Is the most recent Ethereum rally a bull lure or the beginning of a contemporary bull market? Here’s what the ETH-taker buy-sell ratio says about it.

Ethereum Taker Buy/Sell Ratio Has Fallen Below 1 Recently

An analyst in a CryptoQuant post pointed out that the latest sentiment has been bearish in accordance with the metric. The “taker buy-sell ratio” is an indicator that measures the ratio between the taker purchase and taker promote volumes within the Ethereum futures market.

When the worth of this metric is bigger than 1, it suggests the “long” or the taker purchase quantity is increased than the “short” or the taker promote quantity at the moment. Such a development means extra patrons are keen to amass cryptocurrency at the next worth.

On the opposite hand, values of the ratio lower than the edge indicate the taker promote quantity is the extra dominant quantity within the futures market. Thus a bearish sentiment is shared by the bulk in the mean time.

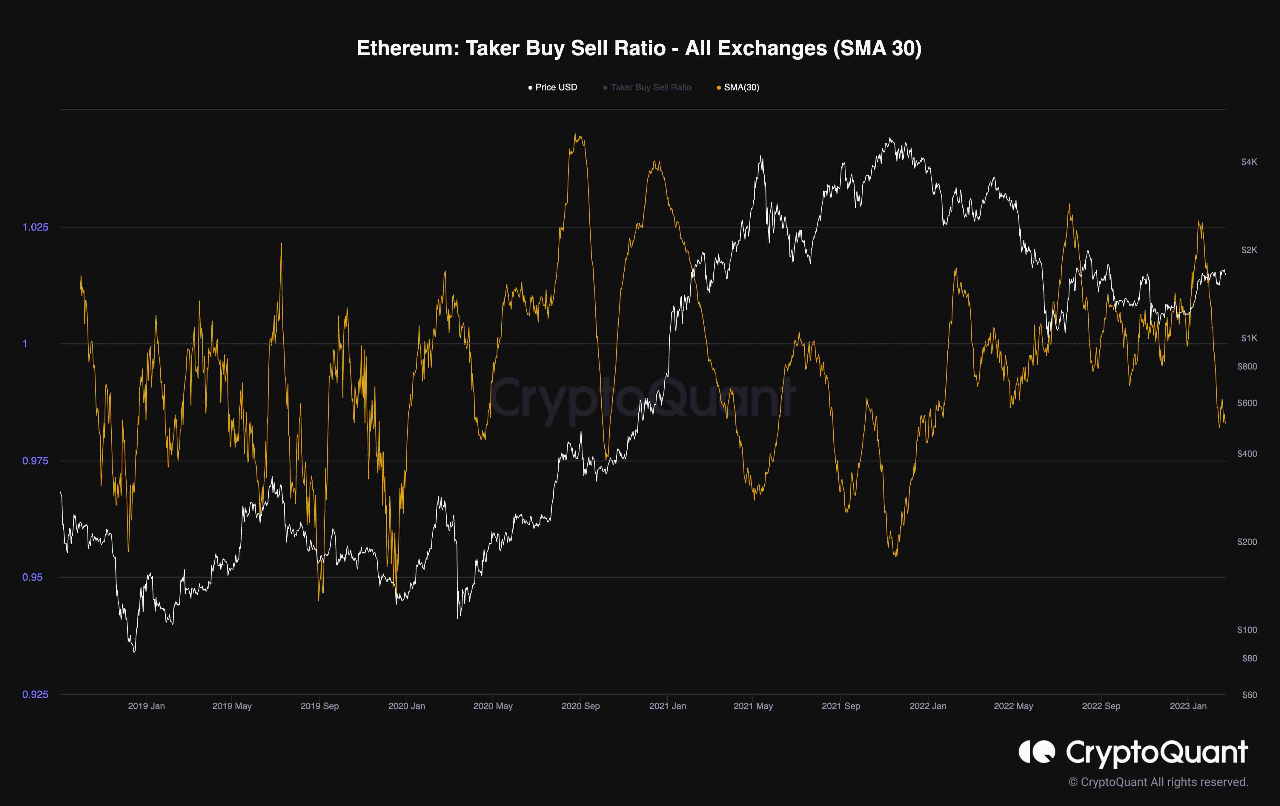

Now, here’s a chart that reveals the development within the 30-day easy shifting common (SMA) Ethereum taker buy-sell ratio over the previous few years:

The 30-day SMA worth of the metric appears to have taken a deep plunge in latest days | Source: CryptoQuant

As displayed within the above graph, the 30-day SMA Ethereum taker buy-sell ratio had shot above the 1 line with the latest rally within the asset worth.

This means that almost all sentiment within the ETH futures market had turned bullish because the coin’s worth rose. However, the indicator’s worth dropped when the rally slowed, and the worth moved sideways.

The taker buy-sell ratio decline continued, and the metric quickly plunged beneath the one mark. This implies that the brief quantity dominated the futures market following the consolidation.

The metric hit a low not too long ago that had simply been seen a yr in the past. From the chart, it’s obvious that with the most recent leg up within the rally, the metric hasn’t proven any important will increase in its worth, and the dominant sentiment continues to be bearish.

Historically, the cryptocurrency has often encountered tops every time the 30-day SMA taker buy-sell ratio has assumed such bearish values. A outstanding instance seen within the graph is the November 2021 bull run prime (that’s, the present all-time excessive worth), which shaped with values of the metric deep beneath the one mark.

The metric’s present worth isn’t as underwater as then, so it might nonetheless see some restoration within the coming days because the sentiment may flip bullish once more with the rally persevering with.

However, the quant cautions:

(…) the latest rally needs to be carefully monitored within the weeks forward to find out whether or not this was simply one other bull lure or a starting of a brand new bull market, as sellers may dominate once more.

ETH Price

At the time of writing, Ethereum is buying and selling round $1,600, up 4% within the final week.

It seems to be like the worth of the asset has declined during the last couple of days | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com