The U.S. Federal Reserve is anticipated to lift the fed funds fee by 25bps to 4.75%-5% throughout the FOMC assembly on Wednesday. It would be the second consecutive 25bps rate hike, pushing borrowing prices to new highs since 2007. Traders anticipate an additional improve in Bitcoin and Ethereum costs because of the banking disaster.

Billionaires Elon Musk and Bill Ackman, economists, and traders consider the central financial institution ought to pause the financial tightening to deliver monetary stability after the collapse of three US banks and the takeover of Credit Suisse. Investors should hold an in depth watch on new financial forecasts and dot plot potential additional fee hikes this yr.

On-Chain Data Indicating Potential Correction in Bitcoin Price

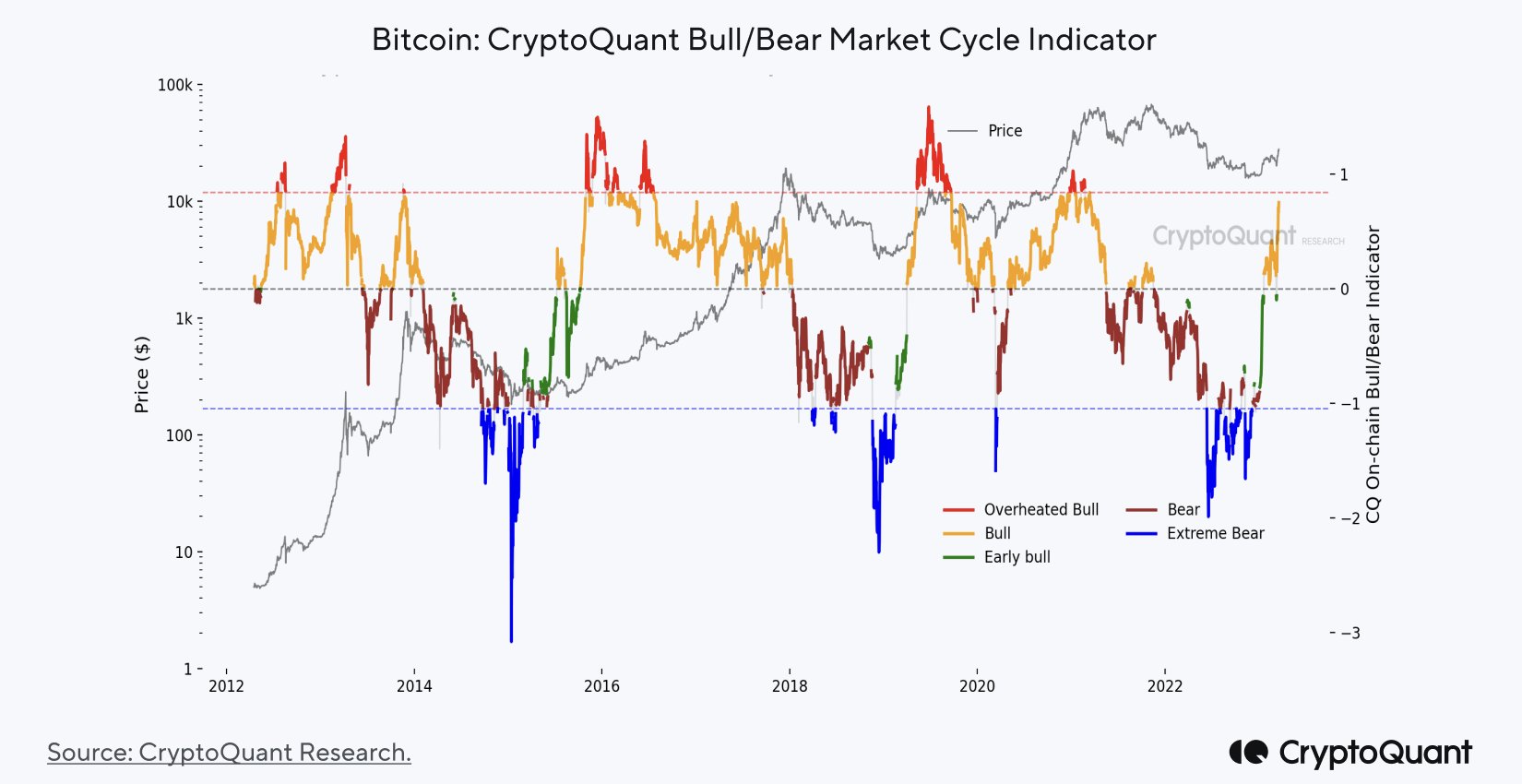

Bitcoin is within the early bull market cycle and the current rally above $28,000 clearly proves it. Moreover, on-chain indicators similar to CryptoQuant’s On-chain P&L Index and inter-exchange flows indicated a bullish Bitcoin narrative.

The Bitcoin Bull/Bear Market Cycle metric signifies a risk of a value correction because it reaches close to the Overheated Bull space. Thus, traders should train warning because of the sudden improve in Bitcoin value in a significantly brief interval.

