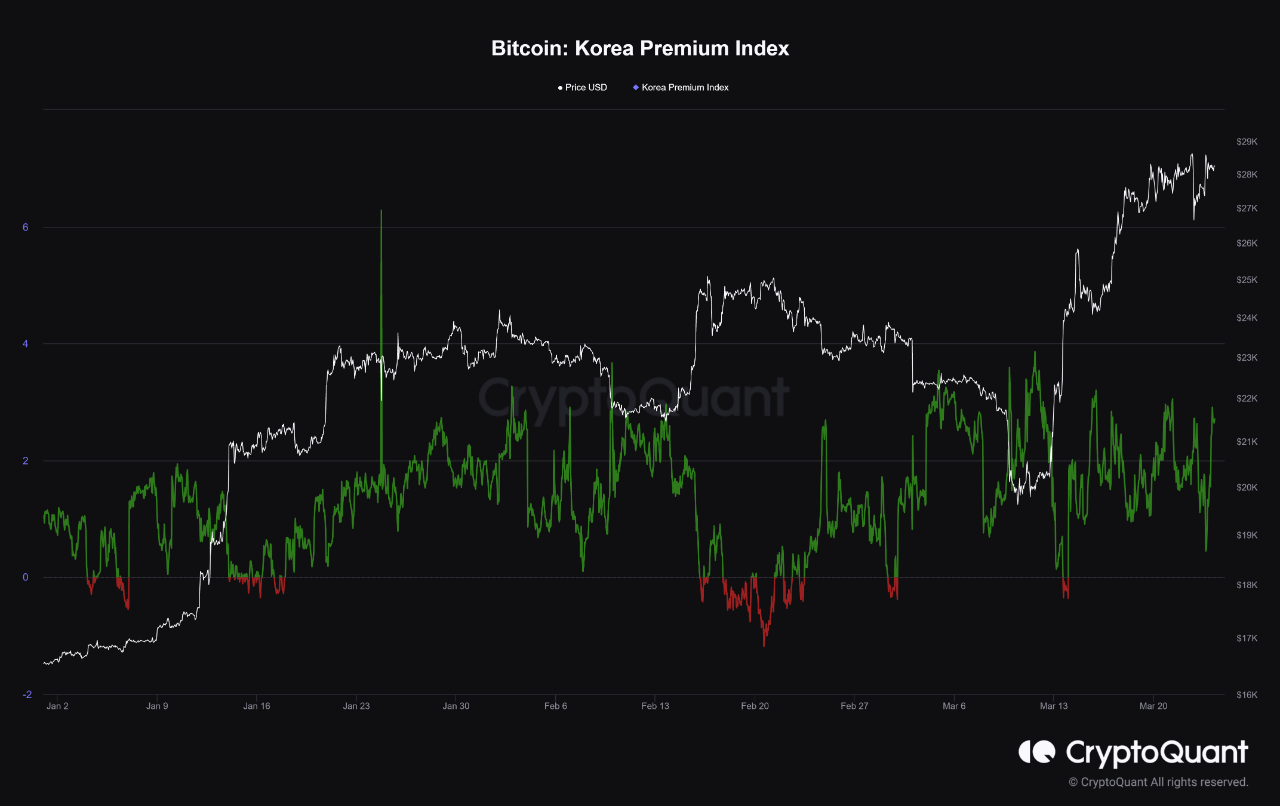

On-chain evaluation and sentiment evaluation revealed Coinbase Premium Index is lowering and Korea Premium Index is rising. High premium values point out sturdy shopping for strain by U.S. and Korean buyers. However, the present state of affairs indicators a extra balanced value momentum.

Moreover, 4 on-chain metrics reveal potential correction within the BTC value for extra upside strikes within the coming days as optimistic sentiment rise. Analysts mentioned Bitcoin has the potential to hit $35,000 amid the banking disaster.

Meanwhile, Ethereum value can be witnessing an upside transfer, with ETH value rising 3% within the final 24 hours amid bullish sentiment. ETH price is buying and selling at $1,710, with a 24-hour excessive of $1,853. Ethereum value will likely be risky amid excessive fuel charges and the Shanghai upgrade set for April 12.

Also Read: Binance CEO “CZ”, Nic Carter On Repercussions Of Operation Choke Point 2.0

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.