On-chain information exhibits that Bitcoin transactions going out of exchanges have been higher than the variety of them entering into for the reason that FTX collapse.

Bitcoin Exchange Withdrawals Have Been Above Deposits Recently

As identified by an analyst on Twitter, BTC trade deposits have been heading down in latest months. There are just a few related indicators right here; the primary is the “exchange withdrawals,” which measures the full variety of transfers which are going out of centralized trade wallets.

The second metric is the “exchange deposits,” which, as is already apparent from the title, merely tells us concerning the variety of the other sort of transactions which are going down out there.

Exchange transactions can present a touch about investor habits out there as holders often use these platforms for promoting and shopping for functions. Deposits are often carried out for distribution, whereas withdrawals could also be carried out for accumulation-related functions.

When these trade transaction metrics are at elevated values, it means the traders are probably actively buying and selling the cryptocurrency proper now.

Another indicator is the “transaction count,” which measures the full quantity of Bitcoin transfers which are going down wherever on the community. This metric naturally provides perception into whether or not the blockchain is getting excessive use by customers or not in the meanwhile.

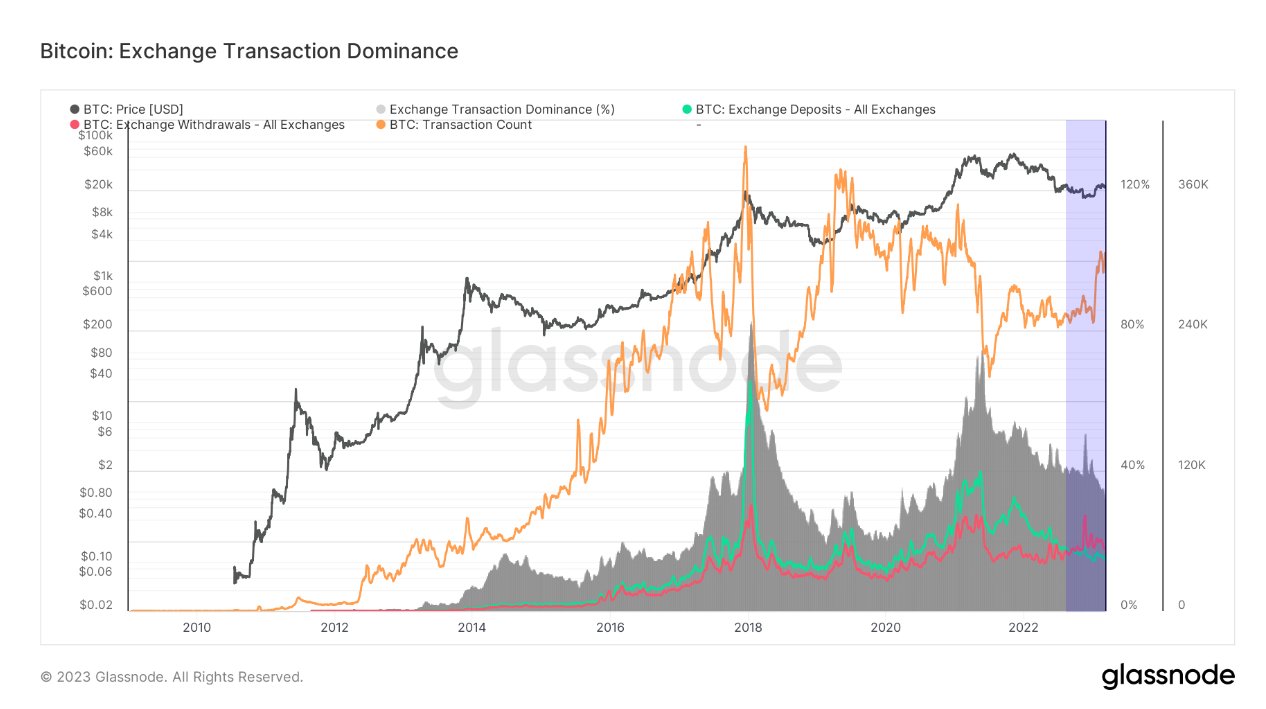

Now, here’s a chart that exhibits the development in these Bitcoin indicators over the complete historical past of the cryptocurrency:

The traits within the transaction rely, trade withdrawals and trade deposits | Source: Jimmy V. Straten on Twitter

As proven within the above graph, the Bitcoin trade depositing transactions have been using a downtrend for the reason that bear market began. This isn’t uncommon and was additionally witnessed over the last bear market (2018-2019).

The motive behind why this development could also be noticed is that the urge for food for buying and selling and particularly promoting goes down as a bear market runs its course and leaves merchants exhausted.

In these previous couple of months, nonetheless, a particular development has appeared within the Bitcoin market that has by no means been seen throughout the cryptocurrency’s historical past earlier than. It’s the truth that the trade withdrawals have overtaken the deposits now.

In the previous, the withdrawals all the time used to remain beneath the deposits. A contributing issue behind this may increasingly have been that miners produce recent Bitcoin outdoors of exchanges after which make deposits for promoting it, thus unbalancing the transactions.

Since the FTX crash again in November 2022, nonetheless, this construction seems to have flipped. The collapse of a platform like FTX renewed concern amongst traders concerning preserving their cash in centralized custody. So, a lot of holders made the choice to withdraw their funds to maintain them in self-custodial wallets, thus resulting in the withdrawal transactions observing an unnatural increase.

The Bitcoin withdrawals have remained increased than the deposits into these preliminary months of 2023, however the hole has been closing not too long ago. It now stays to be seen whether or not the market construction returns to the way it was once earlier than, or if that is the brand new norm.

BTC Price

At the time of writing, Bitcoin is buying and selling round $22,000, down 7% within the final week.

Looks like BTC has consolidated sideways not too long ago | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com