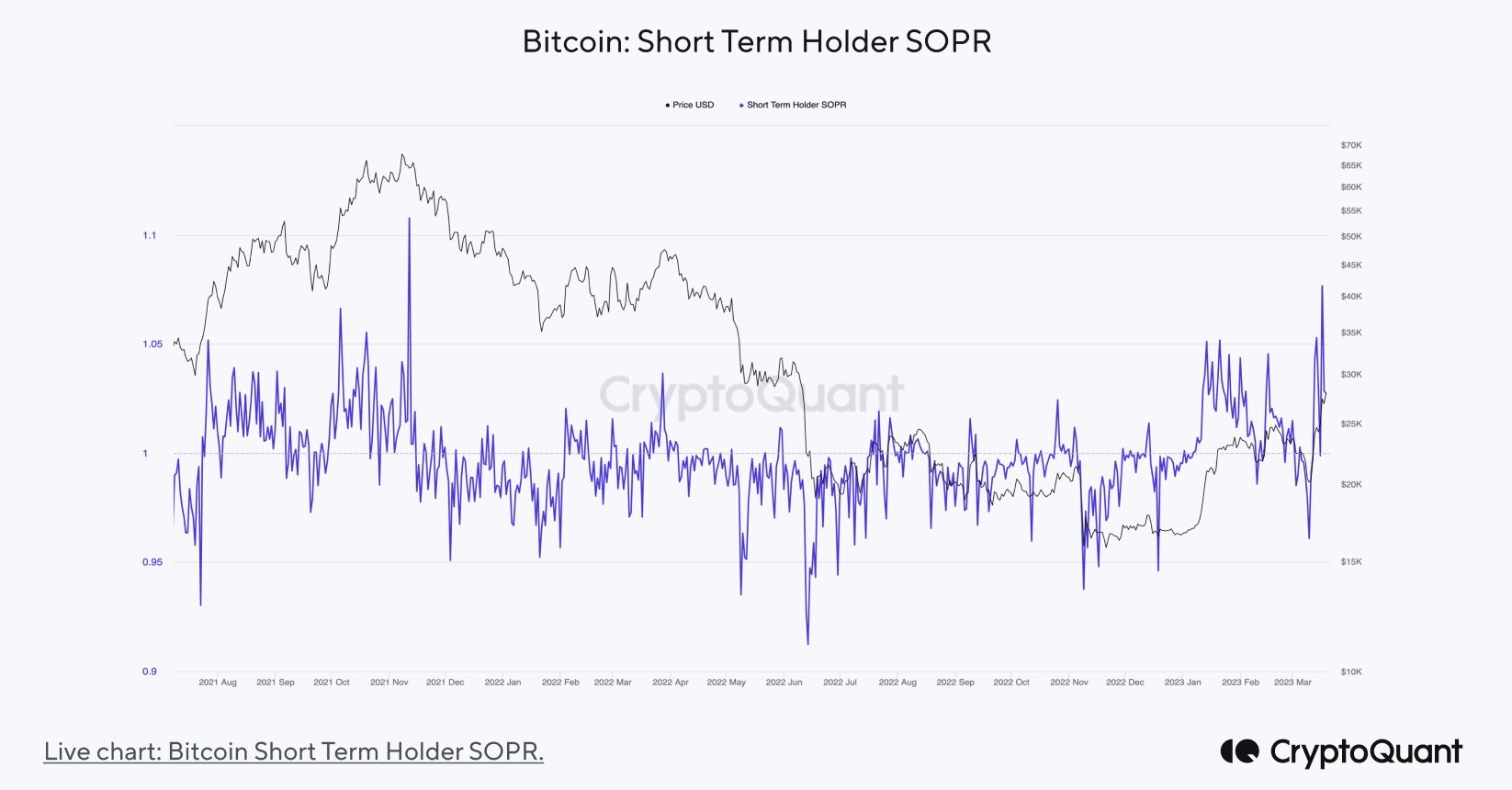

The Bitcoin Short-Term Holders SOPR metric has jumped above 1.5. It signifies traders are reserving earnings at a outstanding revenue margin of seven.6%. It is the best since November 2021, when Bitcoin was buying and selling at $64K. Typically, values over ‘1’ point out extra short-term traders are promoting at a revenue.

