- Bitcoin and the Nasdaq 100 index have a positive correlation

- The two markets’ performances supply a approach to trade Bitcoin

- Volatility is vital in deciphering the positive correlation

Bitcoin and the cryptocurrency market gained in recognition in a comparatively brief interval. Since its start, Bitcoin has been adopted by institutional buyers, making its worth motion nearer to conventional markets.

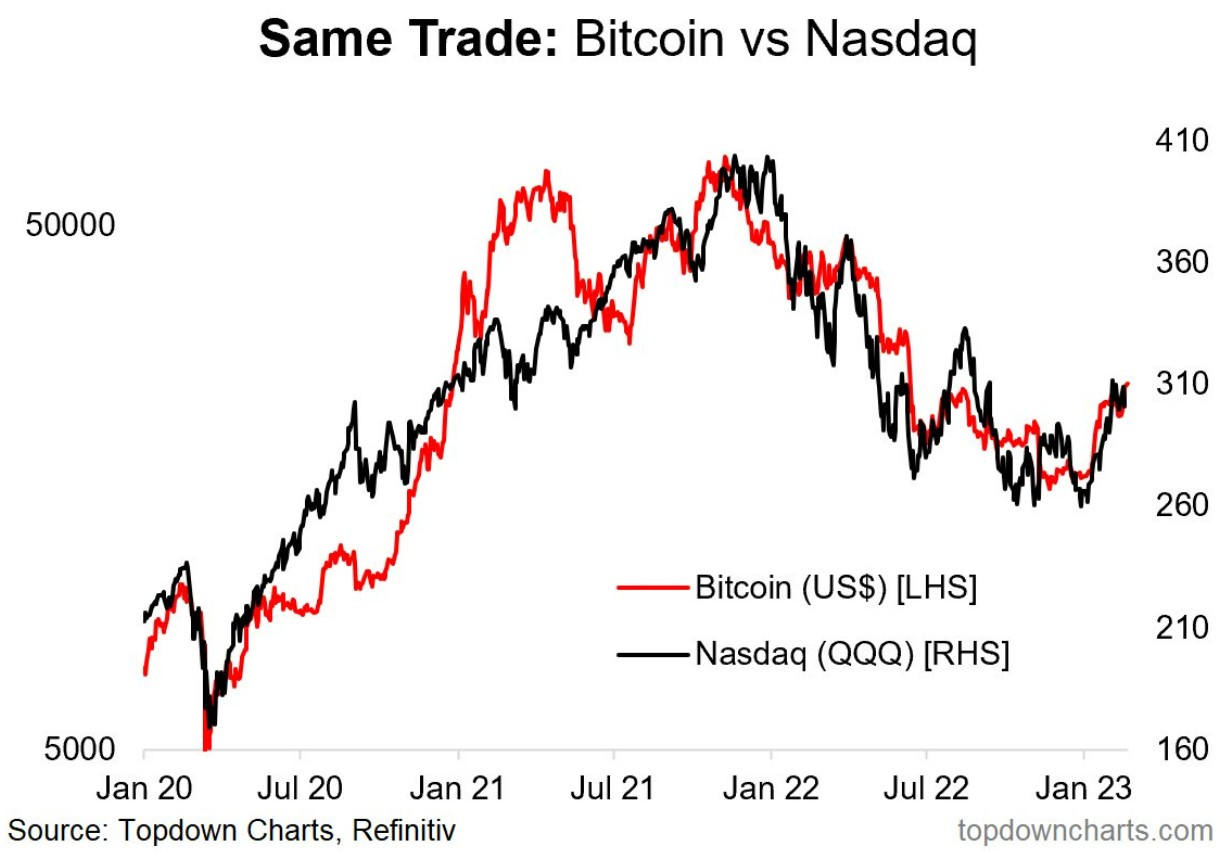

As such, it positively correlates with the inventory market, notably with the Nasdaq 100 index. As seen under, shopping for or promoting Bitcoin or shopping for or promoting the Nasdaq 100 index was principally the identical trade within the final two years.

However, such charts are deceptive. While right, the chart above ignores the elevated volatility within the cryptocurrency market, one which requires particular cash administration abilities from crypto retail merchants.

The positive correlation suggests extra upside for Bitcoin

An fascinating perspective seems if we take into perspective the 2 markets’ volatility. The chart under reveals the final two years’ efficiency for each – Bitcoin delivered +242.42% whereas the Nasdaq 100 +41.89%.

Both performances are spectacular, particularly if we contemplate the 2022 bear market. Bitcoin topped when the Nasdaq 100 index topped, and then the market collapsed as buyers fled the tech sector and the cryptocurrency market.

Judging by the positive correlation, one factor is bound – the nearer the 2 markets’ efficiency is, the extra interesting it’s to purchase Bitcoin. Since the tip of 2020, the hole between the 2 performances has by no means been so slender as in late 2022.

In different phrases, the rally seen within the first buying and selling weeks of 2023 mustn’t shock anybody, given the character of this correlation. As the tech sector bounced from the lows, so did Bitcoin. Only that Bitcoin’s rally outperformed the Nasdaq 100 index’s rally due to the traditionally larger volatility.

To sum up, such a chart is helpful when buying and selling Bitcoin. The nearer the 2 performances are, the larger the case for purchasing Bitcoin.

On the opposite, as Bitcoin outperforms Nasdaq, the larger the case for promoting Bitcoin.