Data reveals the Bitcoin provide older than 1 yr has hit an all-time excessive, exhibiting that the asset’s diamond arms are holding sturdy by way of the rally.

Bitcoin Long-Term Holders Don’t Budge Despite The Rally

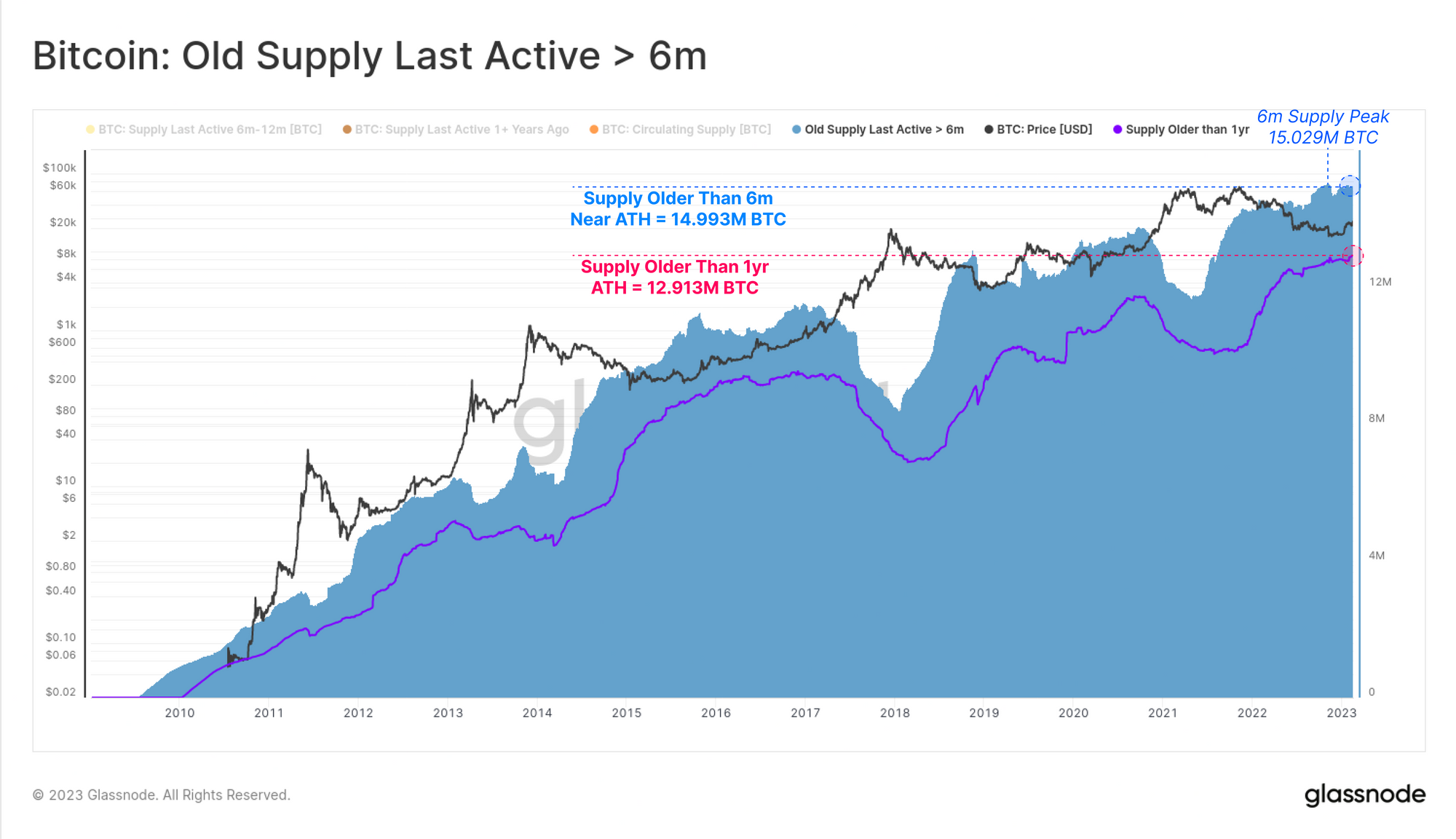

According to the most recent weekly report from Glassnode, the provision older than 6 months can also be close to an ATH proper now. There are two Bitcoin metrics of relevance right here, the “supply older than 6 months” and the “supply older than 1 year.”

As their names already counsel, these indicators embrace cash which were sitting dormant (that’s, they haven’t been moved or offered from a single pockets tackle) since greater than their respective time cutoffs.

Generally, any investor who has been holding onto their cash since greater than 6 months in the past is included within the “long-term holder” (LTHs) group. This signifies that each the provides of curiosity right here (6 months+ and 1 yr+) would come with these holders.

Statistically talking, the longer a token stays dormant on the blockchain, the much less possible it turns into to be offered at any level. As the LTHs maintain onto their cash for such giant durations, they don’t simply promote and are thus known as the resolute “diamond hands” of the market.

Now, here’s a chart that reveals the development within the quantity of the Bitcoin provide held by these LTHs, for 2 totally different beginning cutoffs:

Looks just like the values of the metrics have been climbing in latest days | Source: Glassnode's The Week Onchain - Week 8, 2023

As displayed within the above graph, the Bitcoin provide older than 6 months had seen some decline across the FTX collapse, exhibiting that a few of these LTHs had been put beneath sufficient strain to capitulate through the crash.

The provide older than 1 yr, nevertheless, didn’t discover any important drawdown through the worth plunge, suggesting that it was principally the holders with cash aged between 6-12 months that ended up dumping within the crash. This development could possibly be checked out as an illustration of how the older cash are typically tougher to budge.

Since the crash, each of those provides have noticed an uptrend, with the 1 yr+ hitting a brand new ATH of 12.9 million BTC, whereas the 6 month+ is nearly at one as its present worth is about 14.9 million BTC (final ATH was north of 15 million BTC).

Interestingly, these provides have solely both moved sideways or up because the newest rally within the worth of the asset began. This implies that even the 50% year-to-date (YTD) earnings haven’t been in a position to push these LTHs into taking part in some profit-taking, exhibiting that these buyers doubtlessly maintain some sturdy bullish conviction in regards to the cryptocurrency proper now and will count on even higher returns sooner or later.

BTC Price

At the time of writing, Bitcoin is buying and selling round $24,600, up 13% within the final week.

BTC appears to have been shifting sideways in the previous couple of days | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com