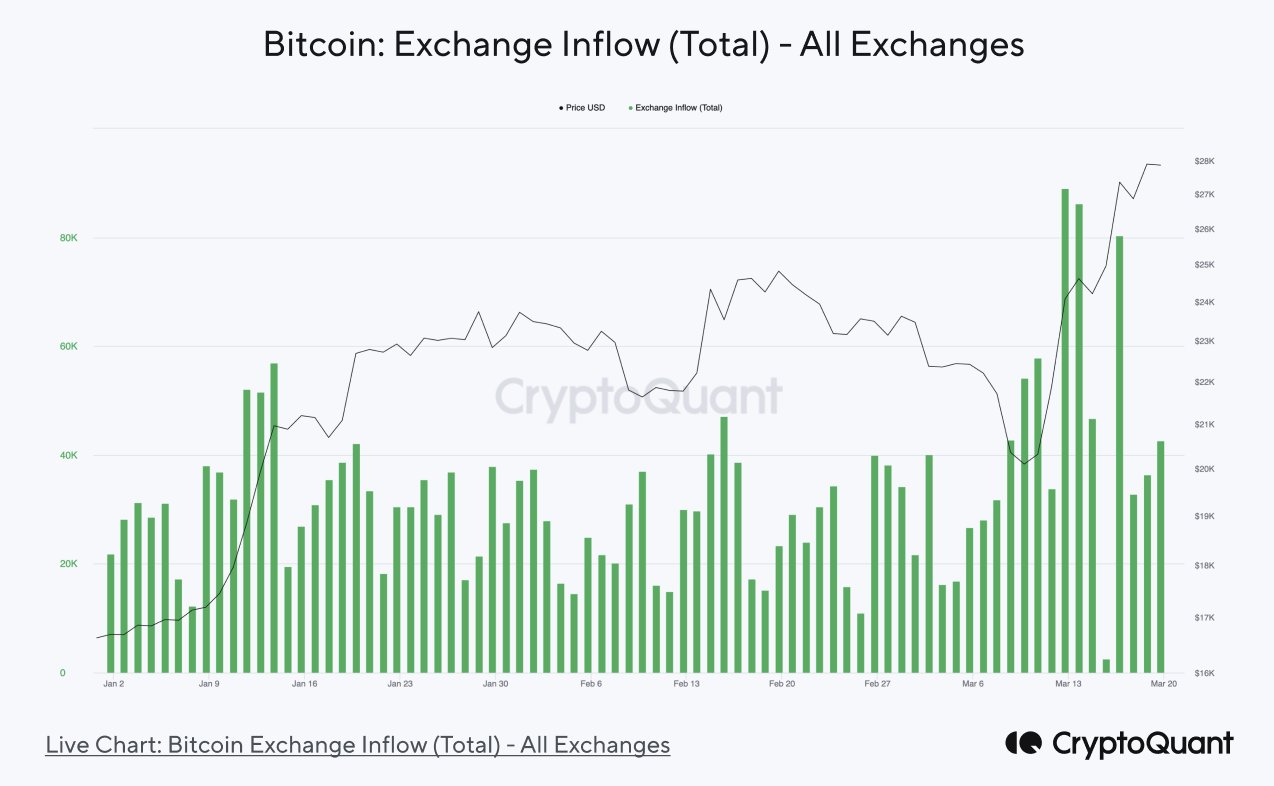

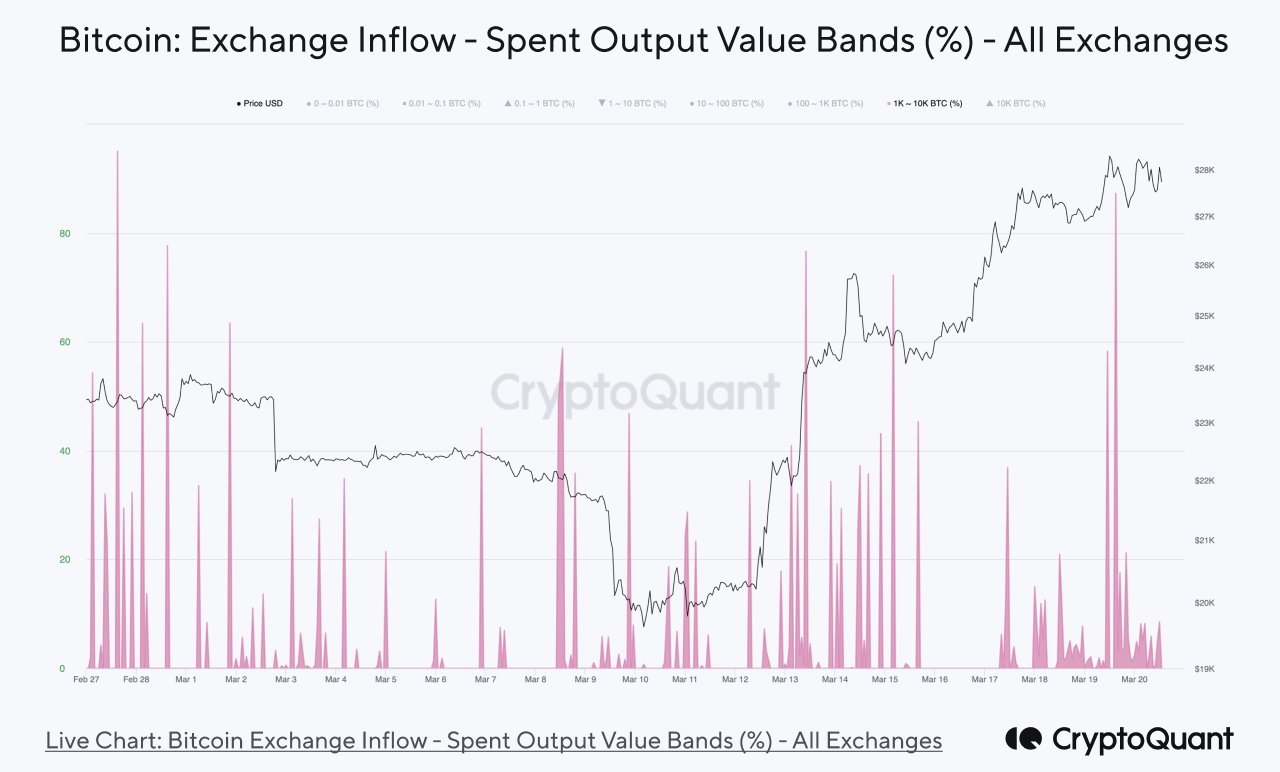

Bitcoin Exchange Inflow metric signifies a big improve in Bitcoin inflows into crypto exchanges because the BTC value rallied above $28,000, reaching the best ranges in 2023. Generally, a excessive worth signifies larger promoting stress within the spot alternate. Thus, a correction in Bitcoin value is anticipated.

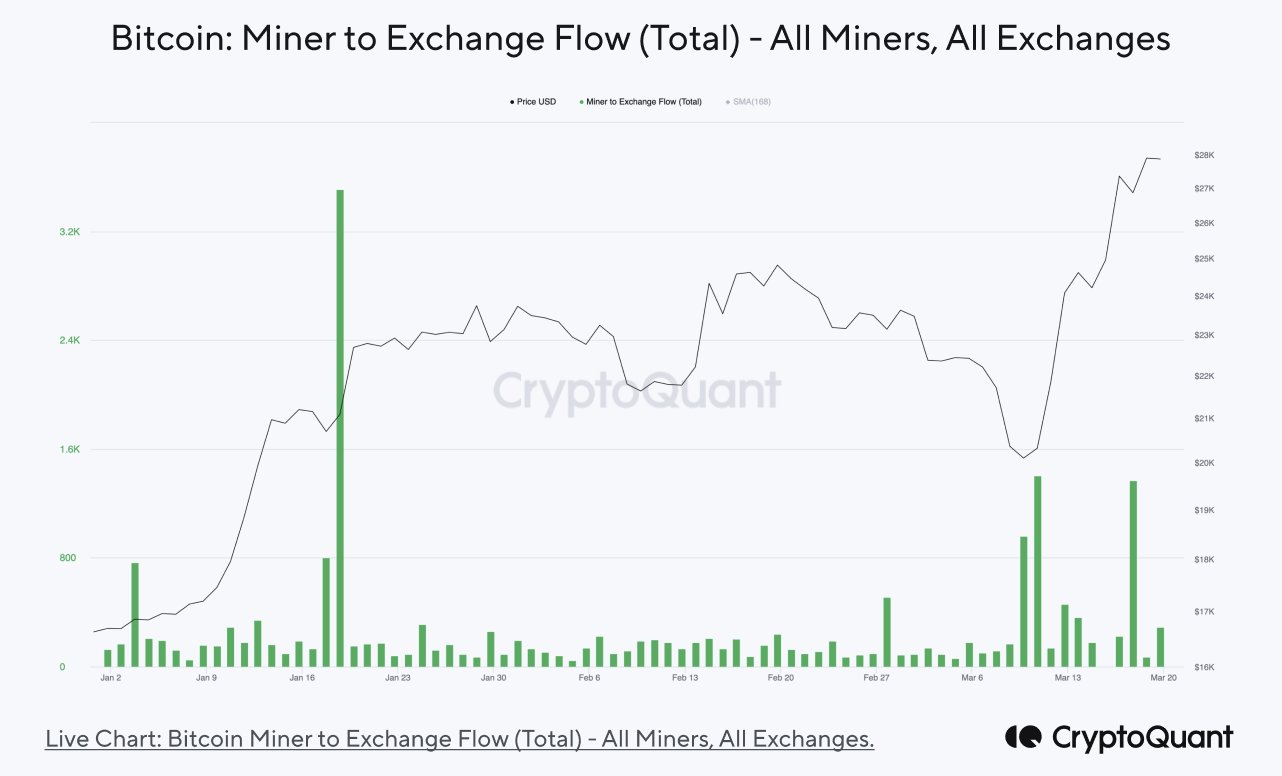

The Bitcoin Miner to Exchange Flow metric exhibits that miners have been contributing to those inflows amid the banking disaster, particularly after the shut down of crypto-friendly Silicon Valley Bank. The miner reserves have fallen once more in March after selloff in January.

Bitcoin Exchange Inflow – Spent Output Value Bands (%) metric signifies huge whale exercise. A substantial proportion (33%) of Bitcoin flowing into exchanges has been from whales. This means that whales have been dominating alternate inflows lately.

Ethereum Price Correction

Meanwhile, Ethereum Exchange Inflow signifies potential ETH value correction and different on-chain metrics stay combined. ETH price is anticipated to witness promoting stress amid the Shanghai improve and Bitcoin downfall.

Some analysts predicted a transfer towards $2000 within the short-term, however will proceed to face resistance close to the psychological degree.

Also Read: Bitcoin Price Set For $35,000 After US Fed Rate Hike Decision: Bloomberg

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.